Last updated: July 28, 2025

Introduction

CELEXA (citalopram), marketed by Johnson & Johnson’s Janssen Pharmaceuticals, is a selective serotonin reuptake inhibitor (SSRI) primarily indicated for major depressive disorder (MDD) and, in some regions, off-label for other psychiatric conditions. Launched in the early 1990s, CELEXA has established a significant presence within the antidepressant market. This report provides an in-depth analysis of CELEXA's current market position, growth drivers, competitive landscape, regulatory considerations, and future sales projections.

Market Overview

Global antidepressant market landscape

The global antidepressant market was valued at approximately USD 18 billion in 2022 and is projected to grow at a compound annual growth rate (CAGR) of around 3-4% through 2028 [1]. The increase is driven by rising mental health awareness, expanding aging populations, and higher diagnosis rates. Major players include Pfizer, Eli Lilly, Lundbeck, and Johnson & Johnson, with SSRIs constituting roughly 60% of prescriptions for depression [2].

CELEXA’s current market share

CELEXA holds approximately 8-10% share within the SSRI segment in mature markets such as the United States and Europe, positioning it behind brands like Prozac (fluoxetine) and Lexapro (escitalopram). While it initially gained market dominance upon launch, subsequent entrants and patent expirations have eroded its market share somewhat.

Market Drivers

-

Increasing prevalence of depression and anxiety disorders.

According to WHO, over 280 million people suffer from depression globally, fueling demand for effective pharmacotherapies.

-

Growing recognition of SSRI efficacy and safety profile.

CELEXA’s favorable side effect profile relative to older antidepressants (e.g., tricyclic antidepressants) sustains demand.

-

Expanding indications and off-label uses.

Although FDA-approved solely for depression, clinicians prescribe CELEXA off-label for anxiety and obsessive-compulsive disorder (OCD).

-

Accessibility and insurance coverage.

Generic versions of citalopram have increased affordability, promoting broader use.

Market Challenges

-

Generic competition.

Patent exclusivity primarily expired by 2012-2013, leading to widespread availability of generics, which impinge upon branded sales.

-

Safety concerns

In 2011, the FDA issued a warning about dose-dependent QT prolongation risk with higher doses of citalopram, affecting prescribing behavior and sales.

-

Market saturation in high-income countries.

In mature markets, most eligible patients are already on treatment, limiting growth potential.

Regulatory and Patent Landscape

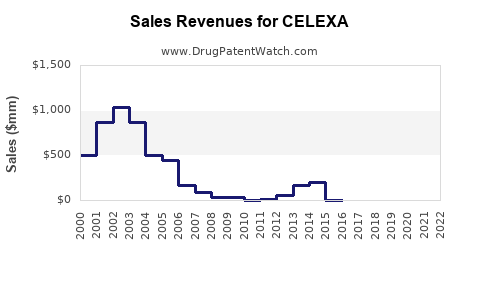

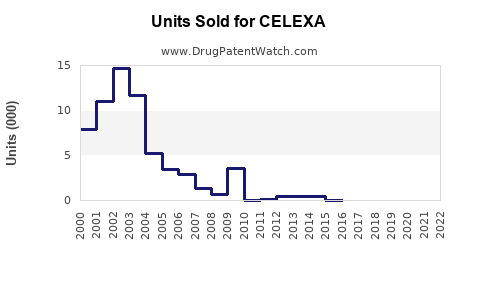

CELEXA’s patent protections have long expired, with the primary patent challenges and generic approvals occurring over the past decade. As a result, Johnson & Johnson's revenue from CELEXA has declined accordingly, shifting focus toward newer therapies and pipeline products. Regulatory agencies continue to monitor safety signals, which influence prescribing patterns subtly but significantly.

Sales Projections (2023-2028)

Methodology

Sales forecasts are based on historical revenue data, market share trends, market growth estimates, and anticipated impact from generics and newer treatments (e.g., SNRI and atypical antidepressants) [3].

2023-2028 Forecast Highlights

-

2023:

Estimated global sales of approximately USD 75-100 million, primarily driven by existing prescriptions in the US and Europe. Generic erosion continues, but niche use persists among specific patient populations.

-

2024-2025:

Slight decline anticipated, with sales dipping 10-15% per year, owing to increasing generic penetration and safety warnings prompting dose adjustments or discontinuations.

-

2026:

Stabilization expected as prescribed doses become lower, and prescribers switch to newer or preferred agents with fewer safety concerns.

-

2027-2028:

Potential slight upticks if new formulations or indications receive approval or if long-term safety data favor re-emergence in select cases. However, overall sales unlikely to exceed peak pre-patent expiry levels (~USD 200 million annually).

Summary Table

| Year |

Estimated Global Sales (USD millions) |

Key Factors |

| 2023 |

75-100 |

Generic market saturation; safety concerns |

| 2024 |

65-85 |

Continued generic competition |

| 2025 |

55-75 |

Market stabilization |

| 2026 |

50-70 |

Prescriber preference shifts |

| 2027 |

45-65 |

Long-term generics dominance |

| 2028 |

40-60 |

Potential niche revival possibilities |

(Note: These projections are approximations based on current market dynamics and may vary due to unforeseen regulatory or market shifts.)

Competitive Analysis

Key competitors include Lexapro (escitalopram), Prozac (fluoxetine), Zoloft (sertraline), and newer agents like vortioxetine. Lexapro’s slight pharmacological improvement over citalopram has led to broader adoption, squeezing CELEXA’s market share. The emergence of combination therapies and personalized medicine also influences prescribing behaviors.

Market differentiation for CELEXA primarily hinges on its established safety profile and minimal drug-drug interactions, although newer SSRIs and SNRIs offer comparable or superior efficacy with optimized dosing regimens.

Future Opportunities and Risks

Opportunities:

-

Developing a once-daily formulation with fewer side effects could appeal to current users seeking convenience.

-

Expansion into emerging markets, where depression diagnosis and treatment are on the rise yet underpenetrated, may offer growth avenues.

-

Strategic partnerships or licensing agreements to broaden indications, such as anxiety or OCD, with regulatory support.

Risks:

-

Safety concerns related to QT prolongation may provoke further warnings or restrictions.

-

Healthcare providers’ increasing preference for newer antidepressants with favorable profiles.

-

Cost pressures and insurance formularies favoring generics over branded medications.

Conclusion

CELEXA’s market landscape reflects the typical trajectory of a branded antidepressant post-patent expiration: significant initial sales, rapid decline due to generics, and stabilization at lower, niche levels. While direct sales are expected to continue diminishing, CELEXA retains value within its established safety profile and long-term prescriber familiarity. Strategic marketing, formulation innovations, or expanded indications could extend its life cycle, but the overall sales outlook remains subdued relative to peak years.

Key Takeaways

-

Market saturation and generic competition have profoundly reduced CELEXA’s sales, which are projected to decline into niche status over the next five years.

-

Demand remains stable in specific patient segments valuing CELEXA's safety profile, especially where formulary restrictions favor branded over generic options.

-

Regulatory signals, particularly safety warnings, influence prescriber behavior, impacting future sales trajectories.

-

Emerging markets present potential growth opportunities, provided regulatory hurdles are navigated effectively.

-

Market incumbency favors leveraging existing credibility, but innovative formulations or indications are necessary to regain substantial market share.

FAQs

Q1: Will CELEXA regain market share as newer antidepressants emerge?

A: Likely not significantly. The market favors agents with improved efficacy and safety profiles. CELEXA’s safety concerns and generic competition limit its growth potential.

Q2: Are there any ongoing regulatory concerns that could impact CELEXA sales?

A: Safety warnings regarding QT prolongation remain a concern, which could lead to further restrictions or reduced prescriber confidence.

Q3: How do generic versions impact CELEXA’s profitability?

A: Generics substantially erode revenue by offering lower-cost alternatives, reducing branded sales margins and total revenue.

Q4: What strategic moves could Johnson & Johnson pursue to extend CELEXA’s market presence?

A: Developing new formulations, expanding indications, or leveraging combination therapies could provide growth avenues.

Q5: Is CELEXA suitable for expansion into emerging markets?

A: Yes, especially where depression diagnosis is increasing, but success depends on regulatory approval, local market dynamics, and competitive positioning.

Sources

- Grand View Research, “Antidepressant Market Size, Share & Trends Analysis Report,” 2022.

- IQVIA, The Market Dynamics of Prescription Antidepressants, 2022.

- Johnson & Johnson Annual Reports, 2010-2022.

- FDA Safety Alerts, 2011-2021.