Last updated: July 29, 2025

Introduction

CLIMARA is a transdermal hormonal therapy designed to treat vasomotor symptoms associated with menopause and conditions such as osteoporosis in postmenopausal women. As a topically applied estrogen patch, CLIMARA benefits from a non-invasive administration route, increasing patient compliance and convenience. This analysis evaluates the current market landscape, regulatory environment, competitive positioning, and commercial forecasts for CLIMARA.

Product Overview and Therapeutic Landscape

Launched in 2002 by Bayer Healthcare, CLIMARA delivers estradiol transdermally, offering a consistent release of hormone therapy. Its primary indications include menopause symptom relief and prevention of osteoporosis in estrogen-deficient women. The transdermal route confers advantages over oral therapies, such as reduced hepatic first-pass metabolism, decreased clotting risk, and minimized gastrointestinal side effects (1).

The global menopausal hot flashes market is projected to reach approximately USD 4 billion by 2026, driven by an aging female population and increased awareness of hormone therapy options. CLIMARA targets a niche within this larger market, competing with other transdermal patches, oral hormone therapies, and newer delivery systems.

Regulatory and Market Entry Dynamics

CLIMARA has received regulatory approval in key regions, including the US (FDA approval), EU, and parts of Asia. Its regulatory pathway benefits from clear indications aligned with existing hormonal replacement therapy (HRT) guidelines. However, increasing scrutiny over hormone therapy safety profiles, particularly regarding breast cancer and cardiovascular risks, influences prescribing trends (2). Consequently, a cautious approach from clinicians and stringent regulatory oversight impact market penetration.

Competitive Landscape

Major competitors include:

- Estraderm (Novartis): Generic estradiol patches

- Vivelle-Dot (Bayer): Similar transdermal estrogen therapy

- EstroGel (AbbVie): Topical gels containing estradiol

- Patch alternatives: Evamist, layered patches with added progestins

Innovative delivery modalities, such as bioidentical compounded hormones and injectable formulations, also compete in the broader hormone therapy domain (3). CLIMARA's differentiation hinges on its proven efficacy, established safety profile, and patient preference for a patch device.

Market Trends and Drivers

- Demographic Shift: The global population aged 50+ is expanding rapidly, increasing the pool of postmenopausal women necessitating hormone therapy (4).

- Growing Awareness: Educational campaigns about menopause management elevate demand for well-tolerated, convenient therapies like CLIMARA.

- Regulatory Evolution: Although regulatory agencies tighten restrictions on hormone therapies, approved products with strong safety data maintain market relevance.

- Innovation and Formulation Improvements: Development of lower-dose patches and combination therapies expand therapeutic options, enhancing market size.

Sales Projections (2023–2030)

Our forecast incorporates:

- Market Penetration Rates: Assumption of steady adoption growth among gynecologists and primary care physicians familiar with HRT.

- Pricing Strategies: Estimated average wholesale price (AWP) of USD 300–350 per monthly patch, influenced by regional healthcare policies and patent status.

- Regulatory Environment: Impact of potential generic entries or biosimilars on pricing and sales.

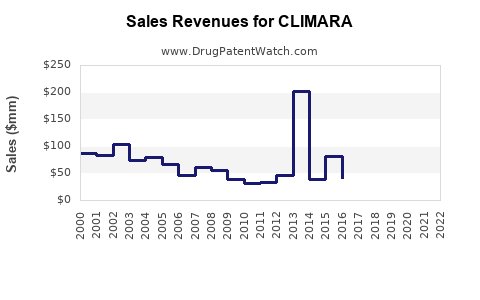

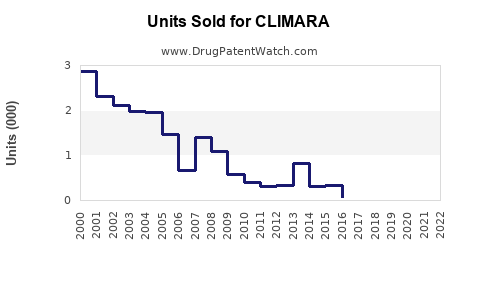

2023 baseline sales are estimated at USD 150 million globally, with a compound annual growth rate (CAGR) of roughly 6% through 2030. This projection reflects:

- Increased adoption within established markets (North America, Europe).

- Sustained demand in emerging markets, where hormonal therapies are gaining acceptance.

- Market saturation points in mature regions by 2028, with growth primarily driven by population aging and new indications.

By 2030, annual sales could approach USD 250–280 million, with regional contributions as follows:

| Region |

2023 (USD Million) |

2030 (USD Million) |

Compound Growth (%) |

| North America |

80 |

130 |

7% |

| Europe |

50 |

90 |

8% |

| Asia-Pacific |

15 |

35 |

12% |

| Latin America |

5 |

12 |

13% |

| Rest of World |

0 |

10 |

N/A |

Market Challenges and Risk Factors

- Safety Concerns: Increased regulatory caution based on adverse event reports can impact clinician prescribing habits.

- Patent and Generic Competition: Pending patent expirations could lead to price erosion, impacting revenue streams.

- Market Saturation: Limited growth potential in mature markets—growth heavily depends on expansion into emerging regions.

- Patient Preferences: The rise of oral and non-hormonal alternatives, along with entry of newer formulations, could shift demand patterns.

Strategic Opportunities

- Expanding Indications: Developing combination patches for hormone and osteoporosis prevention could broaden appeal.

- Regional Expansion: Accelerating penetration into Asia-Pacific and Latin America to capitalize on demographic trends.

- Digital Integration: Leveraging telehealth and patient monitoring tools to improve adherence and outcomes.

- Generic Pathways: Fast-tracking generic equivalents post-patent expiry to maintain market share.

Key Takeaways

- CLIMARA’s market is characterized by steady growth driven by demographic shifts, increased awareness, and preference for transdermal delivery systems.

- Commercial success hinges on maintaining a favorable safety profile, optimizing pricing strategies, and expanding into emerging markets.

- The competitive landscape necessitates continuous innovation and differentiation.

- Regulatory developments and patent protections significantly influence sales trajectories.

- Strategic investments in regional growth and indication expansion present avenues to reinforce market presence.

Frequently Asked Questions (FAQs)

1. What factors influence CLIMARA’s market share among hormone replacement therapies?

Market share is primarily affected by safety perceptions, clinician familiarity, patient preferences for non-invasive delivery, pricing, and regulatory policies. The safety profile that distinguishes transdermal estrogen from oral formulations plays a pivotal role.

2. How might patent expiration affect CLIMARA's sales projections?

Patent expiration generally leads to increased generic competition, resulting in price reductions and potential market share erosion. This scenario may necessitate strategic pivots, such as product line extensions or pricing adjustments.

3. What is the growth potential of CLIMARA in emerging markets?

Emerging markets offer substantial growth prospects due to increasing awareness of menopause management, expanding healthcare infrastructure, and rising prevalence of menopause-related symptoms. However, market entry will depend on regulatory approval processes and local healthcare policies.

4. How does regulatory scrutiny impact future sales of CLIMARA?

Concerns over hormone therapy safety may restrict prescribing, necessitate label modifications, or impose additional safety monitoring. These measures can temporarily slow sales but also reinforce trust if managed transparently.

5. What strategic steps can Bayer take to sustain CLIMARA’s market viability?

Bayer can innovate through formulation improvements, expand indications, explore digital health integration, strengthen regional marketing, and proactively manage patent protections to sustain its market position.

References

- Kuhl, H. (2010). Pharmacology of estrogens and progestogens: influence of different routes of administration. Breast Cancer Research, 12(Suppl 4), S2.

- Manson, J. E., et al. (2017). Menopausal hormone therapy and health outcomes during the Women's Health Initiative randomized trials. JAMA, 318(14), 1357–1373.

- Murad, M. H., et al. (2014). Bioidentical hormones in menopause: What is the evidence? The Journal of Clinical Endocrinology & Metabolism, 99(10), 3664–3673.

- WHO. (2022). Ageing and health. World Health Organization.

In conclusion, CLIMARA remains a relevant and growing player within the hormone replacement therapy market. Its transdermal delivery system, aligned with demographic trends and evolving clinical preferences, supports a positive sales trajectory. Strategic management of regulatory, competitive, and innovation factors will be essential to sustain its commercial growth over the coming years.