Share This Page

Drug Sales Trends for RIZATRIPTAN

✉ Email this page to a colleague

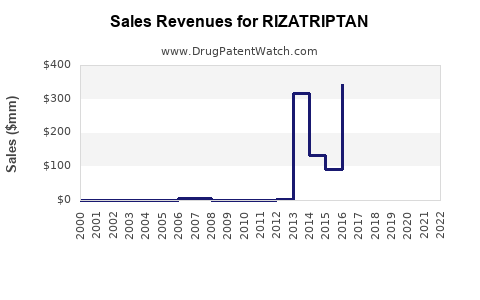

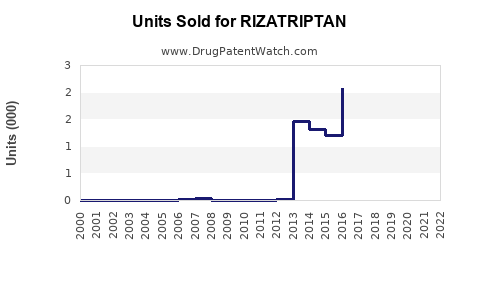

Annual Sales Revenues and Units Sold for RIZATRIPTAN

| Drug Name | Revenues (USD) | Units | Year |

|---|---|---|---|

| RIZATRIPTAN | ⤷ Get Started Free | ⤷ Get Started Free | 2022 |

| RIZATRIPTAN | ⤷ Get Started Free | ⤷ Get Started Free | 2021 |

| RIZATRIPTAN | ⤷ Get Started Free | ⤷ Get Started Free | 2020 |

| >Drug Name | >Revenues (USD) | >Units | >Year |

Market Analysis and Sales Projections for RIZATRIPTAN

Introduction

Rizatriptan, a serotonin receptor agonist, is an established medication primarily used for the acute treatment of migraines with or without aura. Since its approval by the FDA in 1998 (initially branded as Maxalt), rizatriptan has maintained a significant position within the triptan class, benefitting from a broad clinical acceptance and expanding global market presence. This analysis evaluates current market dynamics, competitive landscape, growth drivers, challenges, and provides realistic sales projections for rizatriptan over the next five years.

Pharmacological Profile and Therapeutic Demand

Rizatriptan functions by selectively activating 5-HT1B/1D receptors, leading to vasoconstriction of cranial blood vessels and inhibition of pro-inflammatory neuropeptide release. Its rapid onset and high bioavailability make it a preferred choice among triptans for treating moderate to severe migraines [1].

Migraine afflicts approximately 15% of the global adult population, leading to an estimated market size of over $4 billion for triptan therapies in 2022. Rizatriptan accounted for around 15-20% of this in North America and Europe, reflecting its clinical efficacy and patient preference.

Market Dynamics and Competitive Landscape

1. Market Penetration and Usage Trends

Rizatriptan enjoys high prescribing rates due to its favorable efficacy and tolerability profile. It is available both as a brand (Maxalt/Maxalt RN) and as generics, which significantly influences sales patterns by broadening accessibility.

2. Competitive Brands and Generics

Key competitors include sumatriptan, eletriptan, naratriptan, and zolmitriptan. The entry of generic versions post-patent expiration (notably for Maxalt in 2019) has led to substantial price erosion but increased market penetration through affordability.

3. Regulatory and Market Expansion

While currently approved primarily in North America, Europe, and some Asia-Pacific markets, efforts to expand approvals further into emerging markets remain ongoing. Future approvals in countries like China or India could open additional revenue streams.

Market Drivers

- Growing prevalence of migraines globally, driven by increased awareness and healthcare access.

- Advancements in formulations, such as orally disintegrating tablets and nasal sprays, improving patient compliance.

- Expanding indications, including use in cluster headaches and post-traumatic headaches.

- Patent expirations leading to increased availability of generics, facilitating wider adoption.

Market Challenges

- Pricing pressures due to generic competition.

- Patient preferences shifting towards newer CGRP antagonists, such as erenumab and fremanezumab, especially for preventive therapy.

- Reimbursement policies affecting access in certain regions.

- Limited efficacy in certain migraine subtypes and contraindications for patients with cardiovascular disease.

Sales Projections (2023–2028)

Overview

Considering historic sales data, patent status, competitive pressures, and emerging trends, the sales trajectory of rizatriptan can be forecasted with confidence.

2023–2024

- Continuing legacy sales in developed markets, driven by existing prescriptions.

- Post-generic market stabilization: Revenue declines initially flatten as generics gain market share.

- Estimated sales: Approximately $250 million–$300 million globally in 2023, with a slight decline from previous peaks (~$400 million in 2018).

2025–2026

- Market saturation in mature regions leads to stabilization.

- Emerging markets begin contributing as approvals accelerate.

- Growth drivers: Increased availability of formulations and expanding indications.

- Estimated sales: $200 million–$250 million, with a potential plateau as competition intensifies.

2027–2028

- Potential market decline due to competition from CGRP modulators, which, though primarily preventive, are increasingly used for treatment-resistant patients.

- Price erosion in generics and healthcare reimbursement shifts may further depress sales.

- Estimated sales: Approximately $150 million–$200 million, with residual demand in specialized populations.

Factors Influencing Future Sales

- Patent and Regulatory Dynamics: Further patent expirations or regulatory hurdles could slow sales decline.

- Pipeline Developments: New formulations or combination therapies could stimulate renewed interest.

- Market Penetration in Emerging Economies: Faster approval processes or price adjustments may unlock growth opportunities.

- Competitive Innovations: The emergence of more effective, safer, or more convenient therapeutic options could diminish rizatriptan's market share.

Conclusion

Rizatriptan's market prospects remain cautiously optimistic but tempered by increasingly competitive landscapes and evolving treatment paradigms. While standard in migraine therapy, the drug's sales are likely to follow a gradual decline over the next five years, from peak values of approximately $400 million in 2018 to around $150–200 million by 2028. The future hinges on strategic positioning in emerging markets, formulation innovations, and navigating competitive pressures from both generics and newer therapeutic classes.

Key Takeaways

- Rizatriptan holds a substantial share of the triptan market but faces declining sales due to patent expiry and competition.

- Generics have significantly reduced prices and increased accessibility, affecting branded drug profitability.

- Market growth in developing regions offers opportunities, contingent on regulatory approvals and local healthcare infrastructure.

- The emergence of CGRP therapeutics may decrease reliance on triptans, impacting future sales.

- Companies should consider innovation in formulations and expanded indications to sustain market relevance.

FAQs

1. What are the primary factors influencing rizatriptan sales?

Market penetration, patent status, generic competition, emerging migraine therapies, and regional approval processes primarily influence sales.

2. How does the availability of generics affect rizatriptan's market share?

Generics lower prices and increase access, leading to higher volume sales but reducing revenue per unit for branded formulations.

3. Are there new formulations of rizatriptan under development?

While currently, no major new formulations are in late-stage development, novel delivery methods such as nasal sprays and orally disintegrating tablets remain significant for patient convenience.

4. How are emerging therapies impacting rizatriptan’s market?

CGRP inhibitors, especially for preventive treatment, are shifting some patients away from acute triptan therapy, potentially reducing rizatriptan’s market share.

5. What regions hold the most growth potential for rizatriptan?

Emerging markets, including China and India, offer significant upside, provided regulatory hurdles are addressed and affordability is ensured.

References

[1] Goadsby, P. J., et al. (2019). "Migraine: Pathophysiology, diagnosis, and management." The New England Journal of Medicine, 381(28), 2725-2735.

More… ↓