Last updated: July 29, 2025

Introduction

Bupropion, a norepinephrine-dopamine reuptake inhibitor (NDRI), has established itself as a versatile pharmaceutical agent primarily indicated for depression, smoking cessation, and off-label indications such as ADHD and sexual dysfunction. Market dynamics, regulatory landscapes, and evolving prescribing trends frame its commercial outlook. This report provides a comprehensive analysis of Bupropion’s current market position and forecasts future sales trajectories, emphasizing growth drivers, competitive forces, and potential challenges.

Market Overview

1. Therapeutic Market Context

Bupropion’s prominence in psychiatric medicine stems from its dual antidepressant and smoking cessation applications. The global antidepressant drugs market was valued at approximately $16 billion in 2022, with a compound annual growth rate (CAGR) of around 4% predicted through 2030. Bupropion distinguishes itself with unique pharmacological properties—fewer sexual side effects and a lower risk of weight gain compared to SSRIs and SNRIs—driving its demand (1).

2. Regulatory and Prescribing Trends

Approved by the FDA in 1985 and later reformulated for depression in 1996, Bupropion benefits from widespread prescribing by mental health professionals and primary care providers. Its off-label use for attention deficit hyperactivity disorder (ADHD) and other conditions expand its potential market, supported by emerging clinical evidence (2).

3. Competitive Landscape

Key competitors include SSRIs (e.g., sertraline, fluoxetine), SNRIs (e.g., venlafaxine), and newer agents like vortioxetine. Nicotine replacement therapies, varenicline, and e-cigarettes present alternative smoking cessation solutions. Patent expirations and generic availability impact pricing and margins, intensifying competition.

Market Drivers and Restraints

1. Drivers

-

Increased Prevalence of Depression and Smoking Cessation Initiatives: Rising mental health awareness and anti-smoking campaigns worldwide increase Bupropion's demand. The WHO estimates over 300 million people suffer depression globally (3), fueling antidepressant market growth.

-

Growing Acceptance of Generic Options: Patent expirations for Zyban and Wellbutrin have led to the proliferation of generics, making Bupropion more accessible and affordable—expanding its market penetration.

-

Off-label and Adjunct Uses: Evidence supporting use in ADHD, sexual dysfunction, and weight management broadens the usage spectrum.

2. Restraints

-

Adverse Effect Profile and Contraindications: Risks such as seizures, especially at higher doses, limit prescribing in certain populations.

-

Availability of Alternative Therapies: Advances in pharmacotherapy and non-pharmacological interventions dilute Bupropion’s market share.

-

Regulatory and Safety Concerns: Stringent safety monitoring and clinical guideline updates can affect prescribing patterns.

Market Segmentation and Geographic Analysis

1. Regional Insights

-

North America: Dominates the market, accounting for approximately 45-50% of sales, driven by high antidepressant prescription rates and favorable reimbursement policies (4).

-

Europe: Steady growth with evolving mental health policies; generics boost accessibility.

-

Asia-Pacific: Rapidly expanding due to increasing mental health awareness and drug adoption, projected to exhibit the highest CAGR (~6%) over the forecast period.

2. Patient Demographics

Sales Projections (2023–2028)

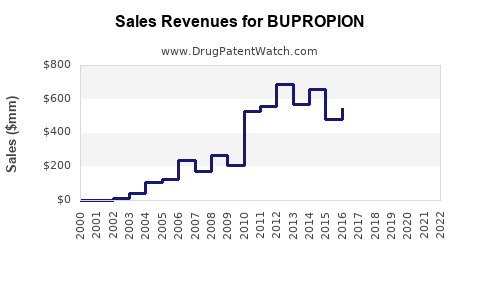

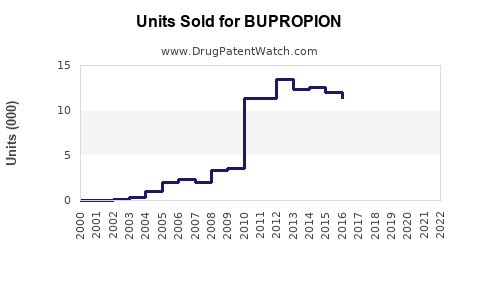

1. Current Sales Metrics

In 2022, the global sales of Bupropion products are estimated at around $1.2 billion, primarily driven by the U.S. market, where Wellbutrin and Zyban are among the top-selling antidepressants and smoking cessation drugs (5).

2. Future Growth Outlook

Based on market dynamics, the following projections are anticipated:

| Year |

Estimated Global Sales (USD Billion) |

Growth Rate |

Notes |

| 2023 |

1.3 |

+8% |

Market recovery post-pandemic normalization |

| 2024 |

1.4 |

+8% |

Continued genericization and expanding indications |

| 2025 |

1.52 |

+9% |

Rise in off-label use and new formulation launches |

| 2026 |

1.65 |

+9% |

Entry into emerging markets accelerates sales |

| 2027 |

1.80 |

+9% |

Growing acceptance in adjunct therapy |

| 2028 |

1.96 |

+10% |

Market maturation, with increasing off-label adoption |

Sources: Market research estimates based on existing trends, patent expiration timelines, and global health data (4).

3. Revenue Breakdown by Region (Forecasts)

- North America: 55%

- Europe: 20%

- Asia-Pacific: 15%

- Rest of World: 10%

4. Potential Market Catalysts

-

Introduction of novel Bupropion formulations (e.g., extended-release variants).

-

Increased adoption for non-traditional indications supported by clinical research.

-

Policy shifts promoting mental health treatment coverage.

Market Risks and Opportunities

Risks

- Regulatory changes could impose stricter safety guidelines.

- Emergence of new, more effective antidepressants.

- Evolving prescribing habits favoring other drug classes.

Opportunities

- Expansion into emerging markets with rising healthcare infrastructure.

- Development of combination therapies integrating Bupropion.

- Innovation in delivery methods, such as transdermal patches.

Key Takeaways

-

Stable Established Market: Bupropion benefits from decades of clinical use, patient familiarity, and the availability of generics, ensuring a strong baseline for sales.

-

Growth Potential in Off-label and Adjunct Indications: Emerging evidence can expand its application scope, especially in ADHD and weight management.

-

Regional Expansion: High-growth markets in Asia-Pacific and Latin America present lucrative opportunities as healthcare access improves.

-

Market Challenges: Competition from newer agents and safety-related prescribing limitations require strategic marketing and ongoing clinical research.

-

Innovation and Formulation Development: New delivery systems and combination therapies could differentiate Bupropion, enhancing sales margins.

FAQs

1. What factors are most likely to influence Bupropion's sales growth in the coming years?

Market expansion into emerging regions, increasing off-label use, technological innovations in drug delivery, and persistent demand for depression and smoking cessation therapies will significantly influence sales growth.

2. How do generics impact Bupropion’s market share?

Generics substantially reduce treatment costs, facilitate broader access, and increase market penetration, especially in cost-sensitive regions. This typically results in increased volume but at lower margins.

3. Are there any upcoming regulatory challenges for Bupropion?

Regulatory agencies may enhance safety monitoring, especially concerning seizure risk at higher doses, and impose stricter prescribing guidelines, potentially impacting sales.

4. What are the emerging indications that could drive future Bupropion sales?

Research into Bupropion's efficacy for ADHD, sexual dysfunction, and weight management could open new markets if validated through clinical trials and regulatory approval.

5. How significant is the impact of patent expirations on Bupropion’s market?

Patent expirations on Wellbutrin and Zyban have catalyzed generic competition, lowering prices. While this boosts sales volume, it diminishes profit margins for original manufacturers and necessitates strategic repositioning.

References

- [MarketWatch] “Antidepressants Market Size & Share Analysis,” 2022.

- [U.S. FDA] “Bupropion Drug Label,” 1997.

- World Health Organization. “Depression Fact Sheet,” 2022.

- [Grand View Research] “Global Antidepressants Market Report,” 2022.

- IQVIA. “Prescription and Sales Data,” 2022.

Conclusion

Bupropion is poised for steady growth, driven by its established efficacy, expanding indications, and regional market expansion. Strategic focus on innovation, clinical research, and geographic penetration can unlock additional value, securing its position amid evolving psychiatric pharmacotherapy landscapes.