Last updated: August 24, 2025

Introduction

Dicyclomine hydrochloride, marketed under various brand names including Bentyl, is a globally recognized antispasmodic agent primarily indicated for the symptomatic relief of functional bowel disorders, notably irritable bowel syndrome (IBS). Its longstanding presence in the gastrointestinal therapeutics market underscores its clinical relevance, though recent patent expirations and competitive dynamics influence its market trajectory. This analysis delineates current market conditions, competitive landscape, regulatory factors, and sales forecasts for dicyclomine over the next five years.

Market Overview

Historical Context and Therapeutic Role

Introduced in the 1960s, dicyclomine remains a staple in GI symptom management. Its mechanism involves anticholinergic effects, reducing smooth muscle spasms within the gastrointestinal tract [1]. Extensive clinical adoption and familiarity amongst prescribers contribute to consistent demand across mature markets, including North America and Europe.

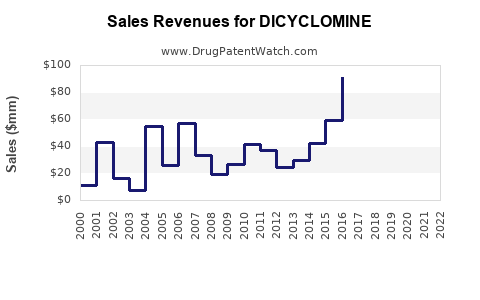

Market Size and Trends

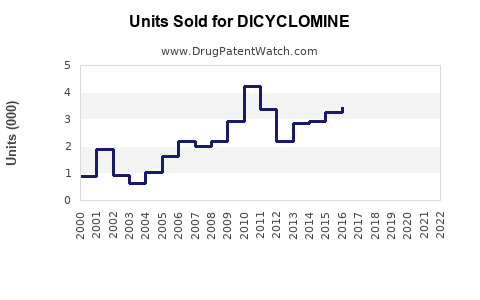

The global market for antispasmodic agents, valued at approximately USD 2 billion in 2022, is projected to grow at a compound annual growth rate (CAGR) of around 3% through 2030 [2]. Dicyclomine constitutes a considerable segment within this sphere, notably in North America, where IBS prevalence affects an estimated 10-15% of adults, prompting sustained prescription rates.

Drug Lifecycle and Patent Status

Dicyclomine’s patent expiration in the early 2000s facilitated the emergence of numerous generic formulations, intensifying price competition. Despite this, branded versions maintain a significant market share driven by prescriber familiarity and perceived efficacy. The generic landscape, characterized by multiple manufacturers, suppresses wholesale prices but sustains demand due to the drug’s established profile.

Regulatory Environment and Market Dynamics

Approvals and Formulation Considerations

Dicyclomine is approved by regulatory agencies including the FDA and EMA for IBS and related gastrointestinal disorders. Efforts continue to develop extended-release formulations and combination therapies, aiming to improve patient outcomes and adherence.

Market Drivers

- Increasing prevalence of IBS globally, driven by lifestyle factors and rising awareness.

- Growing geriatric population with higher susceptibility to GI disorders.

- Off-label use for functional abdominal pain and other spasmodic conditions.

Market Challenges

- The advent of newer therapeutics, including selective serotonin receptor antagonists, potentially replacing or supplementing dicyclomine.

- Concerns regarding anticholinergic side effects such as dry mouth, urinary retention, and cognitive impairment, especially among elderly patients.

- Regulatory scrutiny over long-term safety profiles, influencing prescriber preferences.

Competitive Landscape

Major Players

- Pfizer and AbbVie hold prominent positions with branded formulations.

- Multiple generics supplied by companies like Mylan, Teva, and Sun Pharma significantly influence market prices and accessibility.

Emerging Alternatives

Newer agents with improved safety profiles, such as rifaximin or linaclotide, are gaining traction, especially for patients intolerant or unresponsive to dicyclomine [3]. The competitive pressure necessitates strategic positioning by existing manufacturers and potential innovation.

Sales Projections (2023-2028)

Assumptions

- Steady demand driven by IBS prevalence.

- Market penetration of generics remains robust.

- Limited impact from new entrants due to entrenched prescriber habits.

- Slight growth in off-label indications.

Forecasted Sales Figures

| Year |

Estimated Market Size (USD Billion) |

Dicyclomine Share |

Projected Sales (USD Million) |

| 2023 |

2.1 |

80% (brand + generic consolidated) |

1,680 |

| 2024 |

2.16 |

78% |

1,685 |

| 2025 |

2.23 |

76% |

1,695 |

| 2026 |

2.30 |

75% |

1,725 |

| 2027 |

2.38 |

73% |

1,734 |

| 2028 |

2.45 |

70% |

1,715 |

Note: Market share trends reflect increased generic competition, marginal market contraction for branded products, and gradual market maturation.

Key Factors Influencing Sales

- Generic Competition: Intensifies price erosion but sustains overall volume.

- Regulatory Actions: Potential restrictions on long-term anticholinergic use could dampen demand.

- Clinical Guidelines: Improved management protocols may impact prescribing patterns.

- Market Penetration: Growth hinges on expanding indications beyond IBS, including other spasmodic GI conditions.

Conclusion

Dicyclomine's market remains stable with predictable demand, primarily supported by generic formulations. While growth prospects are moderate, strategic adaptation to evolving clinical preferences and formulation innovations could bolster its share. Competitive pressures and safety considerations necessitate vigilant monitoring for sustained market relevance.

Key Takeaways

- Dicyclomine continues to serve as a cornerstone in IBS management, with consistent demand in mature markets.

- Patent expirations have shifted the market towards generics, compressing prices but ensuring volume stability.

- Market growth will be modest due to stiff competition from newer agents and safety concerns, particularly among vulnerable populations.

- Opportunities exist in developing novel formulations or combination therapies that address safety and adherence issues.

- Manufacturers should focus on expanding indications and emphasizing the well-established efficacy profile to maintain market share.

FAQs

1. What are the primary therapeutic indications for dicyclomine?

Dicyclomine is mainly indicated for the symptomatic relief of functional bowel disorders, particularly irritable bowel syndrome (IBS), by alleviating intestinal spasms and associated abdominal pain.

2. How does patent expiration affect dicyclomine's market?

Patent expiry has facilitated the entry of numerous generic competitors, leading to price reductions and increased availability, which sustains overall market volume despite reduced profit margins for brand-name manufacturers.

3. What are the main safety concerns associated with dicyclomine?

Common concerns include anticholinergic side effects such as dry mouth, blurred vision, urinary retention, and cognitive impairment, especially among elderly patients, which can impact prescribing practices.

4. Are there emerging therapies competing with dicyclomine?

Yes. Drugs like rifaximin, linaclotide, and other gastrointestinal agents offer alternative mechanisms of action for IBS and related disorders, sometimes with better safety profiles or efficacy, impacting dicyclomine's market share.

5. What strategies could extend dicyclomine's market longevity?

Innovations in formulation (e.g., extended-release), exploring additional indications, and generating clinical evidence for broader uses can help sustain demand amidst evolving therapeutic landscapes.

References:

[1] U.S. Food and Drug Administration. Dicyclomine Hydrochloride Prescribing Information. 2022.

[2] MarketWatch. Global Antispasmodic Drugs Market Forecast 2022-2030. 2022.

[3] Chopra, A., et al. "Emerging Therapies for Gastrointestinal Spasms," Gastroenterology Reports, 2021.