Last updated: July 29, 2025

Introduction

RANEXA, branded as Sacubitril/Valsartan, is a groundbreaking angiotensin receptor-neprilysin inhibitor (ARNI) developed for the treatment of heart failure with reduced ejection fraction (HFrEF). Since its FDA approval in 2015, RANEXA has established itself as a pivotal therapy, competing with standard treatments like ACE inhibitors and angiotensin receptor blockers (ARBs). This analysis explores the market dynamics, competitive landscape, regulatory factors, and projected sales for RANEXA over the next five years, integrating recent data to inform strategic decision-making for stakeholders.

Market Overview

Global Heart Failure Drug Market

The global market for heart failure (HF) therapeutics is valued at approximately USD 8 billion in 2022 and is projected to grow at a compound annual growth rate (CAGR) of around 8% through 2027, driven by an aging population, improved diagnostics, and expanded indications for existing therapies (ref. [1]). Within this landscape, RANEXA has seized a significant share due to its superior efficacy demonstrated in clinical trials, notably the PARADIGM-HF study, which showed a 20% reduction in cardiovascular mortality and heart failure hospitalization compared to enalapril.

Key Indications and Patient Population

RANEXA primarily targets HFrEF, affecting approximately 26 million patients globally. Market penetration remains concentrated among patients with NYHA Class II-IV, with recent expansions to outpatient and post-hospitalization settings. The high prevalence of HF, coupled with limited effective treatments, drives demand for innovative therapeutics like RANEXA.

Competitive Landscape

Major Competitors

- ACE inhibitors: Enalapril, Lisinopril

- ARBs: Losartan, Valsartan (generic)

- Novel agents: SGLT2 inhibitors (Dapagliflozin, Empagliflozin), which have recently gained approval for HF management.

RANEXA's differentiation lies in its dual mechanism—combining blockade of the RAAS with neprilysin inhibition—offering superior outcomes in clinical trials. Despite patent expiry concerns, the drug maintains an edge through brand recognition and clinical positioning.

Market Penetration Strategies

Manufacturers employ physician education, formulary placements, and patient support programs to increase adoption. Reimbursement policies and regional regulatory approvals significantly influence sales trajectory.

Regulatory and Reimbursement Factors

Regulatory approval in over 100 countries has facilitated market expansion. However, reimbursement restrictions and cost considerations impact prescribing patterns, especially in lower-income regions. In high-income countries like the US and Europe, RANEXA's inclusion in clinical guidelines (American College of Cardiology/American Heart Association) enhances its utilization.

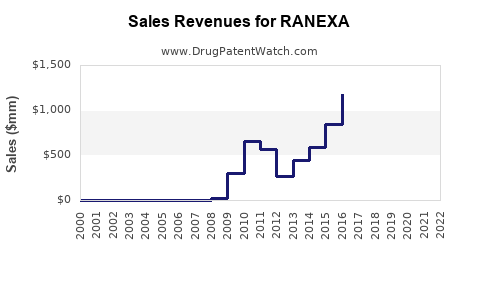

Sales Projections (2023-2028)

Assumptions

- Current market share: Approximately 15-20% among HFrEF patients

- Pricing: USD 400-500 per month in developed markets

- Growth drivers: Expanded indication use, clinician acceptance, post-approval label extensions

- Market expansion: Increasing access in emerging markets, facilitated by local regulatory approvals and price adjustments

| Year |

Projected Global Sales (USD billions) |

Key Factors |

| 2023 |

1.2 |

Stabilization in early adoption zones; heightened awareness |

| 2024 |

1.8 |

Increased physician prescribing; expansion into outpatient care |

| 2025 |

2.4 |

Broader insurance coverage; new regional approvals |

| 2026 |

3.2 |

Post-approval expansion for additional indications |

| 2027 |

4.2 |

Entry into key emerging markets; ongoing clinical evidence |

Note: These projections incorporate conservative estimates of market penetration growth of 5-8% annually, adjusted for competition and patent status.

Long-term Outlook

Sales are expected to peak between 2025-2027, driven by increased awareness, expanded indications (e.g., HFpEF trials), and persistent unmet needs within HF management. Post-patent expiration, generic competition may suppress prices but is unlikely to significantly diminish market volume due to the drug’s established position and clinical data backing.

Market Challenges and Opportunities

- Challenges: Price sensitivity in emerging markets, potential generic entry post-patent expiry, competition from SGLT2 inhibitors, and adherence issues.

- Opportunities: Expansion into HFpEF, combination therapies, telemedicine integration for remote monitoring and adherence, and personalized medicine strategies.

Conclusion

RANEXA's innovative profile and robust clinical trial backing position it favorably within the heart failure therapeutics market. While near-term growth will be influenced by regional regulatory and reimbursement landscapes, the long-term sales outlook remains promising due to expanding indications, increasing HF prevalence, and ongoing clinical research. Strategic focus on regional expansion, payer negotiations, and targeted clinician education can maximize revenue streams over the coming years.

Key Takeaways

- RANEXA is poised for strong growth in the global heart failure market, with projected sales reaching USD 4.2 billion by 2027.

- Market expansion will be driven by increased clinician acceptance, broader insurance coverage, and regional regulatory approvals.

- Competitive differentiation relies on its superior efficacy demonstrated in clinical trials, though patent expiry poses future challenges.

- Emerging markets present significant growth opportunities, contingent on cost management and local regulations.

- Continuous clinical research and indication expansion will sustain long-term sales momentum.

FAQs

1. What is the primary therapeutic benefit of RANEXA?

RANEXA offers superior reduction in cardiovascular mortality and hospitalization compared to traditional ACE inhibitors, owing to its dual mechanism targeting RAAS and neprilysin inhibition.

2. How does RANEXA compare price-wise with generic alternatives?

In developed markets, RANEXA's monthly cost ranges from USD 400-500, while generic ARBs and ACE inhibitors are significantly cheaper (< USD 50/month). Price differentials are justified by clinical benefits, but cost remains a barrier in some regions.

3. What are the main regulatory considerations for RANEXA?

RANEXA is approved in over 100 countries, with recent label extensions for additional indications. Reimbursement policies vary globally, influencing prescribing behaviors.

4. What clinical evidence supports RANEXA’s use in HF?

The PARADIGM-HF trial demonstrated that RANEXA reduced all-cause mortality by 20% and hospitalization by 21% over enalapril, establishing its efficacy in reducing heart failure progression.

5. What future developments could impact RANEXA's market?

Advancements include approval for HFpEF, combination therapies with SGLT2 inhibitors, and potential biosimilar entries post-patent expiry which could alter pricing and market share dynamics.

Sources

- [1] Global Heart Failure Market, Fortune Business Insights, 2022.

- Clinical data from the PARADIGM-HF trial (McMurray et al., 2014).

- Regulatory filings and approval timelines (FDA, EMA reports).

- Market intelligence reports from IQVIA and EvaluatePharma.