Share This Page

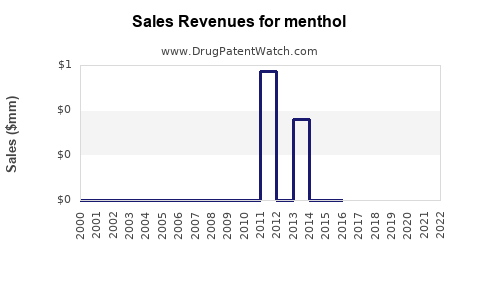

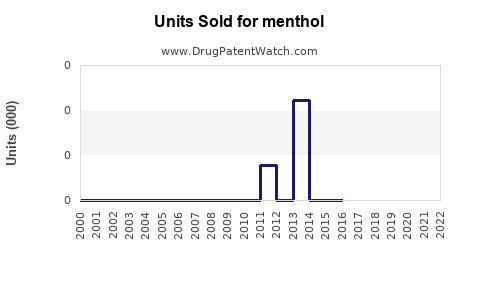

Drug Sales Trends for menthol

✉ Email this page to a colleague

Annual Sales Revenues and Units Sold for menthol

| Drug Name | Revenues (USD) | Units | Year |

|---|---|---|---|

| MENTHOL | ⤷ Get Started Free | ⤷ Get Started Free | 2022 |

| MENTHOL | ⤷ Get Started Free | ⤷ Get Started Free | 2021 |

| MENTHOL | ⤷ Get Started Free | ⤷ Get Started Free | 2020 |

| MENTHOL | ⤷ Get Started Free | ⤷ Get Started Free | 2019 |

| >Drug Name | >Revenues (USD) | >Units | >Year |

rket Analysis and Sales Projections for Menthol: A Strategic Overview

Introduction

Menthol, a naturally occurring organic compound derived primarily from mint plants, has sustained its relevance as an additive across multiple industries, including pharmaceuticals, personal care, food and beverages, and tobacco products. Despite being a commodity with well-established uses, recent market dynamics, evolving consumer preferences, regulatory shifts, and technological innovations necessitate a comprehensive reassessment of menthol’s market landscape and future sales prospects. This analysis consolidates current trends, forecasts market growth, and offers strategic insights for stakeholders interested in the menthol sector.

Market Overview and Industry Applications

Menthol’s primary applications include:

- Pharmaceuticals: Used in formulations for analgesics, decongestants, and cough suppressants. Its cooling sensation facilitates symptomatic relief in respiratory therapies.

- Personal Care & Cosmetics: Incorporated extensively in toothpastes, mouthwashes, skincare, and hair products for flavoring and sensory enhancement.

- Tobacco: Adds a cooling, soothing effect, making menthol cigarettes a significant product segment despite regulatory pressures.

- Food & Beverages: Flavoring agent in confectionery, chewing gums, and beverages to impart a minty taste.

- Others: Including aromatherapy and alternative medicine products.

The global menthol market's current valuation is estimated at approximately USD 500 million (2023), with a compound annual growth rate (CAGR) of 4-6% over the past five years.

Market Dynamics and Drivers

1. Consumer Preferences and Premiumization

Interest in natural and functional products bolsters demand for botanical extracts like menthol. The consumer shift toward plant-based, organic ingredients enhances its popularity across sectors, especially personal care and OTC pharmaceuticals.

2. Regulatory Environment

In regulatory terms, menthol faces tightening regulations, particularly within tobacco. Several regions (including the EU and parts of North America) have introduced restrictions or taxation on menthol-flavored tobacco products, potentially constraining growth in this segment. Conversely, regulation favoring natural flavorings bolsters demand in food and cosmetics.

3. Technological Innovations

Advancements in extraction methods improve the purity and sustainability of menthol supplies, supporting market expansion. Novel formulations leveraging menthol’s cooling and bioactive properties offer new product opportunities.

4. Supply Chain and Raw Material Availability

Menthol production hinges on mint cultivation, chiefly peppermint and spearmint. Climate change and agricultural challenges influence raw material yields, impacting supply stability and pricing.

Regional Market Insights

North America: Dominates owing to mature pharmaceutical and personal care industries; growth driven by consumer health consciousness and organic product trends. Regulatory pressures on tobacco menthol products pose challenges but also create niches for natural menthol substitutes.

Europe: Exhibits steady growth driven by stringent quality standards, consumer preferences for natural ingredients, and innovations in personal care products. Regulations are tightening on flavored tobacco.

Asia-Pacific: The fastest-growing region propelled by emerging economies, expanding personal care markets, and a burgeoning food sector. India and China significantly contribute, leveraging large agricultural bases and increasing manufacturing capacity.

Latin America & Middle East: Present niche opportunities but limited overall market size relative to developed regions.

Competitive Landscape

The menthol market features a mix of global commodity producers and specialty extraction firms. Leading players include:

- Symrise AG: Emphasizing natural sources and sustainable extraction.

- Givaudan: Innovating in sensory science and flavor applications.

- Koppert Biological Systems: Focused on plant-based extraction technologies.

- Other regional producers in China, India, and Europe.

Vertical integration, R&D investment, and sustainable sourcing are critical competitive differentiators.

Sales Projections and Future Outlook

Forecast Period: 2024-2028

Based on current trends, the global menthol market is projected to grow at a CAGR of 4-5% over the forecast period, reaching an estimated USD 650-700 million by 2028. The key factors influencing this projection are:

- Growth in Personal Care and Food Industries: Reinforcing demand for natural flavorings.

- Regulatory Constraints on Tobacco Flavored Products: Potentially suppressing menthol cigarette sales by 10-15%, offsetting some gains.

- Innovation and Product Differentiation: Development of synthetic and bio-based menthol variants that meet consumer and regulatory standards.

The pharmaceutical segment is expected to maintain steady growth, particularly with increased demand driven by respiratory health awareness and OTC product proliferation. The food and beverage sector will continue to be a significant driver, supported by health-conscious consumers seeking natural flavors.

Emerging Opportunities:

- Development of organic, sustainably sourced menthol derivatives.

- Variable pricing strategies driven by raw material costs.

- Expanding in emerging markets with increasing disposable income and shifting consumption patterns.

Strategic Considerations for Stakeholders

- Supply Chain Management: Ensuring reliable sourcing amid climate variability and raw material constraints.

- Regulatory Compliance: Adapting to regional restrictions, especially on flavored tobacco products.

- Innovation & R&D: Focusing on natural, sustainable extraction and formulation techniques aligned with consumer trends.

- Market Diversification: Expanding application portfolios beyond traditional uses to include new sectors such as biopharmaceuticals and wellness products.

Key Takeaways

- The global menthol market remains resilient, supported by diversified applications across multiple industries.

- Growth prospects are favorable but nuanced by regulatory restrictions, particularly in tobacco products.

- Rising consumer preference for natural, sustainable ingredients enhances demand in food, beverage, and personal care sectors.

- Regional leadership persists with North America and Europe, while Asia-Pacific offers rapid growth opportunities.

- Innovation in extraction and formulation, coupled with strategic diversification, will be critical for capturing market share.

FAQs

1. How does regulation impact menthol sales globally?

Regulatory restrictions, especially on flavored tobacco products, influence menthol sales negatively in certain regions but open avenues for natural, compliance-friendly alternatives.

2. What are the main drivers for menthol demand in the coming years?

Consumer preference for natural ingredients, growth in personal care and food sectors, and innovation in product formulations will drive demand.

3. Which regions offer the highest growth potential?

Asia-Pacific presents the highest growth potential due to expanding markets, manufacturing capacity, and consumer demand.

4. What are the challenges faced by menthol producers?

Supply chain vulnerabilities, climate impact on mint cultivation, fluctuating raw material prices, and regulatory restrictions represent key challenges.

5. Can synthetic menthol replace natural sources?

Synthetic menthol, which accounts for the majority of supply, offers cost advantages; however, consumer preferences and regulation favor natural and sustainably sourced menthol, influencing market strategies.

Sources

[1] MarketWatch, "Menthol Market Size, Share & Trends Analysis," 2023.

[2] Allied Market Research, “Menthol Market Forecast,” 2023.

[3] Mint Industry Reports, “Global Mint Cultivation & Menthol Extraction,” 2022.

[4] Euromonitor International, “Ingredients & Flavors Trends,” 2023.

[5] Regulatory Agencies’ Publications, EU Tobacco Regulation, 2022.

More… ↓