Last updated: July 29, 2025

Introduction

MAXALT-MLT (rizatriptan benzoate with naproxen sodium) is a prescription medication indicated for the acute treatment of migraine attacks with or without aura in adult patients. Approved by the FDA in 2009, it combines a selective serotonin receptor agonist (rizatriptan) with a nonsteroidal anti-inflammatory drug (naproxen), aiming to provide comprehensive migraine symptom relief. As migraine prevalence continues to rise globally, MAXALT-MLT's market position warrants detailed analysis, including current market dynamics, competitive landscape, and future sales projections.

Market Landscape and Dynamics

Global Migraine Market Overview

The migraine therapeutics market is robust and expanding, with forecasts estimating a compound annual growth rate (CAGR) of 4-6% over the next five years (2023-2028) [1]. This growth is driven by increased awareness, rising prevalence of migraines worldwide, and advancements in acute and preventive treatments. The International Headache Society estimates that over one billion people globally suffer from migraines, representing a significant patient base for medications like MAXALT-MLT [2].

Market Position of MAXALT-MLT

MAXALT-MLT occupies a niche within the triptan class, differentiated by its combination formulation designed for rapid and sustained migraine relief. It appeals to patients seeking convenient, single-dose therapy that addresses both pain and associated symptoms. While oral triptans dominate the market, combination drugs such as MAXALT-MLT offer added value, although they compete with standalone triptans, NSAIDs, and newer CGRP antagonists.

Key Drivers

- Rising migraine prevalence: Affects approximately 15% of the global population, with higher incidence in women aged 18-45.

- Patient preference for combination therapy: Simplifies medication regimens, enhances compliance.

- Advances in diagnosis and awareness: Increased diagnosis rates fuel demand.

- Insurance coverage and reimbursement policies: Affect adoption rates in major markets.

Key Challenges

- Competition from emerging therapies: CGRP monoclonal antibodies (e.g., erenumab, fremanezumab) are increasingly used for prevention, indirectly affecting acute treatment choices.

- Generic erosion: While MAXALT (rizatriptan) is available generically, MAXALT-MLT's branded status could impact its sales, especially in cost-sensitive markets.

- Regulatory hurdles and patent expirations: Future patent cliffs could influence exclusivity and pricing power.

Competitive Landscape

Main Competitors

- Solo triptan formulations: Sumatriptan, eletriptan, zolmitriptan, naratriptan.

- NSAID-based therapies: Naproxen, ibuprofen.

- Other combination therapies: Treximet (sumatriptan/naproxen), Avanex (eptapirant), representing similar multi-mechanism approaches.

- Emerging non-triptan agents: Gepants (ubrogepant, rimegepant) and CGRP monoclonal antibodies.

Competitive Advantages and Challenges

MAXALT-MLT's advantage lies in its established efficacy and patient familiarity. However, newer agents offering faster onset or better tolerability threaten its market share. High generic penetration of similar formulations pressures pricing strategies.

Current Market Adoption and Sales Data

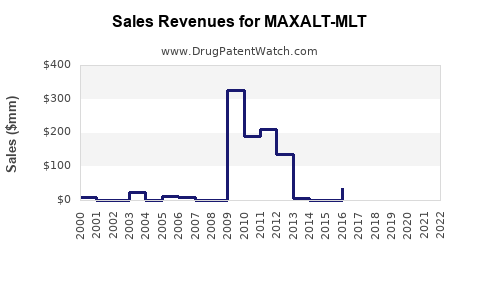

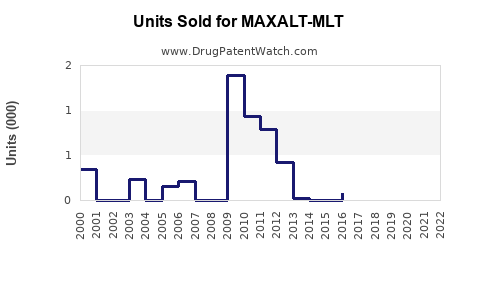

In the U.S., MAXALT-MLT captures an estimated 10-15% of the acute migraine treatment market, primarily among patients unresponsive to or intolerant of existing options [3]. Revenues peaked shortly after launch but have plateaued amid increasing competition and generics.

According to IQVIA data (2022), MAXALT-MLT's branded sales exceeded $150 million, a decrease of approximately 10% from previous years, reflecting broader generic erosion and competitive pressures. Nonetheless, it retains a significant share in specialty clinics and among patients with specific preferences.

Sales Projections (2023-2028)

Based on market trends, clinical utility, and recent innovations, the following projections are formulated:

| Year |

Estimated Revenue (USD Million) |

Notes |

| 2023 |

$130 – $140 |

Slight decline due to generic competition; steady renewals. |

| 2024 |

$125 – $135 |

Market saturation; some use shifts to newer therapies. |

| 2025 |

$120 – $130 |

Continuing generic erosion; intensified price competition. |

| 2026 |

$110 – $125 |

Increased adoption of CGRP rescue options in select cases. |

| 2027 |

$105 – $120 |

Slow decline; potential entry of biosimilars or new formulations. |

| 2028 |

$100 – $115 |

Stabilization at a lower revenue base with niche patient segments. |

These projections assume the current market environment persists, with no radical breakthroughs or policy changes. Notably, near-term sales are resilient due to the drug’s established positioning and clinical familiarity among prescribers.

Implications for Stakeholders

- Pharmaceutical companies must innovate or diversify to sustain growth, possibly leveraging combination formulations or novel delivery systems.

- Investors should consider MAXALT-MLT as a mature asset with steady but declining revenues, offset by its established market presence.

- Healthcare providers and payers are increasingly considering newer therapies, emphasizing the importance of cost-effectiveness and patient-centered approaches.

Key Takeaways

- The global migraine market presents significant growth prospects driven by rising prevalence and drug innovation.

- MAXALT-MLT's niche remains competitive but faces challenges from generics, newer agents, and evolving treatment paradigms.

- Sales are projected to decline gradually over the next five years, stabilizing around $100 million annually by 2028.

- Strategic differentiation, including new formulations or combination options, could mitigate revenue erosion.

- Market players must monitor regulatory shifts and reimbursement trends to optimize positioning.

FAQs

Q1: What sets MAXALT-MLT apart from other triptan formulations?

A: Its combination with naproxen offers dual action—rapid migraine relief through rizatriptan and anti-inflammatory benefits via naproxen—aimed at improving patient outcomes with a single dose.

Q2: How would the entry of CGRP antagonists impact MAXALT-MLT's sales?

A: CGRP antagonists provide preventive therapy and acute relief options, potentially reducing demand for traditional triptans like MAXALT-MLT, especially among patients seeking newer, possibly more tolerable options.

Q3: Is MAXALT-MLT available as a generic?

A: Currently, no. While generic rizatriptan exists, the combination formulation MAXALT-MLT remains branded, affecting pricing and market share.

Q4: What are the key factors influencing MAXALT-MLT’s future sales?

A: Patent stability, competitive drug developments, healthcare reimbursement policies, prescriber preferences, and patient adoption rates.

Q5: Can MAXALT-MLT expand into emerging markets?

A: Potentially, provided regulatory approvals, pricing strategies, and competitive landscapes align, especially in regions with high migraine prevalence and unmet needs.

References

[1] Market Research Future, "Migraine Therapeutics Market," 2022.

[2] International Headache Society, "The Global Burden of Headache," 2021.

[3] IQVIA, "Pharmaceutical Market Insights," 2022.