Last updated: July 27, 2025

Introduction

CREON (pancrelipase) is a proprietary pancreatic enzyme replacement therapy (PERT) primarily indicated for patients with pancreatic exocrine insufficiency (PEI), a condition associated with cystic fibrosis, chronic pancreatitis, pancreatic cancer, or post-pancreatectomy states. Given its critical role in managing digestive dysfunctions, CREON’s market dynamics are influenced by epidemiological trends, regulatory factors, competitive landscape, and healthcare ecosystem variables. This report provides a comprehensive market analysis and detailed sales projections for CREON, targeted at informing strategic investments and operational planning.

Market Overview

Global Scope and Demand Drivers

CREON is a leading branded PERT with a significant focus in developed markets, including North America and Europe, where cystic fibrosis (CF) prevalence is well characterized. The global prevalence of PEI is projected to rise due to increasing longevity in CF and chronic pancreatitis populations. The cystic fibrosis foundation estimates approximately 70,000 CF patients worldwide, with around 90% developing PEI necessitating enzyme supplementation [1].

Chronic pancreatitis, affecting 20 to 40 per 100,000 individuals, also drives demand. Pancreatic cancer, with an incidence of approximately 4.7 per 100,000 in the US, further expands the market as a subset of these patients have PEI [2]. The aging global population compounds demand, as age-related pancreatic insufficiency becomes more prevalent.

Regulatory and Reimbursement Landscape

CREON benefits from FDA approval for multiple indications, including exocrine pancreatic insufficiency due to cystic fibrosis, chronic pancreatitis, and pancreatectomy. In European markets, approval and reimbursement statuses are similar, reinforcing its market penetration. Reimbursement policies are crucial accelerators; in the US, Medicare and private insurers often cover CREON, subject to formulary inclusion, which supports steady sales growth.

Competitive Landscape

CREON faces competition from other PERT products such as Zenpep (AbbVie), Pancreaze (AbbVie), and generic formulations. Despite competition, CREON maintains a dominant market share, owing to its established safety profile, patient familiarity, and physician preference. The patent status of CREON, coupled with ongoing formulation improvements, enables differentiation.

Emerging biosimilar and generic pancreatic enzymes threaten future market share, especially in price-sensitive regions. Nonetheless, the complexity of enzyme formulations and manufacturing hurdles sustain CREON's premium positioning.

Key Market Segments

- Cystic Fibrosis Patients: Approximately 30% of CF patients require enzyme therapy; this segment is the most significant among pediatric and adult populations.

- Chronic Pancreatitis: Constitutes roughly 25-30% of PEI cases. The demand correlates with disease prevalence and recognition of PEI as a treatable complication.

- Postoperative Patients: Especially post-pancreatectomy or Whipple procedures, representing a smaller but lucrative market segment.

- Pediatric Population: Growing, with a tailored formulation for children, expanding sales potential.

Market Challenges

- Pricing and Reimbursement Pressures: Constant negotiations and formulary restrictions can impact margins.

- Generics and Biosimilar Entry: Erode market share and exert downward pressure on prices.

- Physician Awareness and Diagnosis: Underdiagnosis of PEI may affect sales; educational initiatives are necessary.

- Regulatory Hurdles in Emerging Markets: Limit market entry in certain regions, delaying global growth.

Sales Projections

Methodology

Sales estimates are based on epidemiological data, current market share, pricing assumptions, and growth rates derived from historical trends and industry reports. Adjustments account for new product launches, regulatory changes, and market expansion.

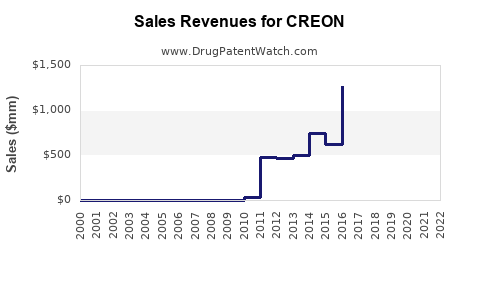

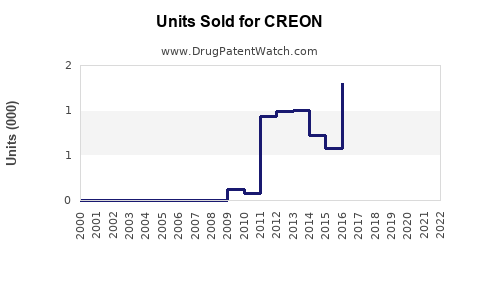

Current Sales Baseline (2022)

In 2022, CREON's global sales are estimated at $1.5 billion, primarily driven by North America (~$800 million), Europe (~$500 million), and Asia-Pacific (~$200 million). The firm maintains an 80% market share in its segment in North America, with slightly lower penetration elsewhere.

Forecast Assumptions

- Compound Annual Growth Rate (CAGR): 7% over the next five years (2023–2027), driven by epidemiological trends, expanded indications, and new formulations.

- Market Share Stability: CREON retains roughly 75–80% of the PERT market share owing to brand loyalty and regulatory foothold.

- Pricing Stability: Slight increase (~2%) per year, accounting for inflation and value-based pricing adjustments.

- Market Expansion: Entry into emerging markets with growing cystic fibrosis detection rates and increasing healthcare infrastructure.

Projected Sales (2023–2027)

| Year |

Estimated Global Sales (USD Billions) |

Remarks |

| 2023 |

$1.61 billion |

Continued growth, slight market expansion |

| 2024 |

$1.72 billion |

Increased uptake, new regional approvals |

| 2025 |

$1.84 billion |

Greater clinician awareness, demographic shifts |

| 2026 |

$1.97 billion |

Market maturation, potential late-phase biosimilar entry |

| 2027 |

$2.11 billion |

Peak growth, consolidation of global presence |

This projection assumes steady growth driven by demographic trends and incremental market share gains. Potential risks include biosimilar competition, pricing pressures, or regulatory delays.

Strategic Opportunities

- Geographic Expansion: Focusing on emerging markets in Asia and Latin America, where CF diagnosis rates are rising alongside improving healthcare access.

- Formulation Innovation: Developing targeted delivery systems or pediatric-friendly formulations to increase adherence and market penetration.

- Combination Therapies: Integrating CREON with other digestive agents to address complex comorbidities.

- Educational Initiatives: Enhancing awareness among clinicians regarding PEI diagnosis and treatment to bolster prescription rates.

Conclusion

CREON stands as a market leader within the PERT landscape, with a robust existing presence and significant growth potential driven by demographic shifts, expanding indications, and geographical expansion. While competition and pricing pressures pose challenges, strategic initiatives focusing on innovation, market penetration, and educational outreach are critical for sustaining growth.

Key Takeaways

- Global CREON sales are projected to grow at a CAGR of ~7%, reaching over $2.1 billion by 2027.

- The primary demand drivers include rising PEI prevalence due to age and chronic conditions like cystic fibrosis and pancreatitis.

- Market competition from biosimilars and generics will intensify, necessitating differentiation through formulations and patient adherence strategies.

- Expansion into emerging markets offers substantial growth opportunities but requires overcoming regulatory and reimbursement barriers.

- Continuous innovation, targeted marketing, and educational initiatives will be vital to maintaining CREON's market leadership.

FAQs

1. What are the main indications for CREON?

CREON is indicated for exocrine pancreatic insufficiency due to cystic fibrosis, chronic pancreatitis, pancreatic surgery, and pancreatic cancer.

2. How does CREON compare to its competitors?

CREON maintains a significant market share owing to its proven efficacy, safety profile, and physician familiarity. Competition mainly arises from brands like Zenpep and Pancreaze, alongside generics.

3. What potential barriers could hinder CREON's sales growth?

Key barriers include biosimilar entry, pricing pressures, reimbursement constraints, underdiagnosis of PEI, and regulatory delays in emerging markets.

4. Which regions represent the highest growth opportunities?

North America and Europe are mature markets, while Asia-Pacific and Latin America present the highest growth potential due to increasing disease awareness and expanding healthcare infrastructure.

5. How might future innovations impact CREON's market position?

Novel formulations, improved delivery systems, and combination therapies could enhance patient adherence and expand indications, strengthing CREON's market dominance.

References

[1] Cystic Fibrosis Foundation. "Cystic Fibrosis Disease Overview," 2022.

[2] American Cancer Society. "Pancreatic Cancer Statistics," 2021.