Last updated: November 16, 2025

Introduction

Lipitor (atorvastatin calcium) stands as one of the most successful pharmaceutical products, widely prescribed for managing hypercholesterolemia and reducing cardiovascular disease risk. Since its launch by Pfizer in 1997, Lipitor has become a cornerstone in lipid-lowering therapy, significantly impacting both the pharmaceutical industry and healthcare outcomes globally. This analysis explores the current market landscape, competitive dynamics, and forecasts future sales, elucidating factors that influence Lipitor’s commercial trajectory.

Market Landscape Overview

Global Cardiovascular Diseases and Market Size

The global burden of cardiovascular disease (CVD) remains substantial, with estimates indicating that CVD accounts for approximately 31% of all global deaths [1]. The increasing prevalence of hyperlipidemia, obesity, and metabolic syndromes fuels demand for lipid-lowering agents like Lipitor. The global statins market, estimated to reach USD 29.45 billion by 2027 from USD 17.2 billion in 2020, underscores the drug class's critical role in adherence to cardiovascular risk management [2].

Lipitor’s Market Share and Competitive Position

Although patent expiration in 2011 facilitated the entry of generic atorvastatin, Lipitor maintained a significant market share due to brand recognition, physician loyalty, and formulary preferences. With the loss of patent exclusivity, generic versions captured a substantial segment, but Lipitor continues to generate revenue through established relationships with healthcare providers and patients.

Regulatory and Patent Landscape

The expiration of Lipitor's patent has led to the proliferation of generic atorvastatin products, intensifying price competition. Pfizer’s strategic transition to biosimilars and high-margin indication-focused marketing are crucial in sustaining revenue streams. Patent litigation and patent term extensions continue to influence the pharmaceutical lifecycle and market exclusivity.

Market Drivers and Barriers

Drivers

- Rising Cardiovascular Disease Incidence: Aging populations and lifestyle factors increase demand.

- Clinical Guidelines: Updated guidelines promoting statins as first-line therapy enhance prescription rates.

- Cost-Effectiveness: Lipitor's proven efficacy and affordability, especially in generic form, promote sustained usage.

- Patient Adherence: Long-term safety profile supports continuous therapy.

Barriers

- Generic Competition: Price erosion impacts margins.

- Generic Substitutions: Physicians’ preference for generics over brand-name drugs reduces Lipitor’s market share.

- Alternative Therapies: PCSK9 inhibitors and other lipid-modifying agents threaten statins’ dominance.

- Regulatory Disputes: Patent disputes and market access restrictions could impact sales.

Financial Performance and Historical Sales Data

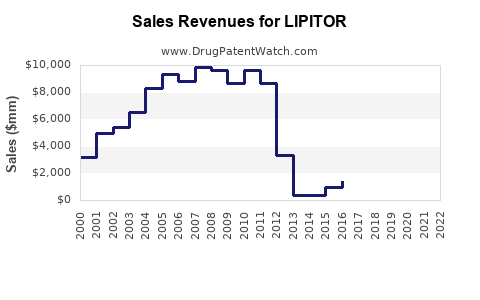

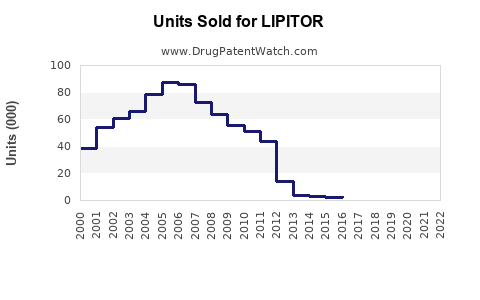

Pfizer reported Lipitor sales peaked around USD 12.6 billion in 2006 [3], with a sharp decline following patent expiry. In 2010, Lipitor generated approximately USD 9.7 billion before the patent cliff. Post-patent, the global sales asymptotically declined, with generic sales offsetting the loss of branded revenue.

Despite decline in total sales, Lipitor remains among the top-selling pharmaceuticals worldwide. In 2020, Lipitor accounted for approximately USD 1.2 billion globally, primarily driven by emerging markets and existing robust prescriptions in developed nations [4].

Future Sales Projections

Market Conditions and Sales Forecasts (2023–2030)

Based on current trends and analyst estimates, Lipitor’s sales trajectory is expected to plateau before gradually declining as generic penetration peaks. However, Pfizer’s strategic positioning and focus on emerging markets could mitigate decline.

Projected Global Sales (USD Billion):

| Year |

Projection |

Notes |

| 2023 |

USD 1.1–1.2 |

Stabilization in mature markets; growth in emerging markets |

| 2024 |

USD 1.0–1.1 |

Competitive pressure; patent expiry effects fully realized |

| 2025 |

USD 0.8–1.0 |

Continued decline; generic dominance |

| 2026–2030 |

USD 0.6–0.8 |

Market tapering; focus on specific indication-based prescribing |

Key Factors Impacting Sales

- Emerging Markets Growth: Countries like China, India, and Brazil exhibit high CVD prevalence and increasing statin access, driven by healthcare reforms and economic growth.

- Regulatory Approvals: Expanded indications, such as for pediatric hyperlipidemia or combination therapies, could bolster sales.

- Competing Therapies: Introduction of PCSK9 inhibitors and gene therapies may further reduce statins’ market share.

- Pricing Strategies: Promotion of fixed-dose combinations and differentiation through clinical benefits could sustain revenue.

Strategic Outlook

Pfizer’s focus on indication-specific marketing, patient adherence programs, and expanding access in middle-income countries will be vital. Additionally, leveraging digital health and data analytics to personalize therapy could help maintain a foothold despite generic competition.

Conclusion

Lipitor’s market landscape has transitioned from dominance through patent protection to a highly competitive environment shaped by generics, new therapies, and evolving clinical guidelines. While total sales have declined from their peak, Lipitor retains residual revenue streams, especially in emerging markets. The outlook suggests a gradual decline in sales, with potential stabilization in specific segments driven by geographic expansion and indication-based strategies.

Key factors like rising global CVD rates, guideline reinforcement, and strategic market positioning will determine Lipitor's ongoing commercial relevance.

Key Takeaways

- Lipitor remains a relevant cardiovascular drug, especially in emerging markets with rising CVD prevalence.

- Patent expiry led to significant sales decline, but brand loyalty and clinical familiarity sustain residual revenues.

- Competition from generics and newer lipid-lowering therapies pose ongoing threats.

- Strategic expansion into emerging markets and indication-specific marketing are crucial for future revenue stabilization.

- Long-term prospects depend on Pfizer’s innovative marketing strategies and the evolving landscape of cardiovascular therapeutics.

FAQs

1. How has Lipitor’s sales been affected by patent expiration?

Patent expiry in 2011 resulted in a sharp decline in Lipitor’s sales due to the influx of generic atorvastatin, leading to price competition and market share erosion.

2. Which markets currently drive Lipitor sales?

Developed markets like the US and Europe initially drove sales; however, emerging economies such as China, India, and Brazil now contribute significantly to residual sales, supported by growing healthcare infrastructure.

3. What competitive threats does Lipitor face?

Generic atorvastatin dominates the lipid-lowering market; newer agents like PCSK9 inhibitors and combination therapies pose additional competition, especially for high-risk patients.

4. Can Lipitor’s sales increase again?

While unlikely to return to peak levels, strategic expansion and indication diversification could stabilize or slightly growth Lipitor’s revenue in targeted segments.

5. How does Pfizer plan to sustain Lipitor’s relevance?

By emphasizing ongoing clinical research, expanding indications, entering emerging markets, and leveraging healthcare partnerships, Pfizer aims to maintain a strategic presence for Lipitor.

Sources:

- World Health Organization. (2021). Cardiovascular diseases.

- Grand View Research. (2021). Statins Market Size, Share & Trends Analysis.

- Pfizer Annual Reports. (2006–2010).

- IQVIA. (2021). Worldwide Medicine Sales Data.