Last updated: July 28, 2025

Introduction

Colchicine, a well-established anti-inflammatory drug primarily used to treat gout and familial Mediterranean fever (FMF), has seen renewed interest due to emerging research on its broader therapeutic applications. The global market landscape, driven by evolving clinical evidence, regulatory shifts, and geographic expansion, demands a comprehensive analysis for stakeholders. This report examines current market dynamics, competitive landscape, regulatory environment, and future sales projections for colchicine over the next five years.

Market Overview

Historical Context

Originally isolated from the autumn crocus (Colchicum autumnale), colchicine has an extensive history dating back centuries as a treatment for gout. Its mechanism involves disrupting microtubule formation, thereby reducing inflammation. Despite its long-standing role, safety concerns—particularly toxicity at high doses—have limited broader use, prompting careful prescribing practices.

Current Therapeutic Uses

- Gout Management: First-line therapy for acute attacks and prophylaxis.

- Familial Mediterranean Fever (FMF): Standard treatment to prevent amyloidosis.

- Pericarditis: Emerging evidence supports colchicine's efficacy in preventing recurrent pericarditis.

- Potential New Indications: Recent studies explore its role in cardiovascular disease, COVID-19, and other inflammatory conditions.

Market Size Estimation

According to GlobalData, the global gout treatment market was valued at approximately USD 1.8 billion in 2022, with colchicine comprising a significant share due to its cost-effectiveness and widespread use in gout and FMF (1). With the rising prevalence of gout and expanding indications, the overall market value for colchicine is poised for growth.

Key Market Drivers

Prevalence and Demographics

Gout prevalence varies by region, with higher incidence among aging populations and those with comorbidities such as obesity, hypertension, and diabetes. The International gout prevalence is estimated at 1-4% globally, projected to increase with aging populations.

Therapeutic Expansion

- The recognition of colchicine’s benefit in preventing post-pericardiotomy syndrome and recurrent pericarditis broadens its application spectrum.

- An increasing body of evidence supports its anti-inflammatory properties in cardiovascular diseases, COVID-19, and potentially other inflammatory conditions, fueling off-label use and clinical research incentives.

Regulatory & Patent Landscape

- Generic versions dominate the market, ensuring cost competitiveness but limiting patent-driven revenue potential.

- Regulatory approvals for new indications vary by region, impacting market access. For example, in Europe, the EMA has approved colchicine for gout, FMF, and pericarditis, facilitating market growth.

Market Challenges

- Safety concerns, notably gastrointestinal toxicity and drug-drug interactions, restrict broader adoption.

- Competition from newer biologic agents for gout and other inflammatory diseases narrows colchicine’s market share.

Competitive Landscape

Key Players

- Ben Venue Laboratories (Teva): A leading generic manufacturer, providing affordable colchicine formulations globally.

- Sandoz (Novartis): Offers generic colchicine products with broad geographic reach.

- Specialty Formulations: Some regional companies produce branded formulations used in specific markets.

Innovative Developments

While no blockbuster patented formulations currently exist, ongoing clinical trials explore colchicine derivatives and combination therapies to enhance efficacy and reduce toxicity.

Regulatory Environment and Impact

FDA and EMA

- Colchicine remains off-patent, with most formulations classified as generics.

- The FDA approved colchicine for gout and FMF, with recent EPS absence for COVID-19 treatment, though some off-label use persists.

- EMA’s approval for pericarditis in Europe has spurred regional market expansion.

Healthcare Policies

- Increasing emphasis on cost-effective treatments elevates colchicine's position, especially in emerging markets.

- Regulatory caution regarding safety profile mandates prescriber education and risk management strategies.

Sales Projections (2023–2028)

Assumptions

- Steady global gout prevalence with an annual growth rate of ~2%.

- Rising adoption for pericarditis and potential subsequent indications at a compounded rate of 4% annually.

- Generic drug market dominance with minimal patent protections, sustaining price competition.

Market Forecast

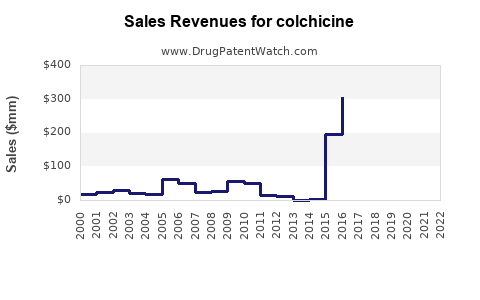

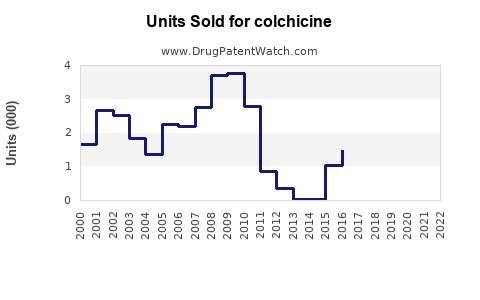

- 2023: Estimated global colchicine sales at USD 600 million, driven by gout and FMF treatment, with additional revenues from pericarditis indications.

- 2024–2028: Compound annual growth rate (CAGR) projected at 6%, reaching approximately USD 950 million by 2028.

- Growth is tempered by safety concerns and competition but is offset by expanding indications and increasing regional uptake, especially in emerging economies.

Regional Breakdown

- North America: Largest share (~40%) due to high gout prevalence and adoption of colchicine for pericarditis.

- Europe: Growing market driven by EMA approvals and clinical guidelines.

- Asia-Pacific: Rapid growth forecast (~8% CAGR) owing to rising gout prevalence and healthcare infrastructure improvements.

Opportunities and Risks

Opportunities

- Expanded indications in cardiovascular and infectious diseases.

- Development of safer formulations or derivatives.

- Increasing awareness and education campaigns to optimize prescribed use and safety.

- Strategic partnerships with regional distributors to penetrate emerging markets.

Risks

- Regulatory restrictions based on safety concerns.

- Competition from biologic agents and newer anti-inflammatory drugs.

- Patent expirations leading to price erosion.

- Off-label and inappropriate use risking adverse events, potentially leading to stricter regulations.

Conclusion

Colchicine's longstanding history and evolving clinical evidence position it as a vital, cost-effective anti-inflammatory agent with expanding therapeutic applications. The combined influence of rising disease prevalence, regulatory support, and ongoing research indicates a positive growth trajectory for the drug, projecting a robust CAGR over the next five years. Strategic focus on safety management, indication expansion, and regional growth can maximize its market potential.

Key Takeaways

- The global colchicine market is projected to reach USD 950 million by 2028, with a CAGR of approximately 6%.

- Growth is driven by increased use in gout, FMF, and emerging indications like pericarditis and cardiovascular conditions.

- Regional markets in North America, Europe, and Asia-Pacific significantly influence sales trends, with emerging markets showing higher growth potential.

- Safety concerns remain a barrier, underscoring the need for improved formulations and risk management.

- Patent expirations and competition from biologics challenge pricing but open opportunities for generics and new indications.

FAQs

1. What are the primary factors influencing colchicine sales growth globally?

The primary factors include rising prevalence of gout and inflammatory diseases, expanding indications such as pericarditis, regulatory approvals, and regional healthcare infrastructure improvements.

2. How does safety concern impact the colchicine market?

Safety concerns about toxicity and drug interactions restrict its broader use, necessitating prescriber education and limiting off-label applications, which can constrain sales growth.

3. Are there upcoming innovations or formulations expected to alter the market outlook?

Research into safer derivatives, combination therapies, and new delivery mechanisms could enhance safety profiles and expand indications, positively impacting future sales.

4. How significant is regional variation in colchicine market performance?

Regional differences are substantial; North America and Europe lead due to higher disease prevalence and regulatory approval, while Asia-Pacific offers high growth potential owing to demographic shifts and increasing healthcare access.

5. What competitive strategies can companies employ to capture market share?

Strategies include pursuing new indications through clinical trials, expanding geographically, optimizing pricing through generics, and investing in safety and formulation improvements.

Sources:

- GlobalData. Gout Treatment Market Report 2022.

- European Medicines Agency. Colchicine Summary of Product Characteristics.