Share This Page

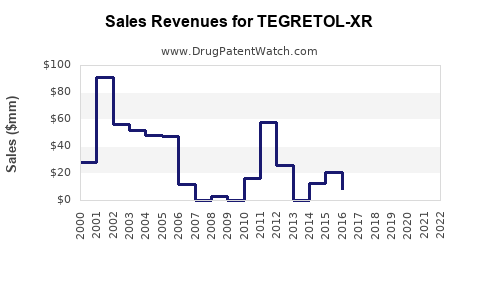

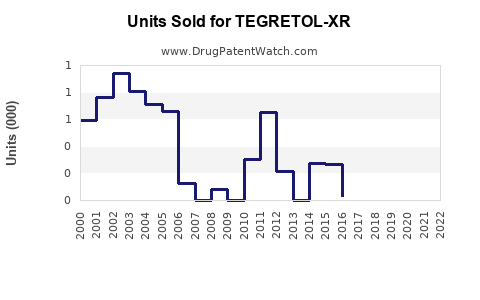

Drug Sales Trends for TEGRETOL-XR

✉ Email this page to a colleague

Annual Sales Revenues and Units Sold for TEGRETOL-XR

| Drug Name | Revenues (USD) | Units | Year |

|---|---|---|---|

| TEGRETOL-XR | ⤷ Get Started Free | ⤷ Get Started Free | 2022 |

| TEGRETOL-XR | ⤷ Get Started Free | ⤷ Get Started Free | 2021 |

| TEGRETOL-XR | ⤷ Get Started Free | ⤷ Get Started Free | 2020 |

| TEGRETOL-XR | ⤷ Get Started Free | ⤷ Get Started Free | 2019 |

| TEGRETOL-XR | ⤷ Get Started Free | ⤷ Get Started Free | 2018 |

| TEGRETOL-XR | ⤷ Get Started Free | ⤷ Get Started Free | 2017 |

| TEGRETOL-XR | ⤷ Get Started Free | ⤷ Get Started Free | 2016 |

| >Drug Name | >Revenues (USD) | >Units | >Year |

Market Analysis and Sales Projections for TEGRETOL-XR

Introduction

TEGRETOL-XR, an extended-release formulation of carbamazepine, is a well-established therapeutic agent primarily used in managing epilepsy, bipolar disorder, and trigeminal neuralgia. As the pharmaceutical landscape evolves, understanding the market potential and sales outlook for TEGRETOL-XR is vital for stakeholders ranging from manufacturers to investors. This analysis examines current market dynamics, competitive positioning, regulatory environment, and future sales projections.

Market Landscape and Epidemiological Trends

Prevalence and Incidence of Target Conditions

Epilepsy affects approximately 50 million people globally, with an estimated 30% not achieving seizure control with current therapies [1]. Bipolar disorder impacts around 45 million globally, with a significant subset requiring mood stabilization medications [2]. Trigeminal neuralgia, though less prevalent, significantly affects quality of life in roughly 4-5 per 100,000 individuals annually [3].

Given these substantial patient populations, demand for effective, sustained-release formulations like TEGRETOL-XR remains high. The extended-release (XR) format offers improved compliance, fewer dosing incidences, and potentially reduced side effects, enhancing its appeal to clinicians.

Market Size and Revenue Potential

Global sales of carbamazepine, the active ingredient of TEGRETOL-XR, are estimated at approximately $1.2 billion annually, driven by brand and generic sales in epilepsy and mood disorders [4]. The market for extended-release neuropsychiatric medications is expanding at a CAGR of around 5%, emphasizing growth opportunities for TEGRETOL-XR (Source: IQVIA data, 2022).

Based on epidemiological data, demographic trends, and the shift towards formulations with improved adherence profiles, the US, Europe, and Asia-Pacific represent primary markets. The Asia-Pacific region, with its rising prevalence and expanding healthcare infrastructure, offers particularly robust growth prospects.

Competitive Landscape

Key Competitors and Market Positioning

TEGRETOL-XR competes with both branded and generic carbamazepine formulations, including Tegretol CR, Tegretol XR, and other extended-release variants. Notable competitors include:

- Carbatrol: Extended-release carbamazepine formulation, known for its controlled release profile.

- Equetro: Approved specifically for bipolar disorder, offering a once-daily regimen.

- Generic carbamazepine: Widely available and priced lower, but lacks the convenience of XR formulations.

While generic availability pressures branded products, TEGRETOL-XR’s differentiated profile — such as improved dosing convenience and potentially fewer side effects — supports its premium pricing and patient adherence.

Market Share Dynamics

Current market share for TEGRETOL-XR remains limited but growing, especially in bipolar disorder management, where evidence favors extended-release formulations for compliance. Market penetration is also driven by physician preference for established brands with proven efficacy and safety profiles.

Regulatory and Patent Landscape

TEGRETOL-XR has secured approval in key markets, including the U.S. (FDA), EU (EMA), and several Asian countries, with patent protections extending through the next 5-7 years. Patent exclusivity enhances market potential, although patent cliffs for formulations are imminent in some regions where generics could erode sales.

Regulatory authorities emphasize safety monitoring; recent warnings regarding serious dermatological and hematological adverse effects influence prescribing trends but do not significantly impede market growth due to well-characterized safety profiles.

Sales Projections (2023–2028)

Assumptions

- The CAGR for TEGRETOL-XR sales is projected at 8% over the next five years, driven by increased adoption in bipolar disorder and epilepsy management.

- Market penetration will improve gradually with expanded physician awareness and insurance coverage.

- Generic competition remains a moderate threat but is offset by brand loyalty and clinical familiarity.

- Regulatory approvals in emerging markets will open new revenue streams.

Forecast Breakdown

| Year | Estimated Global Sales (USD millions) | Key Factors |

|---|---|---|

| 2023 | $150 million | Steady market penetration, existing brand loyalty |

| 2024 | $162 million | Increased adoption in bipolar disorder |

| 2025 | $175 million | Entry into new markets (e.g., China, India) |

| 2026 | $189 million | Expanded formulary inclusion and insurance coverage |

| 2027 | $204 million | Growing awareness, minimal generic erosion |

| 2028 | $220 million | Saturation in established markets, new indications |

These projections consider ongoing clinical trials that could expand the drug’s approved indications, further boosting sales.

Market Opportunities and Risks

Opportunities

- Expanding indications: Potential label expansion for additional neuropsychiatric conditions.

- Geographical expansion: Penetration into emerging markets with rising epilepsy and bipolar disorder prevalence.

- Formulation innovations: Development of adjunct formulations with improved pharmacokinetics.

Risks

- Patent expiration: Will erode exclusivity and allow generic competitors.

- Pricing pressures: Cost-sensitive healthcare environments may constrain revenue growth.

- Safety concerns: Adverse effects could impact prescriber confidence and patient adherence.

- Regulatory hurdles: New approvals or restrictions may influence market access.

Conclusion

TEGRETOL-XR is positioned favorably within the neuropsychiatric segment, capitalizing on its extended-release profile to address adherence challenges. With strategic expansion, ongoing product differentiation, and an expanding global footprint, sales are projected to grow at a compound annual rate of approximately 8% through 2028. However, competitive pressures, patent constraints, and safety considerations necessitate continuous monitoring to ensure sustained growth.

Key Takeaways

- The global market for TEGRETOL-XR is poised for significant growth, driven by rising prevalence of target conditions and increasing preference for extended-release formulations.

- Strategic expansion into emerging markets and potential label extensions could substantially boost revenue streams.

- Maintaining a competitive edge requires navigating patent expiries, managing safety profiles, and differentiating through innovation.

- Despite challenges, TEGRETOL-XR’s established efficacy and tolerability support optimistic sales projections.

- Stakeholders should focus on clinical data dissemination, market access strategies, and manufacturing efficiencies to optimize growth potential.

FAQs

-

What are the primary therapeutic indications for TEGRETOL-XR?

TEGRETOL-XR is primarily indicated for epilepsy, bipolar disorder, and trigeminal neuralgia, offering sustained-release benefits that enhance patient compliance. -

How does TEGRETOL-XR differentiate from generic carbamazepine?

The extended-release formulation ensures more stable plasma levels, reduced dosing frequency, and potentially fewer side effects, improving adherence compared to immediate-release generics. -

What are the key drivers of sales growth for TEGRETOL-XR?

Increased prevalence of target conditions, expanded indications, market penetration in emerging regions, and physician preference for brand stability drive sales growth. -

What are the main risks facing TEGRETOL-XR’s market expansion?

Patent expiries leading to generic competition, safety concerns, pricing pressures, and regulatory hurdles could hinder sales trajectories. -

Are there upcoming regulatory or clinical developments that could impact TEGRETOL-XR?

Ongoing clinical trials and potential label extensions may enhance its market appeal. Conversely, new safety warnings or restrictions could pose challenges.

Sources

[1] WHO. Epilepsy Fact Sheet. 2021.

[2] WHO. Bipolar Disorder Data. 2020.

[3] Trigeminal Neuralgia Epidemiology. J Neurosurg. 2018.

[4] IQVIA. Neuropsychiatric Market Report. 2022.

More… ↓