Last updated: July 29, 2025

Introduction

AMBIEN, the trade name for zolpidem, is a widely prescribed sedative-hypnotic agent primarily used for short-term management of insomnia. Since its FDA approval in 1992, AMBIEN has established itself as a leading pharmacological intervention—benefiting from its rapid onset of action and relatively lower dependency risk than traditional benzodiazepines. This analysis explores the dynamics influencing AMBIEN’s market landscape, competitive positioning, regulatory environment, and sales trajectory up to the foreseeable future.

Market Overview

Global Insomnia Treatment Market Context

The global sleep aid market, encompassing prescription and OTC products, was valued at approximately USD 11 billion in 2022. The segment is driven by rising awareness of sleep disorders, an aging population, and increasing prevalence of comorbidities such as anxiety and depression. The insomnia segment within this market accounts for a significant share, with pharmacological treatments representing the predominant therapeutic approach.

AMBIEN’s Position in the Market

AMBIEN occupies a significant niche, appreciated for its safety profile, rapid hypnotic action, and minimal hangover effects. The drug’s unique mechanism—selective agonism at the GABA-A receptor—coupled with strategic marketing and subsequent product line extensions (e.g., AMBIEN CR), has supported its strong commercial presence. Its balanced profile between efficacy and tolerability makes it a preferred option among clinicians.

Market Drivers and Challenges

Drivers

- Growing Insomnia Prevalence: Estimated that up to 30% of adults globally experience insomnia symptoms [1], expanding the potential patient pool.

- Aging Population: Older adults are more prone to sleep disturbances, bolstering demand.

- Shift Toward Pharmacological Interventions: Increasing preference for short-term medications for immediate relief.

- Product Line Extensions: Introduction of formulations like AMBIEN CR and newer agents (e.g., Zolpimist) sustain market interest.

Challenges

- Regulatory Restrictions & Warnings: FDA black box warning regarding complex sleep behavior (e.g., sleep driving) limits prescriptions.

- Generic Competition: Patent expiries and the proliferation of generics (zolpidem tablets) dilute brand premiums.

- Shift Toward Non-Pharmacologic Options: Cognitive-behavioral therapy for insomnia (CBT-I) is gaining favor, potentially reducing reliance on medications.

- Risks and Side Effects: Concerns over dependency, tolerance, and adverse cognitive effects influence prescribing trends.

Regulatory Environment

Regulatory agencies continuously refine guidelines affecting AMBIEN’s market. The FDA enforced stricter dosage guidelines in 2013, emphasizing minimal effective doses and highlighting risks linked to higher doses [2]. Additionally, recent warnings about complex sleep behaviors have prompted prescriber caution.

Internationally, regulatory landscapes differ; some markets impose stricter controls or promote alternative therapies, affecting global sales potential.

Competitive Landscape

Major competitors include:

- Non-benzodiazepine hypnotics: Eszopiclone (Lunesta), zaleplon (Sonata).

- Benzodiazepines: Temazepam, diazepam.

- Over-the-counter options: Diphenhydramine, melatonin supplements.

- Emerging agents: Dual orexin receptor antagonists like suvorexant (Belsomra), which target sleep regulation differently.

While AMBIEN maintains market share due to its established efficacy, rising competition from newer agents with favorable side effect profiles may impact long-term sales.

Sales Analysis & Projections

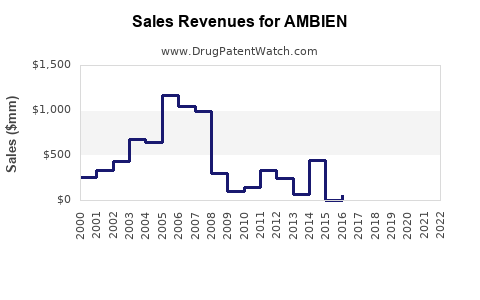

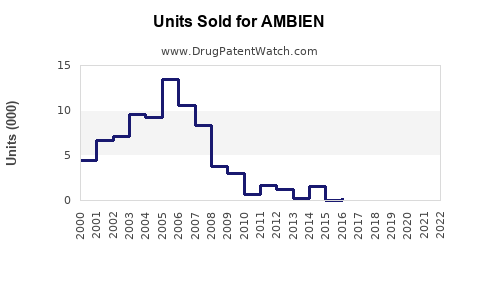

Historical Sales Trends

From the early 2000s through 2015, AMBIEN experienced robust growth driven by increasing sleep disorder diagnoses. Annual global sales peaked around USD 2–2.5 billion, with North America accounting for roughly 60% of revenue, reflecting high prescription rates.

Post-2015, sales plateaued, influenced by:

- Increased regulatory scrutiny.

- Market saturation.

- The advent of generics reducing brand premiums.

- Prescriber and consumer preferences shifting towards non-drug modalities.

Forecasting Future Sales

Using current market data, the following projections are posited:

- Short-term (2023–2025): Slight decline in sales (~3–5% annually) due to generic competition and regulatory constraints.

- Mid-term (2026–2030): Stabilization with potential minor growth (~1–2% annually), driven by expansion into emerging markets and product innovations.

- Long-term (2030+): Possible decline year-over-year, unless new formulations or indications are developed or if non-pharmacologic therapies fail to gain traction.

The impact of COVID-19 accelerated telemedicine and remote prescribing, which potentially increased initial prescriptions but may decline as healthcare systems stabilize. Nonetheless, the core patient demographic remains sizable.

Market Opportunities

- Expansion into Emerging Markets: Growing middle classes and improving healthcare access could open new markets, notably in Asia-Pacific and Latin America.

- Product Line Extensions: Extended-release formulations, combination therapies, or indications for comorbid conditions could reignite growth.

- Digital Health Integration: Leveraging telemedicine and digital adherence programs can improve prescription rates and compliance.

Risks and Mitigation

- Regulatory Restrictions: Vigilant compliance and post-market surveillance are vital.

- Generic Competition: Focus on patient acceptance through formulary positioning and clinical data.

- Market Saturation: Diversifying indications and leveraging combination therapies can counteract saturation effects.

- Developing Non-Drug Alternatives: Investment in or endorsement of non-pharmacologic sleep aids can broaden the therapeutic landscape.

Key Takeaways

- Established Market Presence: AMBIEN remains a significant player in the insomnia treatment landscape but faces increasing competition and regulatory pressure.

- Moderate Growth Expected: Sales are projected to decline modestly in the near term, with stabilization prospects if innovation efforts succeed.

- Strategic Expansion Necessary: Emerging markets and product innovation can provide growth avenues amid competitive and regulatory headwinds.

- Shift towards holistic treatment: Embracing multimodal approaches, including behavioral therapy, will influence future prescribing trends.

- Monitoring Regulatory Developments: Ongoing safety concerns and regulations will shape the market dynamics and require adaptive strategies.

FAQs

1. What factors most significantly influence AMBIEN’s sales growth?

Prescriber acceptance, regulatory restrictions, competition from generics and new agents, and evolving clinical guidelines are pivotal. Adoption of alternative therapies like CBT-I could dampen drug sales.

2. How does the patent status affect AMBIEN’s sales projections?

Patent expiration in the early 2010s led to a surge in generic zolpidem options, reducing brand-specific revenue. Future patent protections or exclusivities for new formulations could temporarily bolster sales.

3. What emerging markets offer the greatest growth potential for AMBIEN?

Asia-Pacific, Latin America, and parts of Africa present significant opportunities due to rising healthcare infrastructure and increasing awareness of sleep disorders.

4. How might new formulations or indications impact AMBIEN’s market?

Extended-release or combination formulations tailored for specific populations could unlock new revenue streams, prolonging market relevance.

5. What non-pharmacological strategies could challenge the position of drugs like AMBIEN?

Cognitive Behavioral Therapy for Insomnia (CBT-I), sleep hygiene education, and digital sleep management platforms are increasingly preferred, potentially reducing reliance on pharmacotherapy.

Conclusion

While AMBIEN remains a core treatment for insomnia, its future sales are poised for modest declines driven by regulatory concerns, generic competition, and shifting treatment paradigms. Strategic investments in innovation, market diversification, and educated prescriber outreach are imperative to sustain its market position amid evolving healthcare landscapes.

References

[1] Morin CM, et al. (2018). The Prevalence of Insomnia in Adults: A Systematic Review and Meta-analysis. Sleep Medicine Reviews.

[2] U.S. Food and Drug Administration. (2013). Safety Announcement: Information on the Risk of Complex Sleep Behaviors with Sleep-Aids Containing Zolpidem.