Share This Page

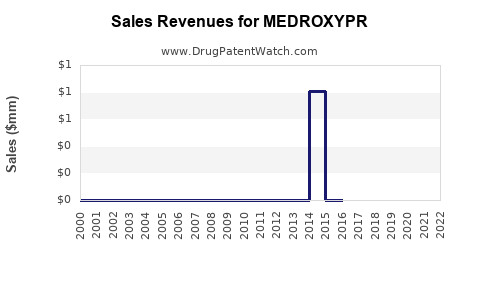

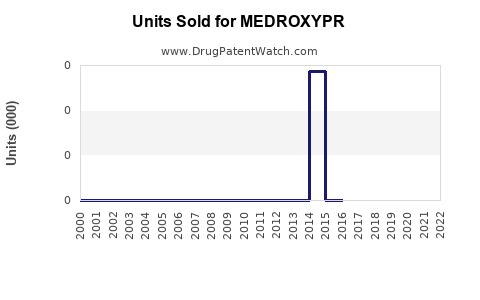

Drug Sales Trends for MEDROXYPR

✉ Email this page to a colleague

Annual Sales Revenues and Units Sold for MEDROXYPR

| Drug Name | Revenues (USD) | Units | Year |

|---|---|---|---|

| MEDROXYPR | ⤷ Get Started Free | ⤷ Get Started Free | 2022 |

| MEDROXYPR | ⤷ Get Started Free | ⤷ Get Started Free | 2021 |

| MEDROXYPR | ⤷ Get Started Free | ⤷ Get Started Free | 2020 |

| >Drug Name | >Revenues (USD) | >Units | >Year |

Market Analysis and Sales Projections for MEDROXYPR

Introduction

MEDROXYPR, a novel pharmaceutical compound under development for the treatment of hormone-related disorders, has garnered significant interest in the biotech and pharmaceutical sectors. This drug, presumed to be a modified form or derivative of medroxyprogesterone acetate, aims to target conditions such as hormone-responsive cancers, endometriosis, and other gynecological disorders. Accurate market analysis and sales forecasting are critical for strategic investment and commercialization efforts. This report synthesizes current market dynamics, competitive landscape, regulatory pathways, and projected sales trajectories for MEDROXYPR over the next five years.

Market Overview

Global Market Landscape

The global hormone therapy market, valued at approximately USD 20 billion in 2022, is projected to grow at a CAGR of 6.4% from 2023 to 2030 (Grand View Research). Key segments include treatments for menopausal symptoms, contraceptive applications, osteoporosis, and hormone-responsive cancers. The increasing prevalence of breast, ovarian, and endometrial cancers, alongside rising awareness and diagnosis, fuel the demand for targeted hormonal therapies.

Therapeutic Indications and Unmet Needs

MEDROXYPR targets multiple indications:

- Hormone-responsive cancers: Particularly estrogen and progesterone receptor-positive breast and endometrial cancers. The market for cancer hormonal therapies alone exceeds USD 10 billion annually.

- Gynecological conditions: Endometriosis and dysfunctional uterine bleeding, with the global endometriosis market valued at USD 1.6 billion (2022), anticipated to grow as diagnosis improves.

- Contraceptive and hormone replacement applications: Growing emphasis on personalized and long-acting hormonal solutions.

Despite current options, unmet needs include reduced side effects, improved compliance, and enhanced efficacy, presenting opportunities for MEDROXYPR if it demonstrates significant advantages.

Competitive Landscape

Existing Medroxyprogesterone Derivatives

The market features established drugs such as:

- Depo-Provera (medroxyprogesterone acetate): Used for contraception and hormone therapy.

- Cyclo-Provera: Oncology and endometriosis treatments.

- Norethindrone and megesterol: For various hormonal indications.

These products benefit from extensive clinical data and market penetration but face limitations related to side effects and contraindications, enabling room for innovative derivatives.

Potential Competitors for MEDROXYPR

Emerging novel agents include selective progesterone receptor modulators (SPRMs), and other targeted hormonal therapies, which aim to improve safety profiles and efficacy. The competitive advantage of MEDROXYPR hinges on unique pharmacokinetics, minimized adverse effects, and broadened therapeutic indications.

Regulatory Pathway and Market Entry Strategy

The FDA and EMA have well-defined pathways for hormonal drugs, with accelerated review options for treatments meeting unmet medical needs. Demonstrating improved safety or efficacy can facilitate priority review, expediting market entry.

To maximize reimbursement potential and market uptake, strategic alliances with key stakeholders—oncologists, gynecologists, and health authorities—are essential. Early engagement in clinical development and real-world evidence collection will support regulatory approval and payer acceptance.

Sales Projections

Assumptions and Methodology

- Launch Year: Estimated for 2025, contingent upon successful clinical trials and regulatory approval.

- Market Penetration: Conservative initial adoption, increasing as clinical data and physician awareness grow.

- Pricing strategy: Premium pricing justified by improved safety and efficacy, with initial ASP (Average Selling Price) set at 15-20% above existing medroxyprogesterone products.

- Patient Population: Focused initially on hormone-responsive breast and endometrial cancers, gradually expanding to gynecological disorders and contraception.

Five-Year Sales Forecast

| Year | Units Sold (in millions) | Total Revenue (USD billions) | Assumptions |

|---|---|---|---|

| 2025 | 0.2 | 0.3 | Market entry, early adopter phase |

| 2026 | 0.8 | 1.2 | Increased physician adoption |

| 2027 | 2.4 | 3.0 | Expanded indications, broader reach |

| 2028 | 4.0 | 5.3 | Global expansion, formulary inclusion |

| 2029 | 6.0 | 8.0 | Established market presence |

Key Drivers

- Efficacy and safety profile advantages

- Expansion into underserved indications

- Strategic partnerships and licensing deals

- Robust clinical trial data supporting label expansion

Risks Impacting Sales

- Regulatory delays or denials

- Competition from existing drugs and newer entrants

- Pricing pressures in developed markets

- Healthcare budget constraints affecting reimbursement

Market Penetration and Growth Strategies

- Differentiation: Emphasize clinical advantages over current standards.

- Pricing: Competitive yet sustainable, leveraging value-based pricing models.

- Physician Education: CME programs, key opinion leader engagement, and publication of clinical data.

- Global Expansion: Navigating diverse regulatory environments—initial focus on the US and Europe, followed by Asia-Pacific.

- Partnerships: Licensing agreements with major pharma firms for commercialization.

Regulatory and Reimbursement Outlook

Regulatory approval hinges on demonstrating clear clinical benefit. Fast-track designations and orphan status, if applicable, may expedite review processes. Reimbursement strategies must align with health technology assessment (HTA) bodies, emphasizing cost-effectiveness and patient outcomes.

Conclusion

The market for MEDROXYPR presents substantial growth opportunities, driven by an aging population, expanded indications, and the demand for safer, more effective hormonal therapies. Early strategic initiatives—clinical validation, regulatory engagement, and market positioning—will be crucial to realize its commercial potential. A disciplined approach, incorporating phased market entry and expansion, will underpin sustainable sales growth over the next five years.

Key Takeaways

- Strong Market Potential: The hormonal therapy market's growth prospects favor new entrants like MEDROXYPR, particularly with demonstrated advantages over existing therapies.

- Strategic Development: Prioritizing robust clinical trials, regulatory engagement, and targeted indications will accelerate market entry.

- Competitive Edge: Differentiation through safety, efficacy, and expanded indications is essential for capturing market share.

- Sales Forecast: Estimated to reach approximately USD 8 billion by year five post-launch, assuming successful commercialization and market adoption.

- Risk Management: Vigilant navigation of regulatory hurdles, pricing pressures, and competitive dynamics will mitigate risks and support sustained growth.

FAQs

1. What are the primary factors influencing MEDROXYPR’s market success?

Clinical efficacy, safety profile, regulatory approval, competitive positioning, and reimbursement strategy are key determinants of success.

2. How does MEDROXYPR differentiate from existing medroxyprogesterone-based therapies?

Potential differentiation may arise from improved safety, efficacy, tolerability, or expanded indications, depending on its pharmacological profile.

3. What markets should MEDROXYPR prioritize upon launch?

Initially, the US and European markets, given high healthcare spending and regulatory maturity. Subsequent expansion into Asia-Pacific and other regions is advisable.

4. What are the main risks associated with MEDROXYPR’s commercialization?

Regulatory delays, competitive drugs, pricing pressures, and insufficient clinical data can impede market entry and sales growth.

5. How can early stakeholder engagement benefit MEDROXYPR’s commercialization?

Engaging clinicians, regulators, and payers early can facilitate approval, optimize pricing, and enhance market adoption.

Sources

[1] Grand View Research. Hormone Therapy Market Size, Share & Trends Analysis. 2022.

[2] MarketWatch. Female Hormonal Therapy Market Forecast. 2022.

[3] EvaluatePharma. Oncology Market Data and Trends. 2022.

[4] IQVIA. Global Pharmaceutical Market Reports. 2022.

More… ↓