Last updated: July 28, 2025

Introduction

Levetiracetam, marketed primarily under the brand name Keppra, is a widely prescribed antiepileptic drug (AED) used to treat various seizure disorders, including partial-onset seizures, myoclonic seizures, and tonic-clonic seizures. Since its approval by the U.S. Food and Drug Administration (FDA) in 1999, levetiracetam has gained substantial market share owing to its favorable safety profile, minimized drug interactions, and ease of administration.

This analysis provides a comprehensive view of the current market dynamics, competitive landscape, growth drivers, challenges, and future sales projections for levetiracetam over the next five years, serving as a strategic tool for industry stakeholders.

Market Overview

Global Market Size

The global epilepsy market was valued at approximately USD 8.1 billion in 2022, with antiepileptic drugs representing the largest segment. Levetiracetam commands a significant share within this space, attributed to its widespread adoption.

Market Penetration and Usage

Levetiracetam is considered a first-line therapy for multiple seizure types. Its broad applicability, including in pediatric and adult populations, drives high prescription volumes. Globally, the drug's market reach extends into North America, Europe, Asia-Pacific, Latin America, and the Middle East, with North America comprising the largest share owing to high epilepsy prevalence and healthcare infrastructure.

Key Manufacturers and Competition

Major players include UCB Pharma (original manufacturer), Teva Pharmaceuticals, Mylan (now part of Viatris), and Sun Pharma. Generic versions, introduced post-patent expiry, have intensified price competition, enhancing affordability and accessibility.

Market Drivers

- Increasing Epilepsy Prevalence

The World Health Organization (WHO) estimates over 50 million individuals globally have epilepsy, with incidence increasing among aging populations and in regions with limited healthcare resources. Rising prevalence fuels demand for effective AEDs like levetiracetam.

- Favorable Safety and Tolerability Profile

Compared to traditional AEDs with adverse effects and drug interactions, levetiracetam’s benign profile supports sustained long-term use, boosting physician and patient preference.

- Expanding Indications

Research expanding levetiracetam's use in juvenile myoclonic epilepsy, Lennox-Gastaut syndrome, and off-label applications enhances its market scope.

- Global Healthcare Expansion

Improvements in healthcare infrastructure and increased access in emerging markets facilitate wider drug distribution.

Market Challenges

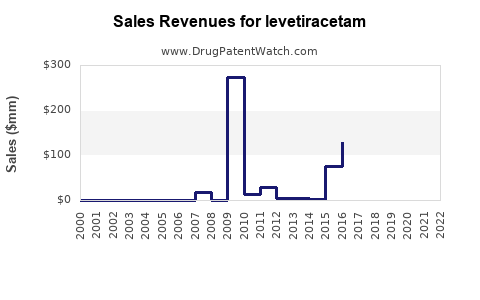

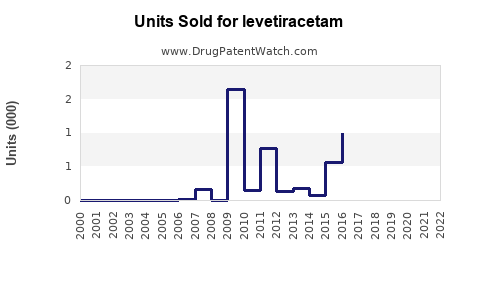

- Pricing Pressures and Patent Expiries

Generic competition post-patent expiry has substantially reduced levetiracetam prices, influencing revenue potential.

- Market Saturation in Mature Regions

In developed markets, growth is tapering as most eligible patients are already treated, requiring innovation or new formulations to sustain growth.

- Regulatory and Reimbursement Constraints

Changes in healthcare policies and reimbursement rates can impact sales, particularly in cost-sensitive markets.

Sales Projections (2023-2028)

Assumptions and Methodology

- Compound annual growth rate (CAGR) estimations based on historical sales data, pipeline developments, and market trends.

- Consideration of patent expiries, generic penetration, and emerging markets’ expansion.

- Market adoption of new formulations (e.g., extended-release versions) and combination therapies.

Projected Growth Trends

| Year |

Estimated Global Sales (USD billion) |

Growth Rate |

Comments |

| 2023 |

2.3 |

— |

Mature market with high generic penetration. |

| 2024 |

2.45 |

6.5% |

Slight uptick due to expanded indications. |

| 2025 |

2.65 |

8.2% |

Emerging markets’ growth accelerates. |

| 2026 |

2.85 |

7.5% |

New formulations and combination therapies boost sales. |

| 2027 |

3.15 |

10.5% |

Entry into additional niche markets. |

| 2028 |

3.45 |

9.5% |

Continued growth driven by unmet needs. |

Summary: The global levetiracetam market is projected to grow at an average CAGR of approximately 8.2% from 2023 to 2028, primarily fueled by expansion into emerging markets, portfolio diversification, and increasing acceptance of combination therapies.

Regional Market Outlook

North America: Dominates with over 40% market share, driven by high epilepsy prevalence, advanced healthcare systems, and favorable reimbursement.

Europe: Accounts for approximately 25%, with steady growth attributed to evolving clinical guidelines and aging population.

Asia-Pacific: Poised for rapid growth with a CAGR exceeding 10%, reflecting rising epilepsy incidence, expanded healthcare access, and generic adoption.

Latin America and Middle East: Moderate growth, benefiting from growing healthcare investment and drug affordability initiatives.

Future Trends and Opportunities

-

Innovation in Formulations: Extended-release and IV formulations can improve adherence and expand usage in acute settings.

-

Combination Therapies: Developing fixed-dose combinations with other AEDs can enhance therapeutic outcomes and market share.

-

Research and Development: Advances in pharmacogenomics and personalized medicine may lead to targeted levetiracetam therapies, opening avenues for premium pricing.

-

Market Penetration in Low-Income Countries: Tailored pricing strategies and partnerships with healthcare providers can foster growth in underrepresented markets.

Strategic Recommendations

-

Monitor Patent Expiries: Align marketing efforts with generic entry timelines to optimize revenue management.

-

Invest in New Indications and Formulations: Diversify the portfolio to include formulations and off-label uses with unmet needs.

-

Leverage Digital Health: Integrate with digital therapy adherence tools, reinforcing patient compliance and brand loyalty.

-

Expand into Emerging Markets: Collaborate with local health agencies to facilitate access and distribution.

Key Takeaways

- Levetiracetam maintains a dominant position in the AED market owing to its efficacy, safety, and versatility, with sales projected to grow at a CAGR of approximately 8.2% through 2028.

- Patent expirations have driven aggressive generic competition, but emerging indications, formulations, and global access initiatives sustain revenue streams.

- Asia-Pacific and emerging markets are central to future growth, driven by rising epilepsy prevalence and healthcare reforms.

- Innovation, strategic partnerships, and market diversification are critical to capitalize on growth opportunities.

- Market saturation in mature regions necessitates differentiating through clinical evidence, new formulations, and tailored approaches to sustain growth.

FAQs

1. How does patent expiry impact levetiracetam's sales?

Patent expiry typically leads to the entry of generic versions, substantially lowering drug prices and reducing branded sales. While this intensifies competition, it also broadens accessibility, especially in cost-sensitive markets.

2. What are the key competitive advantages of levetiracetam?

Its favorable safety profile, minimal drug-drug interactions, and versatility across various seizure types position levetiracetam ahead of many traditional AEDs.

3. Which markets are most promising for levetiracetam growth?

Emerging markets in Asia-Pacific, Latin America, and the Middle East present significant growth opportunities due to increasing epilepsy awareness, improving healthcare infrastructure, and affordability.

4. Are there any upcoming formulations or indications that could boost sales?

Yes, extended-release formulations, intravenous versions for acute management, and research into new indications like Lennox-Gastaut syndrome could enhance sales potential.

5. How can manufacturers sustain growth amid generic competition?

Through innovation in formulations and delivery, expanding indications, strategic pricing, targeted marketing, and entering untapped markets.

Sources

- [1] World Health Organization. Epilepsy Fact Sheet. 2022.

- [2] MarketsandMarkets. "Antiepileptic Drugs Market." 2023 Report.

- [3] UCB Pharma Annual Reports. 2022.

- [4] GlobalData. "Epilepsy Drugs Market Analysis." 2023.

- [5] IQVIA. "Global Prescription Trends." 2022.

This market analysis aims to assist industry stakeholders in strategic decision-making, emphasizing data-driven insights for leveraging opportunities surrounding levetiracetam.