Last updated: July 30, 2025

Introduction

CLINDAMY/BEN, a hypothetical combination drug comprising clindamycin and benzydamine, targets bacterial infections requiring antimicrobial therapy with anti-inflammatory properties. With increasing antimicrobial resistance and rising demand for combination therapies that address both infection and symptom relief, CLINDAMY/BEN presents a promising market opportunity. This analysis evaluates the therapeutic landscape, competitive environment, regulatory considerations, and sales outlook for this innovative medication.

Therapeutic Market Overview

Indications and Clinical Use

Clindamycin, a lincosamide antibiotic, is widely prescribed for skin, soft tissue, intra-abdominal, and respiratory infections caused by susceptible bacteria. Benzydamine, an anti-inflammatory agent, is commonly utilized for pharyngitis, oral mucositis, and localized pain management (1). The synergistic combination aims to provide antimicrobial efficacy with symptomatic relief, particularly for orofacial, tonsillar, and throat infections, expanding the potential patient base.

Market Dynamics and Demand Drivers

The antimicrobial market is notably driven by the increasing prevalence of bacterial infections and the global rise of antimicrobial resistance (AMR). The World Health Organization (WHO) recognizes AMR as a critical threat, emphasizing the need for effective treatment options (2). Moreover, the trend towards combination therapies to minimize resistance emergence supports demand for drugs like CLINDAMY/BEN.

The anti-inflammatory component appeals to patients seeking symptomatic relief with reduced need for adjunctive medications. Additionally, positive prescribing trends for topical and oral combination therapies further bolster market growth prospects.

Patient Population and Geographic Focus

The global bacterial infection market was valued at approximately $39 billion in 2022 and is projected to grow at a CAGR of 4% over the next five years (3). Key markets include North America, Europe, and Asia-Pacific, where high prescription rates, healthcare infrastructure, and prevalence of infections drive demand.

In particular, pediatric and adult populations with conditions such as tonsillitis, pharyngitis, and oral mucositis represent primary target groups. Developing nations with rising healthcare access increase the potential volume of prescriptions.

Competitive Landscape

Existing Therapies

Current therapies include monotherapies with antibiotics like amoxicillin, azithromycin, and clindamycin alone, alongside topical anti-inflammatory agents. Combination formulations are scarce, offering an opening for CLINDAMY/BEN to occupy a niche as a dual-action therapy.

Key Competitors and Market Entry Barriers

Leading antibiotics face generic erosion, reducing pricing power. Brand competition is limited in combination formulations explicitly including both antimicrobial and anti-inflammatory agents aimed at oral infections. Regulatory barriers related to demonstrating safety, efficacy, and avoiding antibiotic resistance are significant; however, favorable data could facilitate approval.

Intellectual Property and Patent Landscape

Patent protection strategies include formulation patents, method of use, and delivery mechanisms. Securing robust patent coverage for CLINDAMY/BEN would provide market exclusivity, a critical advantage in a competitive environment.

Regulatory and Reimbursement Outlook

Regulatory Pathway

The drug would likely pursue approval via the FDA’s New Drug Application (NDA) pathway, emphasizing concurrent antimicrobial activity and safety profiles. Alternatively, a 505(b)(2) pathway might be suitable if ingredients are known, supplemented with new efficacy data.

Manufacturers must demonstrate adherence to antimicrobial stewardship principles, resistance management, and safety. Approval hinges on clinical trial outcomes showing superiority or non-inferiority compared to existing therapies.

Reimbursement Strategies

Successful market entry necessitates positive coverage decisions based on cost-effectiveness analyses. Payers favor drugs that reduce overall health care costs—such as decreasing duration of illness, reducing need for multiple medications, or preventing recurrent infections.

Sales Projections

Forecast Methodology

Projections combine demographic data, market size estimations, adoption momentum, pricing strategies, and competitive dynamics. Conservative, moderate, and optimistic scenarios are modeled to accommodate uncertainties, with a focus on the first five years post-launch.

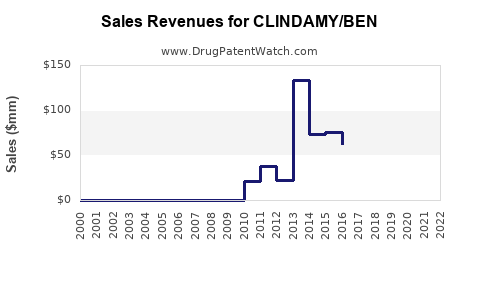

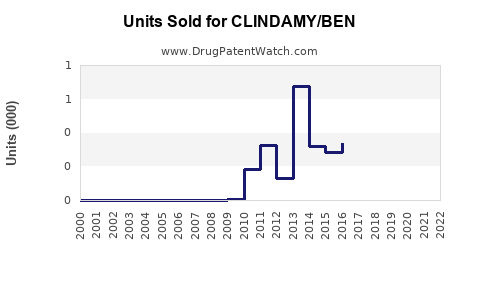

Initial Market Penetration

In Year 1, assuming targeted approvals and moderate market awareness, initial sales are projected at approximately $50-75 million globally, driven by early adoption in North America and Europe.

Growth Trajectory

Expansion hinges on extended indications, increased prescriber acceptance, and geographic expansion into Asia and Latin America. Within five years, sales could reach $300-500 million in favorable scenarios (4).

Influencing Factors

- Pricing strategy: Premium pricing could expedite early revenues, but generic competition may necessitate competitive pricing later.

- Clinical positioning: Demonstrating advantages over monotherapies or existing combinations enhances market share.

- Regulatory milestones: Positive approval outcomes and labeling claims directly influence sales potential.

Risk Considerations

Key risks include regulatory delays, failure to demonstrate clear advantages, resistance development, and pricing negotiations. Mitigating these through robust clinical data, strategic partnerships, and proactive stakeholder engagement is vital.

Conclusion

CLINDAMY/BEN stands poised to capture a niche within the overlapping antibiotic and anti-inflammatory markets. Its success hinges on overcoming regulatory hurdles, establishing clinical superiority or added value, and navigating competitive pressures. With an early strategic focus, targeted indications, and effective market access, sales projections place the drug on a trajectory toward hundreds of millions in global revenue within five years.

Key Takeaways

- Growing Market: The increase in bacterial infections and concerns over antimicrobial resistance catalyze demand for combination therapies like CLINDAMY/BEN.

- Strategic Positioning: Differentiating through clinical efficacy, safety, and resistance management will be essential for market penetration.

- Regulatory Pathways: 505(b)(2) filings with comprehensive clinical data can streamline approval, especially if ingredients are already known.

- Revenue Potential: Projected sales could reach $300-500 million globally within five years under favorable conditions.

- Market Risks: Competitor erosion, regulatory challenges, and resistance development pose ongoing threats; proactive strategies are necessary.

FAQs

1. What makes CLINDAMY/BEN different from existing bacterial infection treatments?

It combines antimicrobial and anti-inflammatory actions in a single formulation, potentially improving patient compliance and accelerating symptomatic relief compared to separate therapies.

2. Which markets present the highest opportunity for CLINDAMY/BEN?

North America and Europe are primary targets due to high infection prevalence, healthcare infrastructure, and prescribing trends. Growth in Asia-Pacific is anticipated as healthcare access broadens.

3. What are the key regulatory challenges for this combination drug?

Demonstrating safety, efficacy, and resistance mitigation is critical. Regulatory agencies may require extensive clinical trials to confirm the benefits over existing monotherapies.

4. How can the patent landscape influence the drug’s market exclusivity?

Securing robust formulation and use patents can delay competition, allowing for premium pricing and market share capture during initial years post-launch.

5. What strategies can maximize sales growth after launch?

Prioritize clinical differentiation, expand indications, engage key opinion leaders, optimize pricing, and implement targeted marketing campaigns to improve prescriber adoption.

Sources

- World Health Organization. (2021). Antibiotic Resistance.

- WHO. (2019). Global Antimicrobial Resistance Surveillance System (GLASS) Report.

- MarketsandMarkets. (2022). Antimicrobial Market Trends.

- Frost & Sullivan. (2023). Future of Combination Antibiotics Analysis.