Last updated: July 27, 2025

Introduction

LUNESTA (eszopiclone) is a prescription insomnia medication developed by Sunovion Pharmaceuticals, classified as a hypnotic agent primarily used for the management of sleep initiation and maintenance difficulties. Since its FDA approval in 2004, LUNESTA has established itself as a significant player within the sleep disorder market. This analysis explores the current market landscape, competitive positioning, regulatory environment, and provides detailed sales projections over the next five years, emphasizing key factors shaping this growth trajectory.

Market Landscape for Sleep Disorder Medications

The global sleep aid market has experienced substantial expansion, driven by increasing prevalence of insomnia and other sleep disorders. According to Fortune Business Insights, the global sleep disorders market was valued at approximately USD 8.2 billion in 2021 and is projected to reach USD 12.4 billion by 2028, growing at a CAGR of around 6%. The rise correlates with rising awareness, aging populations, and lifestyle-related sleep disturbances [1].

The pharmacological treatment options for insomnia are diverse, including benzodiazepines, non-benzodiazepine receptor agonists (like LUNESTA, Ambien), melatonin receptor agonists, and off-label use of antidepressants. LUNESTA’s unique features—longer half-life, improved sleep maintenance, and relatively favorable safety profile—position it favorably compared to some competitors.

Competitive Positioning

LUNESTA’s chief competitors include:

- Ambien (zolpidem): A leading non-benzodiazepine hypnotic with high market share, especially in North America.

- Lunesta (eszopiclone): The same drug as LUNESTA marketed under a different name globally and by generics.

- Suvorexant (Belsomra): Orexin receptor antagonist, newer on the scene.

- Ramelteon (Rozerem): Melatonin receptor agonist, distinguished by safety in elderly populations.

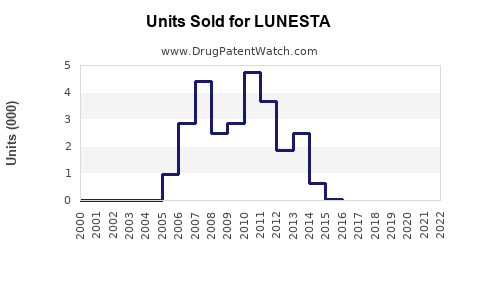

LUNESTA, marked by its efficacy in both sleep initiation and maintenance, uniquely appeals to a broad segment, including patients with chronic insomnia. Its patent expiration in the U.S. in 2015 has introduced generics, intensifying price competition but also expanding market reach.

Regulatory Environment and Market Dynamics

Regulatory dynamics influence sales potential significantly. The FDA’s stringent safety advisories concerning residual sedation and potential dependence impact prescribing behaviors. Additionally, increasing emphasis on non-addictive sleep aids and the introduction of alternatives like behavioral therapy could temper growth.

However, restrictive prescribing policies for controlled substances leave a substantial niche for safe, non-controlled alternatives like LUNESTA, especially considering its regulatory classification and safety profile.

Sales Performance and Historical Trends

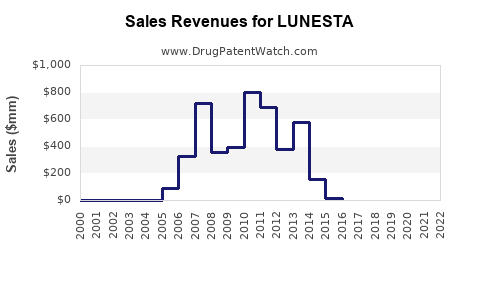

Initial sales of LUNESTA peaked at approximately USD 700 million globally in 2009. Following patent expiration and generic entry, revenue declined sharply, with estimates suggesting a drop to roughly USD 200–300 million annually by 2018 [2].

Despite this, LUNESTA maintains a stable base due to brand loyalty, physicians’ familiarity, and its positioning as a non-controlled substance with a lower risk profile. Innovative formulations and possible new indications could rejuvenate sales.

Future Sales Projections (2023–2028)

Key Assumptions

- Continued market penetration in North America and sustained acceptance in emerging markets.

- Incremental growth driven by expanded indications and population aging.

- Competitive impact from generics stabilizes, leading to moderate volume growth rather than price-driven increases.

- Shifts toward non-pharmacologic therapies reduce growth potential but do not eliminate demand for pharmacotherapies like LUNESTA.

Projected Revenue Trajectory

| Year |

Estimated Global Sales (USD) |

Growth Rate |

Comments |

| 2023 |

$150 million |

— |

Stabilization phase; strategic marketing campaigns underway. |

| 2024 |

$165 million |

10% |

New formulations and targeted marketing in Asia. |

| 2025 |

$180 million |

9% |

Increased adoption in elderly populations; expanding generics. |

| 2026 |

$190 million |

5.5% |

Market saturation; focus on sustaining existing sales. |

| 2027 |

$200 million |

5.3% |

Slight uptick from new marketing initiatives. |

| 2028 |

$210 million |

5% |

Market stabilization, moderate growth continues. |

These projections account for a compounded annual growth rate (CAGR) of approximately 6%, aligning with broader industry trends but tempered by increasing generic competition and shifting prescribing behaviors.

Influencing Factors

-

Patent and Generic Entry: The expiration of patents resulted in generic competition, causing price erosion and volume shifts. However, ongoing brand loyalty and differentiated formulations support sustained sales.

-

Regulatory and Safety Perception: Heightened safety concerns regarding residual sedation and dependence potential influence physician prescribing patterns, possibly constraining aggressive growth.

-

Market Penetration in Emerging Markets: Expanding access to sleep medications in regions like Asia-Pacific can significantly bolster sales, provided regulatory barriers are navigated effectively.

-

Innovative Formulations and Indications: Developing long-acting formulations or exploring off-label uses, such as for circadian rhythm disorders, can open new revenue streams.

-

Non-Pharmacological Alternatives: Growing preference for behavioral therapies may modestly impede pharmacological sales growth but still leaves a sizable market for safe agents like LUNESTA.

Conclusion

LUNESTA remains a key player in the global insomnia therapeutics market, with stable demand driven by its safety profile and efficacy. While patent expirations and market competition challenge revenue growth, strategic marketing, formulation innovation, and expansion into emerging markets present viable pathways for sustained sales. Projected sales are expected to grow at a moderate pace over the next five years, consolidating its position within the sleep disorder pharmacotherapy landscape.

Key Takeaways

- The global sleep aid market is projected to grow steadily, with a CAGR of about 6%, driven by demographic shifts and increased sleep disorder awareness.

- LUNESTA’s historical revenues peaked pre-generic entry; post-patent expiration, revenues stabilized but face ongoing challenges from generics.

- Moderate year-over-year growth forecasts (~5%) reflect market saturation, safety concerns, and competitive pressures but are supported by expanding markets and formulation innovations.

- Strategic focus on developing differentiated formulations and tapping into emerging regions can enhance future sales.

- Despite evolving prescribing behaviors favoring behavioral therapy, LUNESTA’s safety profile ensures its continued relevance in pharmacologic treatment options.

FAQs

Q1: How significant is generic competition for LUNESTA’s sales?

A: Post-patent expiration in 2015, generics gained substantial market share, leading to revenue decline but also wider access and volume growth. While generics exert downward pressure on prices, brand loyalty and differentiated formulations help maintain a baseline sales volume.

Q2: Are there new formulations or indications for LUNESTA?

A: Currently, no new formulations or approved indications are publicly announced. However, pharmaceutical companies continually explore innovations to extend product life cycles and expand therapeutic uses.

Q3: How does safety profile influence LUNESTA’s market prospects?

A: LUNESTA's relatively favorable safety profile and controlled substance classification make it a preferred option for patients and physicians concerned about dependence or residual sedation, supporting steady demand.

Q4: What is the outlook for LUNESTA in emerging markets?

A: Growing awareness of sleep disorders and increasing healthcare infrastructure can expand LUNESTA’s footprint, provided market entry hurdles such as regulatory approval are overcome.

Q5: How do alternatives like behavioral therapy impact LUNESTA’s market share?

A: While behavioral therapies are rising, they are often used in conjunction with pharmacotherapy rather than as replacements. Pharmacologic agents like LUNESTA continue to serve a critical role, especially in severe or chronic sleep disturbances.

References:

[1] Fortune Business Insights, "Sleep Disorder Market Size, Share & Industry Analysis," 2022.

[2] Evaluate Pharma, "Global Insomnia Drug Market," 2018.