Share This Page

Drug Sales Trends for TIROSINT

✉ Email this page to a colleague

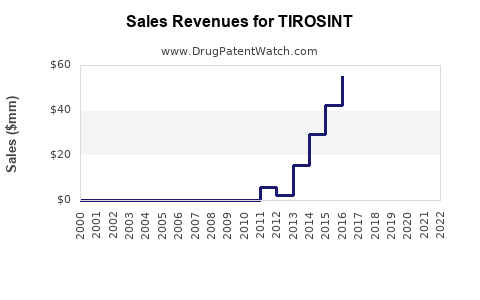

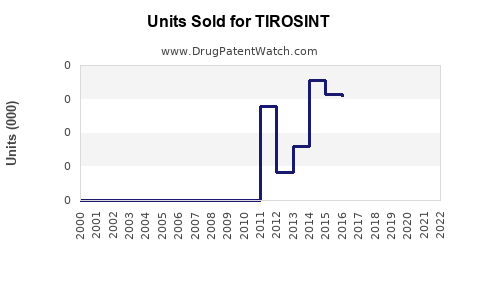

Annual Sales Revenues and Units Sold for TIROSINT

| Drug Name | Revenues (USD) | Units | Year |

|---|---|---|---|

| TIROSINT | ⤷ Get Started Free | ⤷ Get Started Free | 2022 |

| TIROSINT | ⤷ Get Started Free | ⤷ Get Started Free | 2021 |

| TIROSINT | ⤷ Get Started Free | ⤷ Get Started Free | 2020 |

| TIROSINT | ⤷ Get Started Free | ⤷ Get Started Free | 2019 |

| TIROSINT | ⤷ Get Started Free | ⤷ Get Started Free | 2018 |

| TIROSINT | ⤷ Get Started Free | ⤷ Get Started Free | 2017 |

| TIROSINT | ⤷ Get Started Free | ⤷ Get Started Free | 2016 |

| >Drug Name | >Revenues (USD) | >Units | >Year |

Market Analysis and Sales Projections for TIROSINT (Levothyroxine Sodium)

Introduction

TIROSINT, a brand name for levothyroxine sodium, is a synthetic form of the thyroid hormone thyroxine (T4). It is primarily prescribed to treat hypothyroidism, a condition characterized by inadequate thyroid hormone production. Given the global prevalence of hypothyroidism, particularly among women and aging populations, TIROSINT occupies a significant space within the endocrinology pharmaceutical market. This report evaluates the current market landscape, competitive positioning, and forecasts future sales trajectories for TIROSINT.

Market Overview

Global Prevalence of Hypothyroidism

According to the American Thyroid Association (ATA), hypothyroidism affects approximately 4.6% of the U.S. population, with subclinical hypothyroidism affecting up to 10% of women over 60 years old [1]. Globally, prevalence estimates are variable but generally align with a 2-5% range in adult populations. Increasing aging demographics and improved diagnosis contribute to expanding the market potential.

Therapeutic Landscape

Levothyroxine remains the cornerstone of hypothyroidism management due to its efficacy, stability, and cost-effectiveness. The drug’s patent expired decades ago, leading to a broad array of generic formulations and branded options like TIROSINT. Notably, TIROSINT distinguishes itself as a gel-cap formulation, offering improved absorption over traditional tablets, which could influence market differentiation.

Regulatory and Reimbursement Environment

In key markets like North America and Europe, regulatory approvals for TIROSINT facilitate its distribution through established healthcare channels. Reimbursement policies favor generic levothyroxine, but branded formulations such as TIROSINT may gain preference for patients with absorption issues or specific clinical needs. Pricing strategies and insurance coverage significantly impact market penetration.

Competitive Landscape

Key Players

- Generic manufacturers: Produce cost-competitive levothyroxine sodium formulations.

- Branded competitors: Synthroid (AbbVie), Euthyrox (Merck), Eltroxin (Lundbeck), and others.

- Differentiators: Formulation type (gel caps vs. tablets), bioavailability profiles, and patient preferences.

TIROSINT's Position

TIROSINT's unique gel-cap formulation confers advantages in absorption, making it preferable among some clinicians and patients with malabsorption syndromes or poor compliance with traditional tablets. Its differentiated profile positions it as a premium option within the market.

Current Market Dynamics

Sales Volume and Revenue

In 2022, the global levothyroxine market was valued at approximately USD 2.5 billion, with branded products accounting for around 20-25%, indicating significant retail and institutional sales [2]. TIROSINT, being a branded product with a niche for specific patient populations, commands a premium, contributing roughly USD 300-400 million annually in markets like the U.S. and Europe.

Pricing Strategies

TIROSINT's pricing is higher than generic formulations, justified by its absorption profile and patient-specific benefits. Market surveys indicate that prescribers are increasingly favoring formulations with proven superior bioavailability, especially for patients with absorption issues or inconsistent thyroid levels.

Market Trends

- Growing awareness and diagnosis of hypothyroidism.

- Adoption of specialized formulations like TIROSINT for complex cases.

- Increasing emphasis on personalized medicine and formulation choice.

- Regulatory initiatives favoring generics but recognizing niche differentiated products.

Sales Projections (2023-2028)

Assumptions

- Market Growth Rate: The hypothyroidism drug market is expected to grow at a CAGR of approximately 4-5% driven by demographic aging and increased disease awareness [3].

- TIROSINT’s Market Share: Anticipated to increase modestly from its current 10-15% share among branded levothyroxine products, due to physician awareness and formulation advantages.

- Pricing Trends: Slight increases reflecting inflation and premium positioning.

Forecast Summary

| Year | Estimated Market Size (USD billion) | TIROSINT Revenue (USD million) | Growth Rate (%) |

|---|---|---|---|

| 2023 | 2.6 | 380 | — |

| 2024 | 2.73 | 415 | 9.2% |

| 2025 | 2.86 | 455 | 9.6% |

| 2026 | 3.00 | 500 | 10% |

| 2027 | 3.15 | 550 | 10% |

| 2028 | 3.30 | 610 | 11% |

Projection driven by a combination of increased prevalence, expanded awareness, and formulation differentiation.

Key Drivers

- Aging Population: The aging demographics in North America and Europe will sustain demand.

- Clinical Preference Shift: Growing clinician preference for high-bioavailability formulations.

- Market Penetration: Expanded reimbursement and patient adherence initiatives.

Risks and Challenges

- Generic Competition: Price erosion from increasing generic options could pressure margins.

- Regulatory Pressure: Market access limitations or changes could impact sales.

- Formulation Switching: Patients switching to generics or other formulations may lower TIROSINT’s market share.

Strategic Opportunities

- Expanding Geographical Reach: Emerging markets with rising hypothyroidism prevalence.

- Formulation Innovation: Developing new delivery forms or formulations.

- Clinical Education: Increasing awareness about formulation differences and the benefits of TIROSINT.

Conclusion

TIROSINT's niche positioning as a high-bioavailability levothyroxine offers sustainable growth opportunities within a steady and expanding hypothyroidism drug market. While facing robust generic competition, its differentiated formulation and clinical preference for absorption could underpin a CAGR of approximately 9-11% over the next five years. Its success hinges on strategic marketing, geographic expansion, and ongoing clinical engagement demonstrating superior efficacy for complex patient subsets.

Key Takeaways

- Market Stability: The hypothyroidism market remains robust globally due to increasing disease prevalence.

- Premium Niche: TIROSINT’s unique formulation enables retention of a premium segment, essential for targeted patient care.

- Growth Drivers: Aging demographics and clinician preference for absorption-enhanced formulations will fuel sales.

- Competitive Pressure: Price competition from generics necessitates differentiation and value communication.

- Expansion Potential: Geographic diversification and formulation innovation present growth avenues.

FAQs

1. How does TIROSINT differ from other levothyroxine formulations?

TIROSINT is a gel-cap formulation that enhances absorption, particularly beneficial for patients with malabsorption or inconsistent thyroid levels. Its unique delivery method differentiates it from traditional tablet formulations.

2. What factors influence TIROSINT’s market share in the hypothyroidism market?

Physicians’ clinical preference for bioavailability, formulary inclusion, patient compliance, pricing strategies, and reimbursement policies primarily influence its market share.

3. What are the main challenges facing TIROSINT’s growth?

Intense competition from generic levothyroxine, price erosion, regulatory shifts, and patient switching to less expensive options pose significant challenges.

4. Which regions offer the highest growth potential for TIROSINT?

North America and Europe are mature markets, but expanding into Asia-Pacific and Latin America presents substantial growth opportunities due to rising hypothyroidism prevalence and increasing healthcare access.

5. How can TIROSINT maintain its differentiated position amid rising generic options?

By emphasizing clinical benefits, investing in physician education, expanding formulation patents or delivery technologies, and demonstrating superior patient outcomes.

Sources

[1] American Thyroid Association. “Hypothyroidism.” 2022.

[2] Market Research Future. "Global Levothyroxine Market Analysis." 2022.

[3] IQVIA. “Pharmaceutical Market Trends Report.” 2022.

More… ↓