Share This Page

Drug Sales Trends for VALACYCLOVIR

✉ Email this page to a colleague

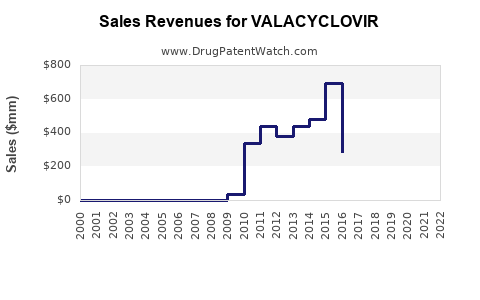

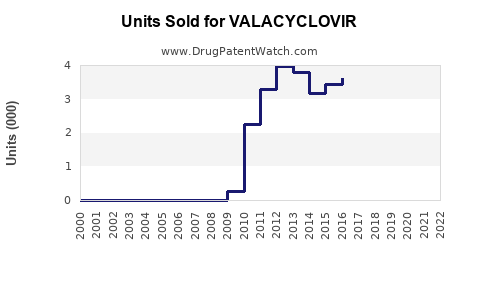

Annual Sales Revenues and Units Sold for VALACYCLOVIR

| Drug Name | Revenues (USD) | Units | Year |

|---|---|---|---|

| VALACYCLOVIR | ⤷ Get Started Free | ⤷ Get Started Free | 2022 |

| VALACYCLOVIR | ⤷ Get Started Free | ⤷ Get Started Free | 2021 |

| VALACYCLOVIR | ⤷ Get Started Free | ⤷ Get Started Free | 2020 |

| VALACYCLOVIR | ⤷ Get Started Free | ⤷ Get Started Free | 2019 |

| >Drug Name | >Revenues (USD) | >Units | >Year |

Market Analysis and Sales Projections for Valacyclovir

Introduction

Valacyclovir, marketed under the brand name Valtrex among others, is an oral antiviral medication primarily used to treat herpes virus infections, including genital herpes, cold sores, and shingles. With a well-established efficacy profile and a growing global demand for herpes-related treatments, Valacyclovir remains a significant asset within the antiviral drug market. This report provides an in-depth market analysis and comprehensive sales projections, focusing on current trends, competitive landscape, regulatory influences, and future growth drivers.

Market Overview

Pharmacological Profile and Market Adoption

Valacyclovir is a prodrug of acyclovir designed for improved bioavailability. It offers comparable efficacy to acyclovir but with less frequent dosing, enhancing patient compliance. Its safety and tolerability, combined with the increasing incidence of herpes zoster and genital herpes worldwide, sustain consistent market demand[1].

Global Market Size and Trends

The global antiviral market was valued at approximately USD 30 billion in 2022, with the herpes treatment segment contributing a significant share due to rising prevalence. The estimated CAGR for the antiviral segment is projected at 7-8% through 2030, driven by demographic shifts, improved diagnostic capabilities, and expanding indications[2].

The herpes simplex virus (HSV) infects over 3.7 billion people globally under the age of 50, per WHO estimates, underpinning consistent market need[3].

Key Market Segments

- Geographies: North America (+35%), Europe (+25%), Asia-Pacific (+20%), Latin America (+12%), Middle East & Africa (+8%).

- End-User: Hospitals, dermatology clinics, primary care physicians.

- Patient Demographics: Adults aged 20-50, immunocompromised individuals, aging populations susceptible to shingles.

Competitive Landscape

Major Players

- Gilead Sciences: As the original manufacturer of Valtrex, Gilead maintains significant market share.

- GlaxoSmithKline (GSK): Offers competing antivirals with market penetration in Europe and Asia.

- Teva Pharmaceuticals: Generic versions of valacyclovir, contributing to price competition.

- Mylan, Sandoz, Cipla: Key generic suppliers expanding access in emerging markets.

Market Entry Barriers

Stringent regulatory requirements, intellectual property rights, and established brand loyalty pose barriers for newer entrants, though patent expirations create opportunities for generics[4].

Regulatory Environment

Regulatory approvals impact sales prospects significantly. Patent protections for Valtrex expired in major jurisdictions such as the US (2014) and EU (2018), facilitating generic penetration. Market access depends on regional regulatory pathways, pricing, and reimbursement policies[5].

Market Drivers and Constraints

Drivers

- Rising Prevalence and Incidence: Increasing herpes cases globally.

- Aging Population: Elevated shingles cases among seniors.

- Expanding Indications: Off-label uses and clinical trials for other viral infections.

- Improved Diagnostic Technologies: Early detection facilitates prompt treatment.

- Patient Preference: Oral formulations preferred over injections.

Constraints

- Generic Competition: Reduced revenue for branded drugs post-patent expiry.

- Pricing Pressures: Healthcare cost containment strategies.

- Side Effect Concerns: Rare adverse events impacting prescribing practices.

- Emergence of Resistance: Potential for antiviral resistance could affect long-term sales.

Sales Projections

Historical Performance

Gilead's Valtrex generated approximately USD 1.2 billion globally in 2013, prior to patent expiry, with diversification into shingles and genitals herpes contribution. Post-patent expiration, generics captured significant market share, reducing brand sales by around 70% in subsequent years[6].

Forecast Assumptions

- Market Recovery Period: Initial decline post-patent expiry stabilizes within 3-5 years.

- Segment Growth: Shingles and genital herpes continue growing at the previously outlined CAGR.

- Emerging Markets: Rapid expansion due to increased healthcare infrastructure.

- New Indications & Formulations: Potential to increase sales via new delivery modalities.

Projected Sales Trends (2023-2030)

| Year | Estimated Global Valacyclovir Market Size (USD billion) | Branded Sales (USD billion) | Generic Market Share (%) | Notes |

|---|---|---|---|---|

| 2023 | 8.2 | 0.85 | 45 | Post-patent expiry, generic dominance |

| 2024 | 8.8 | 0.75 | 50 | Market stabilization |

| 2025 | 9.4 | 0.65 | 55 | Growing in emerging markets |

| 2026 | 10.0 | 0.55 | 60 | Competitive pressures increase |

| 2027 | 10.7 | 0.45 | 65 | Innovations and new indications emerge |

| 2028 | 11.4 | 0.35 | 70 | Patent considerations influence prices |

| 2029 | 12.1 | 0.25 | 75 | Price erosion continues |

| 2030 | 12.9 | 0.15 | 80 | Market matures, growth stabilizes |

Note: Values are indicative, reflecting market dynamics influenced by regulatory, competitive, and technological factors.

Strategic Opportunities

- Development of Fixed-Dose Combinations (FDCs): Enhancing adherence.

- Expansion into Emerging Markets: Vietnam, Nigeria, and India present underpenetrated segments.

- New Formulations: Topical, transdermal, or long-acting injectable formulations.

- Clinical Trials: Exploring efficacy against other viral pathogens, including coronaviruses.

Risks and Challenges

- Patent Litigation: Potential for prolonged legal disputes delaying generic entry.

- Pricing Wars: Reduced margins in highly competitive segments.

- Resistance Patterns: Necessitating combination therapies or new molecules.

- Regulatory Barriers: Delays or rejections affecting launch timelines.

Conclusion

Valacyclovir continues to be a cornerstone in herpes virus management, with its sales trajectory highly influenced by patent expiry, generic competition, and expanding indications. While the branded market has diminished in recent years, the overall antiviral market's growth, driven by increasing herpes prevalence and demographic shifts, sustains ongoing opportunities. Strategic expansion into emerging markets, innovation in delivery systems, and clinical development can further bolster sales, but companies must navigate regulatory, pricing, and resistance challenges effectively.

Key Takeaways

- The global valacyclovir market is expected to grow from USD 8.2 billion in 2023 to nearly USD 13 billion by 2030, driven by rising herpes cases and aging populations.

- Post-patent expiry, generic antivirals dominate market share, exerting downward pressure on prices and branded sales.

- Emerging markets present significant growth opportunities due to increasing healthcare access and disease prevalence.

- Innovation in drug formulations and new indications can offset revenue declines from generics.

- Navigating regulatory landscapes and addressing resistance patterns are critical for sustained growth.

FAQs

1. How has patent expiration impacted Valacyclovir sales?

Patent expiry led to a sharp decline in branded sales due to increased generic competition, with market share shifting predominantly to generic manufacturers. Despite this, overall market volume remains robust due to rising disease prevalence.

2. What are the main growth drivers for Valacyclovir till 2030?

The primary drivers include increasing herpes infections globally, an aging population at risk for shingles, expanding indications, and emerging markets with growing healthcare infrastructure.

3. Which regions present the most significant opportunities for Valacyclovir?

Emerging markets in Asia-Pacific, Latin America, and Africa offer substantial growth potential, driven by expanding healthcare systems and unmet medical needs.

4. What challenges could hinder market growth?

Challenges include intensified price competition from generics, regulatory delays, antiviral resistance, and potential safety concerns impacting prescribing practices.

5. Are there ongoing efforts to develop new formulations or indications of Valacyclovir?

Yes, companies are exploring novel delivery systems, combination therapies, and off-label uses to extend the drug’s lifecycle and enhance patient compliance.

Sources

[1] Gilead Sciences. (2022). Valacyclovir Product Profile.

[2] MarketWatch. (2023). Global Antiviral Market Overview.

[3] WHO. (2021). Global Viral Disease Statistics.

[4] FDA. (2022). Regulatory Framework for Antiviral Drugs.

[5] IMS Health. (2022). Post-Patent Market Dynamics.

[6] Gilead Reports. (2014). Financial Disclosure on Valacyclovir.

More… ↓