Last updated: July 29, 2025

Introduction

ENBREL (etanercept) stands as a pioneering biologic therapy within the realm of immunomodulators, primarily targeting autoimmune diseases such as rheumatoid arthritis (RA), psoriatic arthritis, ankylosing spondylitis, and plaque psoriasis. Since its commercialization in 1998 by Immunex Corporation (acquired by Amgen in 2002), ENBREL has established itself as a cornerstone biologic therapy, with a robust market presence driven by clinical efficacy, physician adoption, and a broad label expandability.

This analysis evaluates the current market landscape, key drivers influencing sales, competitive positioning, regulatory factors, and provides forward-looking sales projections through 2030, considering emerging trends, patent landscapes, and evolving clinical guidelines.

Market Landscape Overview

Global Revenue and Market Penetration

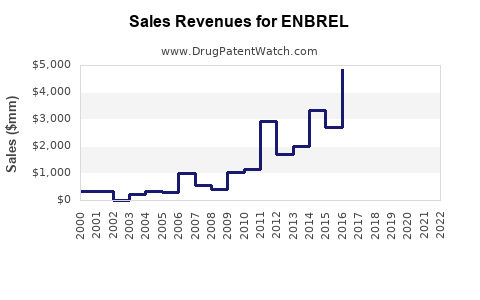

As of 2022, ENBREL's global sales surpassed $4.5 billion, reflecting its dominant position in the biologic immunomodulator segment (source: Evaluate Pharma). Its revenue trend exhibits a steady CAGR of approximately 3-5% over the past five years, with peaks driven by new indications and broader adoption.

In the United States, ENBREL remains the top-selling biologic for autoimmune conditions, representing roughly $2.3 billion in annual revenue (2022). The European market demonstrates similar penetration, supported by established reimbursement pathways.

Market Segments and Indications

ENBREL's primary indications include:

- Moderate to severe rheumatoid arthritis (RA)

- Psoriatic arthritis

- Axial spondyloarthritis (including ankylosing spondylitis)

- Plaque psoriasis

- Juvenile idiopathic arthritis (JIA)

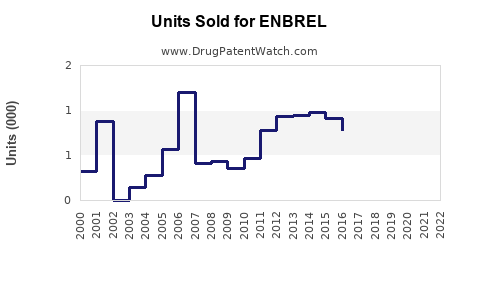

The expansion into additional indications and formulations (e.g., biosimilars) fuels growth, with a shifting landscape driven by competition and patent status.

Competitive Environment

Key Competitors

ENBREL faces competition mainly from other TNF-alpha inhibitors such as Humira (adalimumab), Stelara (ustekinumab), Cosentyx (secukinumab), and newer biologics like Skyrizi (risankizumab). Biosimilars, particularly in Europe, have begun to erode market share post-patent expiry of ENBREL in some regions, although patent protections and legal battles continue to shape market access.

Biosimilar Impact

The introduction of biosimilars from companies like Samsung Bioepis and Biogen has affected ENBREL sales, especially in Europe and emerging markets, leading to price erosion and increased competition. However, in the U.S., patent litigations have temporarily limited biosimilar penetration, preserving revenue streams.

Regulatory and Patent Dynamics

ENBREL's patent protections have historically safeguarded market exclusivity until 2029 in key markets, although legal challenges and patent expirations in other regions have started to influence sales dynamics. Moreover, expanded FDA approvals for additional indications and formulations (e.g., biosimilar versions) promise to extend its market presence.

The evolving regulatory landscape emphasizes cost-effectiveness evaluations, influencing formulary placements and reimbursement policies, thus impacting sales trajectories.

Market Drivers and Barriers

Drivers

- Growing prevalence of autoimmune diseases: The global burden of RA alone affects over 20 million individuals, increasing demand for biologic therapies.

- Clinical efficacy: ENBREL's proven efficacy and safety record sustain its utilization rate.

- Expanded indications: Approval for juvenile RA and other indications broadens its market.

- Patient adherence: Feasibility of subcutaneous administration improves compliance, maintaining consistent sales.

- Physician familiarity: Long-standing presence fosters trust, encouraging continued use.

Barriers

- Patent expirations and biosimilar entry: Threaten market share and pressurize pricing.

- Pricing and reimbursement constraints: Cost-effectiveness debates and payer restrictions limit access.

- Emergence of alternative therapies: Newer biologics with improved safety profiles or convenient dosing regimens challenge ENBREL's dominance.

- Manufacturing and supply chain issues: Potential disruptions could impact sales.

Sales Projections (2023–2030)

Forecasting ENBREL's sales requires considering multiple factors:

- Patent timeline: Patents expected to expire in key markets by 2029, opening the door for biosimilar competition.

- Pipeline and label expansions: Regulatory approvals for additional indications could offset biosimilar erosion.

- Regional market dynamics: U.S. and Europe exhibit different biosimilar adoption rates and reimbursement policies.

Baseline Scenario (Moderate Growth, 2–3%)

Under a conservative outlook, compounded annual growth rates (CAGR) of 2–3% are projected, considering continued stability in mature markets and gradual biosimilar penetration post-2029. By 2030, sales could reach approximately $6.5 billion globally.

Optimistic Scenario (High Adoption, 4–6%)

Assuming accelerated biosimilar uptake coupled with successful expansion into new indications and increased treatment penetration, sales may surpass $8 billion by 2030, sustaining ENBREL's position as a leading biologic.

Pessimistic Scenario (Delayed Biosimilar Adoption, Market Saturation)

Market disruptions or slower-than-expected biosimilar entry could limit growth, with sales plateauing near $5.5 billion through 2030.

Strategic Implications

Pharmaceutical companies must navigate patent landscapes, foster innovation through label expansion, and optimize pricing strategies to sustain market share. For ENBREL specifically, leveraging its established clinical profile while embracing biosimilar competition offers a pathway to preserve revenues. Emphasis on patient-centered care, formulary negotiations, and international market expansion will be pivotal.

Key Takeaways

- ENBREL remains a dominant biologic in autoimmune disease treatment, with a stable revenue base and broad indication portfolio.

- Patent expirations in the late 2020s will accelerate biosimilar competition, risking revenue erosion unless mitigated by label expansion and market penetration strategies.

- Regional regulatory frameworks and payer policies significantly influence sales growth, necessitating adaptive commercialization strategies.

- Continued innovation, including new indications and formulations, will be essential to sustain growth.

- Precise sales forecasting underscores the importance of timing in biosimilar entry and market approval pathways.

FAQs

1. When is ENBREL's patent set to expire, and how will it impact sales?

ENBREL’s key patents are scheduled to expire around 2029 in major markets like the U.S. and Europe. Post-expiry, biosimilar competition is expected to increase, potentially reducing prices and eroding market share unless offset by label expansions or new indications.

2. How do biosimilars influence ENBREL's future sales trajectories?

Biosimilars introduce price competition, leading to reduced revenues in regions with early acceptance. Their impact varies based on regional patent protections, regulatory approvals, and payer policies. Strategic engagement and differentiation will determine the extent of their influence.

3. What are the main factors that could sustain ENBREL sales despite biosimilar entry?

Label extensions into new indications, improvements in formulation (e.g., auto-injectors), patient loyalty, and geographical market expansion are key to maintaining sales levels post-biosimilar entry.

4. How do clinical guideline updates affect ENBREL's market share?

Guidelines endorsing biologics like ENBREL for early and moderate disease states bolster prescribing. Conversely, recommendations favoring newer agents with improved safety or dosing profiles could shift market dynamics unfavorably.

5. What emerging trends could reshape the market for ENBREL?

Emerging non-TNF biologics, personalized medicine approaches, and the advent of oral small molecule alternatives could challenge traditional TNF inhibitors’ dominance, influencing long-term sales prospects.

Sources

- Evaluate Pharma. Biologic Market Data, 2022.

- Amgen Inc.. ENBREL product information, 2022.

- IQVIA. Pricing and Market Access Report, 2022.

- FDA and EMA approval records.

- Market research reports from GlobalData and BioPharm Insight, 2022.