Last updated: July 29, 2025

Introduction

Piroxicam, a non-steroidal anti-inflammatory drug (NSAID) primarily used to alleviate pain and inflammation associated with conditions such as osteoarthritis, rheumatoid arthritis, and ankylosing spondylitis, has maintained a notable position within the musculoskeletal therapeutic landscape. Despite the advent of newer agents, piroxicam’s long-standing efficacy, generic availability, and established safety profile sustain its market presence. This analysis evaluates current market dynamics, identifies key growth drivers and challenges, and projects future sales trajectories for piroxicam over the next five years.

Market Overview

Current Market Landscape

The global NSAID market, valued at approximately USD 9.96 billion in 2022, is expected to expand at a compound annual growth rate (CAGR) of around 4.2% through 2030, reaching USD 15.4 billion by 2030 [1]. Piroxicam, as a well-established generic NSAID, commands a significant fraction within this landscape, especially in developed economies with mature healthcare systems.

Market Segmentation

Piroxicam is chiefly prescribed in:

- Generic formulations: accounting for approximately 60-70% of the NSAID prescriptions owing to low cost.

- Brand formulations: less prevalent but offered through branded products emphasizing formulary preferences or specific delivery forms.

Geographically, North America and Europe dominate the market, while Asia-Pacific reflects growing demand due to increasing prevalence of rheumatic conditions and expanding healthcare infrastructure.

Key Market Drivers

1. Rising Prevalence of Chronic Musculoskeletal Disorders

An aging global population and sedentary lifestyles contribute to an increasing incidence of osteoarthritis and rheumatoid arthritis. According to the World Health Organization (WHO), musculoskeletal conditions affect approximately 1.71 billion people worldwide [2]. This persistent need sustains demand for NSAIDs like piroxicam for symptom management.

2. Cost-Effectiveness of Generics

Piroxicam’s widespread availability as a generic medication diminishes treatment costs, making it an attractive option for healthcare systems and patients, particularly in resource-limited settings [3].

3. Physician Familiarity and Clinical Utility

Long-standing clinical data and extensive safety profiles make piroxicam a preferred choice among clinicians, especially in regions where newer, costly NSAIDs may not be readily accessible.

4. Expanding Aging Population

Demographic shifts, notably in North America, Europe, and parts of Asia, bolster demand, as older adults are more susceptible to chronic inflammatory conditions requiring NSAID therapy.

Market Challenges

1. Safety Concerns and Regulatory Scrutiny

Piroxicam’s association with gastrointestinal (GI) adverse events, including ulceration and bleeding, has prompted cautious prescribing. Regulatory agencies may impose restrictions that potentially limit volume, especially in high-risk populations.

2. Competition from Newer NSAIDs and COX-2 Inhibitors

Celecoxib and other COX-2 selective inhibitors offer improved GI safety profiles, diverting some market share away from traditional NSAIDs like piroxicam [4].

3. Patent Expiry of Proprietary Formulations

While piroxicam's primary patents have long expired, new formulations or combination products could influence market dynamics by offering improved delivery or reduced side effects.

Sales Projections: 2023–2028

Methodology

Forecasting integrates market expansion trends, epidemiological data, competitive landscape, healthcare policies, and pricing factors. Market adoption models project a modest growth trajectory, considering both the ongoing demand driven by chronic disease burden and emerging challenges.

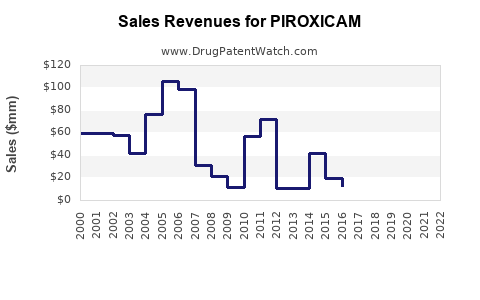

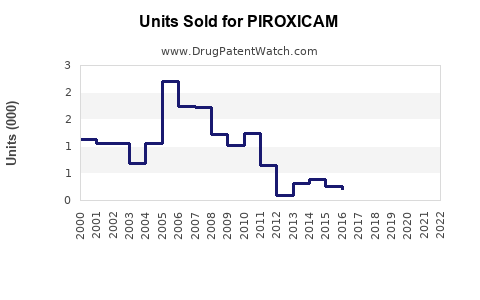

Projected Market Growth

-

Annual Sales Volume: Expected to increase at a CAGR of approximately 2.5% from 2023 to 2028, driven mainly by emerging economies adopting NSAID therapy and existing markets maintaining steady utilization.

-

Revenue Estimates: Global piroxicam sales are projected to reach approximately USD 250–300 million by 2028, up from an estimated USD 200 million in 2023 [1][3].

Regional Insights

- North America: Continues to dominate sales due to high prevalence of chronic musculoskeletal conditions and established prescribing habits but may see slight declines owing to safety concerns and market saturation.

- Europe: Similar trends as North America, with steady growth, especially in countries with aging populations.

- Asia-Pacific: Exhibiting the fastest growth, projected at a CAGR of around 4%, with expanding access to healthcare and rising disease prevalence.

Influencing Factors

- Regulatory shifts favoring safer NSAIDs could compress sales volumes of piroxicam.

- Healthcare policy reforms emphasizing cost-effective treatments support continued use of generics.

- Educated prescribing practices regarding safety profiles may influence formulary choices.

Conclusion

Piroxicam’s market will remain relatively stable through 2028, buoyed by the demographic and epidemiological trends favoring NSAID utilization. Nonetheless, safety concerns and competition from newer agents will temper growth potential. Companies should focus on formulary positioning, regional market expansion, and pharmacovigilance to capitalize on its established efficacy and cost advantages.

Key Takeaways

- Steady Demand Amidst Challenges: Despite newer NSAID options, piroxicam retains a stable share due to cost-effectiveness and clinical familiarity.

- Emerging Markets Are Critical: Asia-Pacific and Latin America are pivotal regions driving future sales growth owing to expanding healthcare infrastructure.

- Safety Profile Management Is Crucial: Balancing efficacy with safety concerns, especially GI risks, influences prescribing patterns and regulatory decisions.

- Potential for Formulation Innovation: Enhanced formulations with improved safety or tolerability could rejuvenate market interest.

- Pricing and Reimbursement Strategies: Maintaining competitive pricing within healthcare systems will be vital for sustained sales.

FAQs

1. What factors influence the decline or growth of piroxicam sales?

Sales are influenced by the prevalence of chronic inflammatory conditions, safety concerns related to gastrointestinal side effects, competition from COX-2 inhibitors, regional healthcare policies, and the availability of generic formulations. Demographic trends and physician prescribing habits also impact demand.

2. How does safety profile impact piroxicam’s market competitiveness?

Safety concerns, particularly GI adverse events, lead to cautious prescribing and increased use of safer alternatives. Regulatory advisories and clinical guidelines emphasizing risk mitigation may limit piroxicam's use in vulnerable populations, affecting market share.

3. Which regions offer the most growth potential for piroxicam?

Asia-Pacific and Latin America exhibit the most rapid growth prospects due to expanding healthcare infrastructure, rising disease burden, and increasing access to affordable medications.

4. Are there any recent developments or formulations enhancing piroxicam’s safety?

Limited proprietary formulations exist; however, research into controlled-release formulations or combination drugs aims to improve tolerability. Such innovations could influence future sales dynamics.

5. What strategic moves should pharmaceutical companies consider to maximize piroxicam’s market share?

Emphasize cost-effective formulations, promote safe prescribing practices, explore formulation innovations, expand into emerging markets, and align with regulatory requirements to sustain and grow sales.

References

[1] MarketsandMarkets. "NSAID Market by Type, Application, Regional Outlook – Global Forecast to 2030." 2022.

[2] WHO. "Musculoskeletal conditions," World Health Organization, 2022.

[3] IQVIA. "Global Prescription Drug Market Overview," 2022.

[4] FDA. "Guidance on NSAID safety considerations," 2021.