Share This Page

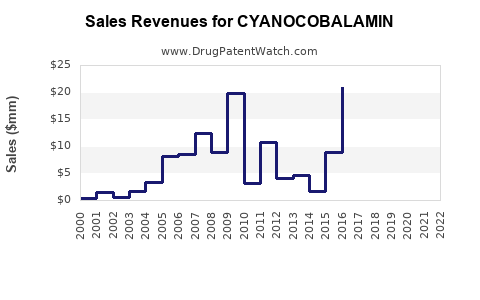

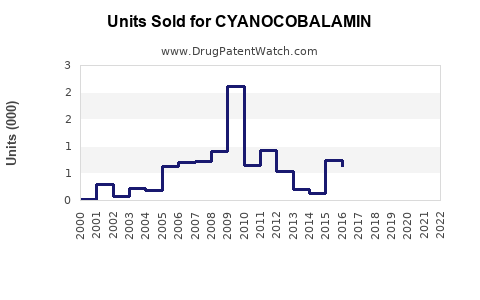

Drug Sales Trends for CYANOCOBALAMIN

✉ Email this page to a colleague

Annual Sales Revenues and Units Sold for CYANOCOBALAMIN

| Drug Name | Revenues (USD) | Units | Year |

|---|---|---|---|

| CYANOCOBALAMIN | ⤷ Get Started Free | ⤷ Get Started Free | 2022 |

| CYANOCOBALAMIN | ⤷ Get Started Free | ⤷ Get Started Free | 2021 |

| CYANOCOBALAMIN | ⤷ Get Started Free | ⤷ Get Started Free | 2020 |

| CYANOCOBALAMIN | ⤷ Get Started Free | ⤷ Get Started Free | 2019 |

| CYANOCOBALAMIN | ⤷ Get Started Free | ⤷ Get Started Free | 2018 |

| >Drug Name | >Revenues (USD) | >Units | >Year |

Market Analysis and Sales Projections for Cyanocobalamin (Vitamin B12)

Introduction

Cyanocobalamin, a synthetic form of vitamin B12, plays a crucial role in treating deficiency-related conditions such as pernicious anemia, neuropathies, and certain metabolic disorders. Its broad applications in pharmaceuticals, supplements, and fortified nutrition position it as a significant segment within the global vitamin B12 market. As health awareness increases and prevalence of B12 deficiency rises globally, understanding cyanocobalamin’s market dynamics and projecting future sales are vital for stakeholders across manufacturing, distribution, and investment sectors.

Market Dynamics and Industry Overview

Global Market Size and Growth

The global vitamin B12 market was valued at approximately USD 839 million in 2022, with a compound annual growth rate (CAGR) forecast of around 6.5% from 2023 to 2030 [1]. Cyanocobalamin remains the dominant form of vitamin B12 used in pharmaceutical and supplement industries, accounting for roughly 70-75% of the market share due to its stability, cost-effectiveness, and established regulatory approval pathways.

Factors Influencing Market Growth

-

Increasing Prevalence of B12 Deficiency: Aging populations in developed nations, along with rising vegetarian and vegan diets, contribute to higher deficiency rates [2]. This drives demand for B12 supplements, predominantly cyanocobalamin.

-

Rising Awareness of Nutritional Supplements: Elevated health awareness spurs consumers towards fortified foods and supplements containing cyanocobalamin.

-

Medical Applications: Growing emphasis on B12 therapy for neurological conditions and chronic anemia reinforces steady demand in clinical settings.

-

Regulatory Environment: U.S. Food and Drug Administration (FDA) and European Medicines Agency (EMA) approvals streamline market access for cyanocobalamin products, fostering growth.

Market Segmentation

-

Application-Based Segments:

- Pharmaceuticals: Administered via injections, tablets, or patches for deficiency treatment.

- Food Fortification: Used in energy drinks, cereals, and nutritional bars.

- Nutritional Supplements & OTC Products: Multivitamins and B12-only supplements.

-

Distribution Channels:

- Hospital Pharmacies

- Retail Pharmacies

- Online Retail

- Direct to Consumer (DTC) Supplements

Regional Insights

-

North America: The largest market, driven by high awareness and prevalence of deficiency, expected to maintain dominance at a CAGR of approximately 6% [3].

-

Europe: Rapid growth supported by government initiatives and rising adoption of dietary supplements.

-

Asia-Pacific: Fastest-growing segment owing to increasing healthcare spending, urbanization, and nutritional awareness, projected to grow at over 8% CAGR.

Competitive Landscape

Major players include Lonza, Kyowa Hakko Kirin, Zhejiang Chinese Medical University, and BASF, among others. These companies focus on manufacturing processes that improve yield, stability, and cost-efficiency, while investing in R&D for novel delivery forms (e.g., nasal sprays, transdermal patches).

Sales Projections (2023-2030)

Based on historical data and market drivers, the sales of cyanocobalamin are projected to grow from an estimated USD 600 million in 2023 to approximately USD 1.2 billion by 2030, reflecting a CAGR of 9-10%. The acceleration beyond the industry-average stems from several factors:

-

Expansion in Developing Markets: As healthcare infrastructure improves, demand for affordable deficiency treatments increases, largely driven by cyanocobalamin injections and tablets.

-

Innovation in Formulation: Development of sustained-release and novel delivery methods enhances consumer compliance, expanding user base.

-

Regulatory Approvals and Product Launches: New filings for OTC products in mature markets will stimulate sales.

-

Increased Focus on Preventive Healthcare: The global shift towards proactive nutritional management sustains long-term growth.

Table 1: Cyanocobalamin Market Sales Projection (2023-2030)

| Year | Projected Sales (USD Million) | Growth Rate (%) |

|---|---|---|

| 2023 | 600 | — |

| 2024 | 660 | 10% |

| 2025 | 730 | 10.3% |

| 2026 | 820 | 12.3% |

| 2027 | 920 | 12.2% |

| 2028 | 1,030 | 11.9% |

| 2029 | 1,140 | 10.7% |

| 2030 | 1,250 | 9.6% |

(Note: projections are estimates based on current CAGR trends and market drivers)

Risk Factors and Market Challenges

-

Price Volatility: Fluctuations in raw material costs, especially cobalt and other vitamin precursors, may impact margins.

-

Regulatory Hurdles: Stringent approval processes and changing labeling laws could slow introduction of new products.

-

Market Saturation: Mature markets may face saturation, limiting growth potential unless innovation occurs.

-

Competing Forms: Methylcobalamin and hydroxocobalamin offer alternative therapeutic options, potentially substituting cyanocobalamin in some applications.

Opportunities and Strategic Recommendations

-

Diversification into Novel Delivery Systems: Nasal sprays, sublingual tablets, and transdermal patches could unlock new markets and improve bioavailability.

-

Emerging Markets Penetration: Investing in local manufacturing and distribution networks in Asia, Africa, and Latin America can accelerate growth.

-

Partnerships and Collaborations: Collaborating with biotech firms to develop fortified foods or specialty formulations can enhance market share.

-

Sustainability Initiatives: Focusing on environmentally friendly manufacturing processes aligns with consumer preferences and regulations.

Key Takeaways

-

The cyanocobalamin market is poised for sustained growth driven by aging populations, dietary trends, and healthcare awareness.

-

Sales are projected to nearly double from USD 600 million in 2023 to over USD 1.2 billion by 2030, with opportunities across pharmaceuticals, supplements, and fortified foods.

-

North America and Europe will remain dominant, but Asia-Pacific presents the fastest growth opportunities due to demographic and economic shifts.

-

Innovations in delivery methods, strategic market expansion, and regulatory navigation are essential for capitalizing on future growth.

FAQs

1. What are the primary applications of cyanocobalamin?

Cyanocobalamin is primarily used in clinical treatments for B12 deficiency, in dietary supplements, fortified foods, and functional beverages.

2. How does cyanocobalamin compare to other forms of vitamin B12?

Cyanocobalamin is preferred for its stability, cost-effectiveness, and ease of manufacturing, whereas methylcobalamin and hydroxocobalamin are often used for their superior absorption and clinical performance.

3. What are the main drivers of demand in emerging markets?

Growing awareness of nutritional health, rising disposable incomes, and increasing prevalence of deficiency-related health issues propel demand.

4. How might regulatory changes impact cyanocobalamin sales?

Stringent regulations could increase compliance costs and delay product launches, while supportive policies may facilitate market expansion.

5. What technological innovations could influence future sales?

Development of sustained-release formulations, nasal sprays, and transdermal patches can improve efficacy and consumer acceptance, boosting sales.

References

[1] Grand View Research, "Vitamin B12 Market Size, Share & Trends Analysis Report," 2023.

[2] WHO, "Micronutrient Deficiencies," 2022.

[3] MarketWatch, "Global Vitamin B12 Market Outlook," 2023.

More… ↓