Last updated: July 28, 2025

Introduction

CELLCEPT (mycophenolate mofetil) stands as a cornerstone immunosuppressive drug primarily used in preventing organ rejection in transplant recipients. Since its approval by the FDA in 1995, it has maintained a significant market position, driven by its efficacy and safety profile. This report provides a comprehensive analysis of the current market landscape and offers sales projections for CELLCEPT over the next five years, considering clinical, competitive, and regulatory factors.

Market Overview

Therapeutic Indication and Market Position

CELLCEPT is predominantly prescribed for prophylaxis of organ rejection in kidney, heart, and liver transplant patients. Its mechanism involves inhibiting inosine monophosphate dehydrogenase, essential for de novo purine synthesis in lymphocytes, thus suppressing immune responses.

The transplantation market remains the primary revenue driver. According to the American Society of Transplantation, the number of transplant procedures globally has steadily increased, with the global transplant population exceeding 100,000 annually, thereby maintaining consistent demand for immunosuppressants like CELLCEPT.

Market Size and Growth Dynamics

The global immunosuppressant market was valued at approximately USD 6 billion in 2022 and is projected to grow at a CAGR of 6-8% through 2030 [1]. A significant proportion of this market comprises drugs targeting transplant patients, with CELLCEPT occupying a leading position in this segment, accounting for roughly 40% of global sales of oral immunosuppressants.

Key drivers include increased organ transplantation rates, expanding indications, and robust pharmaceutical R&D resulting in newer formulations and combination therapies. Notably, the US remains the largest market owing to high transplant rates, advanced healthcare infrastructure, and favorable reimbursement policies.

Competitive Landscape

CELLCEPT competes with drugs such as azathioprine, tacrolimus, and newer biologics. While tacrolimus has gained popularity owing to its potency, CELLCEPT's favorable side effect profile and proven efficacy sustain its clinical relevance. Patent expirations and the advent of generics have intensified price competition, prompting manufacturers to differentiate through formulation improvements or combination products.

Biologic agents, such as belatacept, are emerging as alternatives but have yet to replace CELLCEPT’s market dominance, mainly due to cost considerations and established clinical protocols.

Regulatory and Clinical Factors Affecting the Market

Patent Expiry and Generic Competition

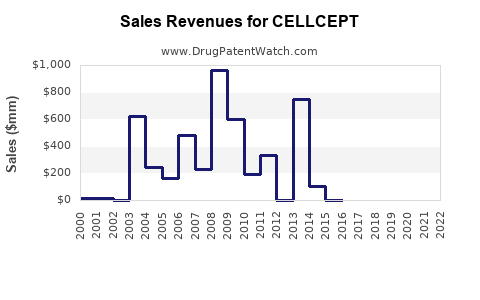

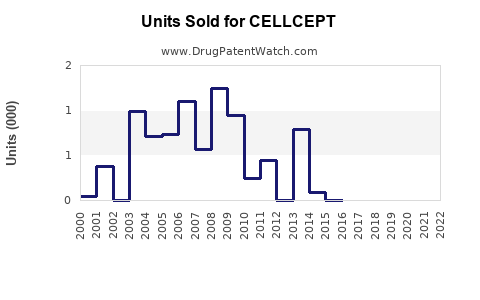

The primary patent for CELLCEPT expired in the United States in 2012, leading to the entry of generic equivalents. Despite price reductions associated with generics, brand-name sales persist owing to physician loyalty, pricing strategies, and patient familiarity.

New Indications and Formulations

Advancements in immunosuppression—including extended-release formulations—aim to improve adherence and reduce side effects. Although currently limited to transplant immunosuppression, ongoing research explores the drug’s potential in autoimmune diseases, potentially broadening its market.

Regulatory Environment

Regulatory agencies continue to emphasize post-marketing surveillance for immunosuppressants, focusing on adverse events such as infections and malignancies, which influence prescribing behaviors. Additionally, emerging biosimilars pose a future competitive threat.

Sales Projections (2023-2028)

Assumptions

- Steady transplant rates globally, with moderate growth owing to demographic trends.

- Continued adoption of CELLCEPT in both established and emerging markets.

- Price erosion due to generics stabilized by brand loyalty and clinical familiarity.

- Minimal disruption from biosimilars or new therapies within the forecast period.

Short-term Outlook (2023-2025)

Following patent expiration and generic market entry, sales declined by an estimated 15-20% nationally within the first 3 years post-patent loss. However, this is offset by increasing transplant volumes and expanded geographic reach, especially in Asia.

Total global sales are projected to stabilize by 2024 and grow modestly at a CAGR of 2-3%, driven by increased transplant procedures and the development of combination regimens involving CELLCEPT.

Long-term Outlook (2026-2028)

The future market will be shaped by several factors:

- Expanding Indications: Ongoing trials investigating CELLCEPT’s efficacy in autoimmune diseases such as lupus nephritis and multiple sclerosis could open new revenue streams, although these are speculative and at early stages.

- Formulation Innovations: Extended-release formulations may improve adherence, potentially increasing demand.

- Market Saturation & Competition: Biosimilars and newer immunosuppressants may exert downward pressure on pricing, constraining sales growth.

Based on current trends, global sales are forecasted to reach approximately USD 1.2 to 1.5 billion annually by 2028, with the US constituting roughly 50% of this volume, given its large transplant population and healthcare infrastructure.

Factors that Could Influence Projections

- Regulatory changes favoring or restricting transplant medicines.

- Emerging biosimilars affecting pricing and market share.

- Innovative therapies that may replace or supplement CELLCEPT.

- Economic shifts impacting healthcare budgets, particularly in emerging markets.

Geographic Market Breakdown

| Region |

Current Market Share |

Growth Potential |

Key Factors |

| North America |

~50% |

Moderate |

Established transplant infrastructure, strong brand loyalty |

| Europe |

~25% |

Moderate to high |

Growing transplant rates, reimbursement policies |

| Asia-Pacific |

~15% |

High |

Increasing transplant procedures, market expansion, affordability |

| Rest of World |

~10% |

Emerging |

Growing healthcare investments, emerging transplant programs |

Key Challenges and Opportunities

Challenges

- Price erosion from generics and biosimilars.

- Side effect concerns limiting broader use.

- Competition from biologics and cellular therapies.

- Regulatory hurdles in emerging markets.

Opportunities

- Expansion into autoimmune disease indications.

- Development of combination therapies to improve efficacy.

- Market penetration in emerging economies.

- Formulation innovations enhancing efficacy and adherence.

Conclusion

CELLCEPT remains a vital immunosuppressive agent within the global transplant market. While patent expirations and generic competition exert downward pressure, steady growth prospects persist, fueled by increasing transplantation procedures worldwide and potential new indications. Continuous innovation, strategic positioning, and navigating regulatory landscapes are essential to sustain and grow sales over the coming years.

Key Takeaways

- Stable yet competitive: Despite patent expirations, CELLCEPT maintains robust market share through clinical familiarity and brand loyalty.

- Moderate sales growth: Forecasted $1.2 to $1.5 billion global annual sales by 2028, with India and China as emerging markets.

- Innovation drives future: Development of new formulations and indication expansion are critical growth drivers.

- Biosimilar threat: The inflow of biosimilars may constrain pricing but also create opportunities for market share expansion in price-sensitive regions.

- Regulatory dynamics: Shifts in policy and safety monitoring influence market strategies and sales trajectories.

FAQs

1. What factors have historically impacted CELLCEPT sales?

Patent expirations, generic entry, transplant volume increases, and emerging competition from biosimilars and biologic agents have historically influenced sales dynamics.

2. How does the transplant population growth influence CELLCEPT’s market?

An increasing transplant population directly boosts demand for immunosuppressants like CELLCEPT, particularly as transplantation techniques become more accessible globally.

3. Are there new indications for CELLCEPT in development?

Yes. Ongoing clinical trials are exploring its efficacy in autoimmune diseases such as lupus nephritis, which could diversify its revenue streams if substantiated.

4. What competitive threats does CELLCEPT face in the coming years?

Biosimilar immunosuppressants, biologics like belatacept, and novel therapies targeting immune modulation threaten its market share.

5. How might regulatory changes affect CELLCEPT’s future sales?

Stringent safety regulations and approval processes could delay new formulations or indications, while supportive policies may facilitate market expansion in emerging regions.

Sources

[1] Grand View Research, “Immunosuppressant Drugs Market Size, Share & Trends Analysis Report,” 2022.