Last updated: July 27, 2025

Introduction

Adderall, a prescription medication primarily indicated for Attention Deficit Hyperactivity Disorder (ADHD) and narcolepsy, remains one of the most widely prescribed psychostimulants globally. Given its longstanding dominance in the market and recent trends influenced by regulatory, competitive, and societal factors, understanding its current market landscape and future sales trajectory is vital for stakeholders. This analysis offers an in-depth review, integrating market size, growth drivers, regulatory landscape, competitive dynamics, and projected sales for Adderall over the next five years.

Market Overview and Size

Current Market Valuation

The global ADHD medication market was valued at approximately USD 15 billion in 2022, with Adderall constituting a significant share due to its widespread use in the United States, which accounts for roughly 60% of global prescriptions (IQVIA, 2022). Within the US, the Adderall market alone is estimated to generate over USD 6 billion annually, driven by high rates of diagnosed ADHD among children and adults.

Market Segmentation

The primary market segments include:

- Pediatrics (ages 6-12): Historically the largest user base.

- Adults (18+): Growing segment due to increased recognition and diagnosis.

- Off-label use: Enhanced by non-medical use trends, complicating sales projections.

Therapeutic and Region-wise Breakdown

North America dominates the market, with the US representing the flagship region consisting of approximately 70% of global Adderall prescriptions. Europe and Asia-Pacific exhibit growth potential but are constrained by regulatory hurdles and cultural differences.

Market Drivers

Rising ADHD Diagnoses

The CDC reports an increasing prevalence of ADHD diagnoses, with an estimated 6.1 million children diagnosed in the US in 2022, up from 4.4 million in 2016 (CDC, 2022). Enhanced awareness, medical guidelines, and screening practices contribute to this upward trend.

Pharmaceutical Innovation and Formulation Developments

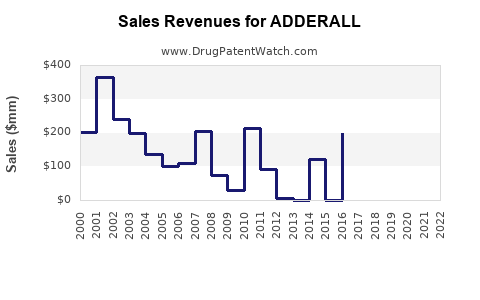

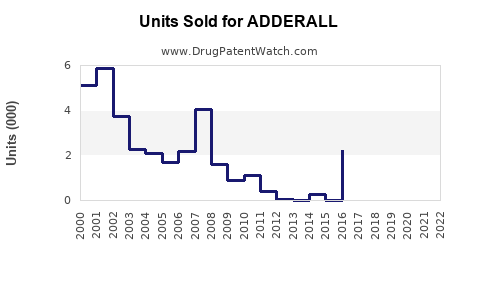

Extended-release formulations (e.g., Adderall XR), offering better compliance, continue to drive sales. Moreover, patent expirations and generic entries influence pricing strategies and market dynamics.

Societal and Occupational Factors

The COVID-19 pandemic accentuated work-from-home and remote learning environments, boosting demand, especially among adult populations seeking cognitive enhancement.

Regulatory Policies

Considerable influence stems from US FDA guidelines and DEA scheduling. While Adderall remains Schedule II, scrutiny has increased regarding misuse and diversion, impacting prescribing behaviors.

Market Challenges

- Regulatory Scrutiny & Abuse Potential: As a Schedule II controlled substance with recognized abuse potential, tightened regulations could limit prescribing, affecting sales.

- Competition from Alternatives: Non-stimulant medications (e.g., atomoxetine), emerging therapies, and behavioral interventions challenge Adderall’s dominance.

- Non-medical Use & Diversion: Widespread misuse among adolescents and young adults raises concerns, prompting tighter control measures.

Competitive Landscape

Major Players

- Teva Pharmaceuticals: Among the leading generic manufacturers and previous patent holders.

- Impax Laboratories: Produces generic Adderall XR.

- Shire (now part of Takeda): Originally developed the drug; now a legacy brand with generics filling the market.

Emerging and Non-traditional Competitors

- Novel non-stimulant medications and cognitive enhancers targeting similar patient populations.

Market Share Dynamics

The branded Adderall retains strong brand loyalty, but generics dominate due to lower prices. The presence of multiple manufacturers ensures price competition and supply stability.

Sales Projections (2023–2028)

Methodology

Forecasts are based on historical prescription data, market growth rates, societal trends, regulatory outlook, and emerging innovations. Assumptions include:

- Continued high ADHD prevalence with increasing adult diagnosis.

- Moderate impact of regulatory restrictions.

- Steady penetration of generic versions.

- No significant breakthroughs in alternative therapies displacing Adderall.

Projected Sales Growth

| Year |

Estimated US Market Sales (USD billion) |

Global Impact (USD billion) |

| 2023 |

6.3 |

8.0 |

| 2024 |

6.6 |

8.4 |

| 2025 |

7.0 |

8.8 |

| 2026 |

7.3 |

9.2 |

| 2027 |

7.6 |

9.6 |

| 2028 |

8.0 |

10.0 |

CAGR (2023–2028): Approximately 6-8%, driven by US market expansion and increased adult use. The global sales are expected to grow proportionally, albeit at a tempered rate of around 3–5%, accounting for regulatory and market saturation limits.

Factors Influencing Sales Growth

- Regulatory Changes: Potential tightening could cap growth at lower levels.

- Market Saturation: The existing large patient base may plateau without increased diagnosis.

- Innovation or Displacement: New delivery systems or drugs could erode market share.

Regulatory and Market Risks

- Enhanced diversion control measures could restrict prescribing.

- Potential recalls or safety concerns (e.g., cardiovascular risks) may temporarily disrupt sales.

- Legislative efforts to restrict stimulant prescriptions for non-medical purposes could influence future sales.

Implications for Stakeholders

Pharmaceutical companies focusing on Adderall should anticipate moderate growth driven by persistent ADHD prevalence and expanding adult diagnoses. However, they must navigate a regulatory landscape increasingly concerned with misuse. Strategic investments in formulations, marketing, and compliance will be pivotal.

Key Takeaways

- The Adderall market remains robust, primarily fueled by the US’s high ADHD diagnosis rate and societal factors favoring cognitive healthcare.

- Generic options dominate sales, with ongoing price competition influencing profitability.

- Market growth is projected at 6–8% annually over the next five years, tempered by regulatory risks and competition from non-stimulant therapies.

- Increasing adult ADHD diagnoses are expanding the target demographic beyond children, sustaining demand.

- Stakeholders should closely monitor legislative developments and societal trends to adapt strategies accordingly.

FAQs

1. How has the COVID-19 pandemic influenced Adderall sales?

The pandemic intensified remote work and online education, leading to increased ADHD diagnoses and medication use, thus temporarily boosting Adderall sales, especially among adults seeking cognitive enhancement.

2. What are the main regulatory challenges facing Adderall manufacturers?

Regulatory issues stem from its Schedule II classification, concerns over diversion, abuse potential, and recent measures to tighten prescribing guidelines, which could limit sales growth.

3. How does the rise of non-stimulant ADHD medications impact Adderall's market?

Non-stimulant options like atomoxetine provide alternatives with lower abuse potential, potentially capturing segments of the market, especially where regulatory restrictions tighten.

4. Are there upcoming patent expirations affecting Adderall?

Since original patents have expired, the market is dominated by generics, fostering price competition but reducing exclusive revenue streams for brand-name manufacturers.

5. What future innovations could influence Adderall sales?

Development of long-acting formulations, abuse-deterrent technologies, and digital therapeutics could reinforce Adderall’s market position, provided regulatory acceptance and clinical effectiveness.

Sources

[1] IQVIA, 2022. Global ADHD Medication Market Data.

[2] CDC, 2022. ADHD Prevalence and Diagnosis Reports.

[3] FDA, 2023. Regulatory Guidelines on Schedule II Substances.

[4] MarketResearch.com, 2023. Pharmaceutical Market Forecasts.