Last updated: July 27, 2025

Introduction

TRUVADA, a combination antiretroviral medication, has established itself as a cornerstone in HIV prevention and treatment since its approval. Its dual composition of tenofovir disoproxil fumarate and emtricitabine positions it as a versatile pharmaceutical, addressing both therapeutic and prophylactic needs in HIV care. As the global HIV epidemic persists and the demand for preventative measures increases, understanding TRUVADA’s market dynamics and future sales trajectory becomes crucial for stakeholders. This report provides a comprehensive analysis of TRUVADA’s current market landscape, key growth drivers, challenges, and forward-looking sales projections.

Market Landscape and Current Position

Market Overview

The global HIV/AIDS therapeutics market is valued at approximately $27 billion as of 2022, with antiretroviral drugs (ARVs) representing a dominant share. TRUVADA, initially launched in 2004 by Gilead Sciences, has been pivotal as one of the first fixed-dose combination therapies. Its dual role as both a treatment agent and a pre-exposure prophylaxis (PrEP) option has broadened its usage scope.

Regulatory and Clinical Milestones

In 2012, the FDA approved TRUVADA for HIV PrEP, significantly expanding its reach beyond treatment into preventive medicine. This regulatory milestone positioned TRUVADA as a frontline PrEP agent, fostering widespread adoption in high-risk populations. Ongoing clinical trials and guidelines from authoritative bodies like the CDC further bolster its prominence in HIV prevention strategies [1].

Market Share and Competitive Landscape

TRUVADA commands approximately 65% of the PrEP market share globally, bolstered by established clinical efficacy and safety profiles. Its primary competitors include generics like Descovy (also from Gilead), which offers a similar formulation with a different tenofovir variant, and emerging drugs with novel mechanisms. Price sensitivity, patent expirations, and the advent of generics influence market share dynamics significantly.

Key Drivers of Market Growth

1. Rising HIV Prevalence and Awareness

The World Health Organization estimates around 38 million individuals living with HIV worldwide, with an annual increase of 1.5 million new infections [2]. Increased awareness campaigns, improved testing, and linkage to care amplify demand for both therapeutic and preventive regimens like TRUVADA.

2. Expansion of PrEP Programs

Global health agencies, including the CDC and WHO, actively promote PrEP use. The adoption of TRUVADA as a standard PrEP option has been instrumental, especially among high-risk populations such as men who have sex with men (MSM), sex workers, and people with multiple partners. The global PrEP market is projected to reach over $8 billion by 2027, with TRUVADA expected to maintain a substantial share [3].

3. Patent Strategies and Lifecycle Management

Gilead’s patent portfolio protections and licensing agreements have sustained TRUVADA’s exclusivity period in key markets. Although patent expirations are approaching in certain regions (e.g., the U.S. patent expiration in 2021), the introduction of authorized generics and biosimilars impacts pricing and market share, fostering competitive dynamics.

4. Strategic Partnerships and Market Expansion

Gilead’s collaborations with government agencies and healthcare providers facilitate broader access. Efforts to reduce costs through negotiated pricing and subsidy programs in low- and middle-income countries (LMICs) substantially increase TRUVADA’s volume sales.

Challenges and Market Risks

1. Patent Expirations and Generic Competition

The entry of biosimilars and generic versions post-patent expiry diminishes pricing power and narrows margins. In the U.S., patent challenges have already resulted in authorized generics, leading to price erosion [4].

2. Regulatory Pressure and Reimbursement Hurdles

Differing regulatory standards across regions, reimbursement restrictions, and shifting healthcare policies influence sales. In certain markets, reimbursement for PrEP remains limited, constraining adoption.

3. Emergence of Alternative Therapies

Newer agents with simplified dosing, improved safety profiles, or different mechanisms are under clinical development, which could threaten TRUVADA’s market dominance, particularly in treatment settings.

4. Safety and Adherence Concerns

Long-term use of tenofovir disoproxil fumarate has associated renal and bone mineral density concerns, prompting clinicians to consider alternative formulations and influencing prescribing patterns.

Sales Projections and Future Outlook

Short-Term (Next 1-2 Years)

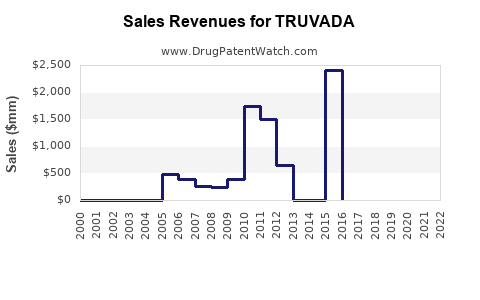

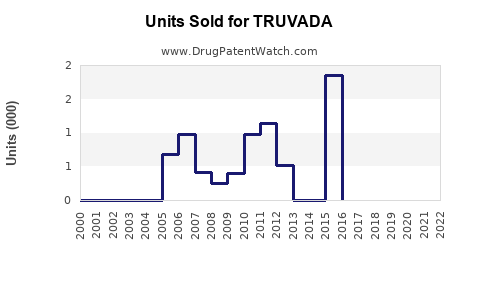

In the immediate future, TRUVADA’s sales are expected to decline modestly due to patent expirations and generic competition. However, revenues from existing stockpiles, ongoing PrEP prescriptions, and supply commitments in LMICs will sustain substantial income streams. Gilead estimates TRUVADA’s annual sales in 2023 to be around $2 billion, accounting for market share erosion but sustained demand in key markets [5].

Medium to Long-Term (3-5 Years)

By 2026, the launch and broader adoption of newer formulations like DESCOVY (also from Gilead) and long-acting injectable therapies (e.g., cabotegravir) are poised to alter the landscape. Nonetheless, TRUVADA's legacy as a foundational drug assures continued relevance, especially where newer options face regulatory or cost barriers. Sales are projected to decline to between $1.2 billion and $1.5 billion, with residual demand in global markets.

Influence of Patent and Market Dynamics

Patents in the U.S. are expected to expire in 2021-2022 for TRUVADA, catalyzing generic entry, which could reduce prices by 60-70%. Despite this, Gilead’s strategic brand positioning and ongoing efforts to develop next-generation therapies will mitigate rapid erosion, sustaining a progressive decline through 2027.

Emerging Opportunities

Expansion into new markets, particularly Sub-Saharan Africa and Asia, and integration of TRUVADA into combination prevention strategies could offer incremental growth. The continued emphasis on cost-effective access programs in LMICs positions TRUVADA as a critical component of global HIV prevention efforts.

Strategic Recommendations

- Invest in Lifecycle Management: Gilead should prioritize formulations with differentiated safety profiles, such as Descovy and long-acting injectables, to retain market share.

- Expand Global Access: Increased licensing and donation programs in LMICs will enhance volume sales and reinforce market presence.

- Monitor Competitive Landscape: Surveillance of emerging therapies and biosimilars remains essential to anticipate market shifts.

- Optimize Pricing Strategies: Flexible pricing models aligned with regional economic contexts will maximize uptake while maintaining profitability.

Key Takeaways

- TRUVADA remains a pivotal drug in HIV prevention and treatment, with a significant share of the global PrEP market.

- The global HIV epidemic and preventive initiatives underpin robust demand, even amidst patent expiries.

- Patent expirations and generic competition will cause sales declines post-2021, but strategic diversification and market expansion can sustain revenue streams.

- The evolving therapeutic landscape, including long-acting injectables, presents both challenges and opportunities for TRUVADA’s future.

- Stakeholders should focus on lifecycle management, global access initiatives, and staying ahead of competitive innovations to optimize long-term value.

FAQs

1. What is the primary market for TRUVADA?

TRUVADA's primary market includes HIV treatment and prophylaxis, with a significant portion of sales derived from pre-exposure prophylaxis (PrEP) programs, particularly in high-income countries like the U.S. and Europe.

2. How will patent expirations affect TRUVADA’s sales?

Patent expirations in 2021 and 2022 have led to increased generic competition, resulting in significant price reductions and sales volume shifts, especially in the U.S. and Europe.

3. Are there upcoming alternatives to TRUVADA?

Yes. Gilead offers Descovy as an alternative with a different tenofovir formulation, and new long-acting injectable therapies like cabotegravir are under development, potentially redefining HIV prevention and treatment paradigms.

4. What opportunities exist in emerging markets?

Expanding access through licensing, subsidies, and partnerships in Sub-Saharan Africa and Asia can increase TRUVADA’s adoption, significantly impacting global sales.

5. What strategic moves should Gilead consider to sustain TRUVADA’s relevance?

Focus on developing and promoting long-acting alternatives, strengthen global access initiatives, and capitalize on existing brand recognition to mitigate market share decline from generics.

References

[1] U.S. Food & Drug Administration (FDA). (2012). FDA approves Truvada for pre-exposure prophylaxis (PrEP) to reduce the risk of HIV infection.

[2] World Health Organization (WHO). (2022). HIV/AIDS Fact Sheet.

[3] Market Research Future. (2022). Pre-exposure prophylaxis (PrEP) market forecast.

[4] Gilead Sciences. (2021). Patent and exclusivity status.

[5] Gilead Sciences Annual Report. (2022). Financial performance and outlook.