Last updated: July 27, 2025

Introduction

NORVASC (amlodipine besylate) is a widely prescribed antihypertensive medication indicated primarily for the treatment of hypertension and angina pectoris. As a long-standing blockbuster drug, NORVASC has established a stable market presence due to its proven efficacy and favorable side effect profile. This analysis evaluates the current market landscape, competitive positioning, and future sales projections, providing crucial insights for stakeholders.

Market Landscape and Key Drivers

Global Prevalence of Hypertension and Cardiovascular Disease

The rising global incidence of hypertension remains the primary driver of NORVASC's sustained demand. According to the World Health Organization (WHO), over 1.2 billion people worldwide suffer from high blood pressure, with the prevalence expected to escalate amid aging populations and lifestyle shifts [1]. The World Heart Federation estimates that cardiovascular diseases (CVDs) cause approximately 17.9 million deaths annually, reinforcing the need for effective antihypertensive therapies.

Market Penetration and Usage Trends

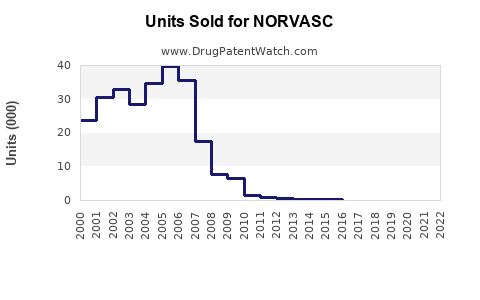

NORVASC commands a significant share of the calcium channel blocker (CCB) segment, leveraged by its once-daily dosing, minimal adverse effects, and extensive marketing. Its usage spans diverse populations, including elderly patients and those with comorbidities, further enhancing its market penetration.

Regulatory and Patent Status

Amlodipine's patent expiry around 2014 opened avenues for generic competition, markedly reducing price points and expanding accessibility in both developed and emerging markets. Nevertheless, NORVASC remains a brand leader owing to brand loyalty and physician preference, supported by marketing efforts and formulary placements.

Market Trends and Innovations

Recent trends emphasizing personalized medicine and combination therapies bolster the antihypertensive market. Fixed-dose combinations incorporating amlodipine (e.g., NORVASC/atorvastatin) continue to grow, widening therapeutic options and reinforcing demand.

Competitive Landscape

Major Players

- Pfizer (original manufacturer of NORVASC)

- Generics producers (e.g., Teva, Mylan, Sandoz)

- Other antihypertensive agents (ACE inhibitors, ARBs)

Competitive Position

Despite generic competition, Pfizer's brand maintains robust market share through physician trust, patient loyalty, and established marketing channels. The emergence of combination formulations enhances NORVASC’s competitive edge, especially where brand recognition and proven safety profiles are advantageous.

Pricing and Accessibility

Generic entries have fragmented pricing, making NORVASC more accessible. Market dynamics favor low-cost generics, effectively balancing volume and margins for Pfizer and other entities.

Sales Projections

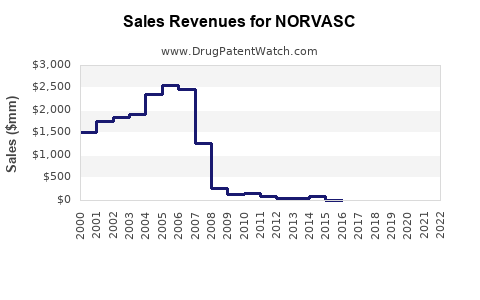

Historical Sales Performance

Pfizer reported global sales of NORVASC at approximately $700 million in 2021 [2]. Post-patent expiry, sales experienced a decline but stabilized due to generic entry and market penetration. The compound annual growth rate (CAGR) for the last five years hovered around -3% but showed signs of plateauing with increased use in combination therapies.

Forecast Assumptions

- Market Penetration: Continued high rates in hypertensive patient populations.

- Growth Drivers: Aging demographics, rising CVD prevalence, increased awareness.

- Market Challenges: Pricing pressures, generics competition, regulatory constraints.

- Emerging Markets: Rapid growth in Asia-Pacific and Latin America, emphasizing affordability and accessibility.

Projection Scenarios

Optimistic Scenario:

If strategic marketing, expanding indications, and combination therapies boost sales, NORVASC could return to a CAGR of around 3%, reaching approximately $850 million by 2028.

Conservative Scenario:

In the face of intensified generic competition and price erosion, sales may stagnate or decline marginally, stabilizing near $650-$700 million over the next five years.

Baseline Projection:

Assuming moderate growth and stable market share, projected sales may hover around $750 million by 2028.

Strategic Opportunities

-

Combination Therapies: Developing or promoting fixed-dose combinations can stimulate demand by simplifying treatment protocols.

-

Emerging Markets: Focused expansion into regions with rising hypertension prevalence and less saturated pharmaceutical markets.

-

Formulary and Insurance Penetration: Enhancing formulary placements and insurance coverage can augment physician prescribing patterns.

-

Innovative Formulations: Sustained-release or novel delivery mechanisms could extend lifecycle and maintain market relevance.

Potential Risks and Mitigation

- Price Competition: Aggressive pricing from generics could erode margins; strategic branding and value demonstration are essential.

- Regulatory Changes: Stringent healthcare policies might impact prescribing and reimbursement; proactive engagement mitigates this risk.

- Market Saturation: Physician and patient loyalty to existing therapies could limit growth; expanding indications and combination therapies can address this.

Conclusion

NORVASC continues to sustain a lucrative market position owing to its proven efficacy and favorable profile. While faced with challenges typical of blockbuster drugs post-patent expiry, strategic focus on combination therapies, emerging markets, and formulary positioning offers pathways to growth. Vigilant monitoring of market dynamics and preemptive adaptations will be critical for maximizing future sales.

Key Takeaways

- Stable Demand: Despite patent expiry, NORVASC benefits from brand recognition, physician trust, and a broad patient base.

- Growth Opportunities: Expansion into combination therapies and emerging markets fuels upside potential.

- Market Challenges: Price erosion from generics necessitates strategic differentiation through value-added formulations.

- Sales Outlook: Projected to reach ~$750 million by 2028 under moderate growth scenarios.

- Strategic Focus: Emphasize innovation, market expansion, and payer engagement to sustain and grow market share.

FAQs

1. How has patent expiry affected NORVASC sales?

Patent expiry led to increased generic competition, resulting in volume growth but eroding margins. Nonetheless, brand loyalty and fixed-dose combinations have stabilized sales.

2. In which markets does NORVASC hold the strongest position?

The United States, Europe, and emerging markets such as Asia-Pacific exhibit high demand, driven by cardiovascular disease prevalence and healthcare access expansion.

3. What role do combination therapies play in NORVASC’s future?

They serve as growth catalysts by offering convenience, improving adherence, and capturing broader patient segments, especially in polypharmacy contexts.

4. How does competitive pricing impact NORVASC’s market share?

Price competition from generics challenges margins but maintains accessibility. Differentiation through added value or formulations is key to preserving market share.

5. What are the primary risks to NORVASC’s sales trajectory?

Market saturation, pricing pressures, regulatory shifts, and evolving treatment guidelines pose risks that require strategic mitigation.

References

[1] World Health Organization. "Hypertension." WHO Fact Sheets. 2022.

[2] Pfizer Annual Report, 2021.