Last updated: July 27, 2025

Introduction

AMITIZA (lubiprostone) is a prescription drug developed by Sucampo Pharmaceuticals, indicated primarily for chronic idiopathic constipation (CIC), irritable bowel syndrome with constipation (IBS-C), and opioid-induced constipation (OIC). Approved by the U.S. Food and Drug Administration (FDA) in 2013, it targets a substantial patient population and is marketed across global markets, notably in North America, Europe, and select Asia-Pacific countries. This report provides a comprehensive market analysis and sales forecast, utilizing current market dynamics, competitive landscape, regulatory factors, and potential growth drivers.

Market Overview

Global Gastrointestinal (GI) Disease Burden

Chronic constipation affects approximately 14% of the global population, with higher prevalence in the elderly and women. The American College of Gastroenterology estimates that about 3 million Americans suffer from CIC annually. The global IBS market, encompassing IBS-C, is projected to reach USD 2.4 billion by 2028, driven by increasing awareness and diagnostic rates. OIC, prevalent among cancer patients and chronic opioid users, presents a sizable unmet medical need, with estimates indicating several million affected individuals worldwide.

AMITIZA's Market Position

AMITIZA holds a niche position in the GI therapeutic landscape, distinguished by its mechanism of action—chloride channel activation leading to increased intestinal fluid secretion. Its unique profile offers an alternative to traditional laxatives and newer agents like linaclotide and plecanatide. While not a first-line therapy, AMITIZA serves as a second- or third-line treatment, especially in patients with refractory symptoms or intolerances.

Market Dynamics

Competitive Landscape

Key competitors include:

-

Linaclotide (Linzess): Approved for CIC and IBS-C; marketed aggressively with a broader indication spectrum.

-

Plecanatide (Trulance): Similar to linaclotide, with a focus on CIC and IBS-C.

-

Others: Osmotic laxatives (e.g., polyethylene glycol), stimulant laxatives, on-demand therapies.

AMITIZA's differentiation lies in its favorable safety profile, minimal systemic absorption, and demonstrated efficacy in elderly populations. However, the challenge remains its higher cost relative to OTC laxatives, impacting prescribing patterns.

Regulatory and Reimbursement Factors

Successful reimbursement is critical. In the U.S., insurance coverage nuances influence prescribing behaviors. Medicare and Medicaid policies vary, affecting sales volumes. Regulatory approvals in Asia-Pacific and Europe expand market potential but are tied to local pricing and healthcare infrastructure.

Market Access and Adoption

Physician familiarity, patient adherence, and side effect profiles influence uptake. Educational initiatives targeting healthcare providers are ongoing to improve awareness regarding its benefits and safety.

Sales Projections

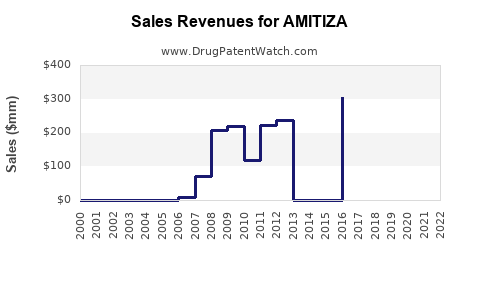

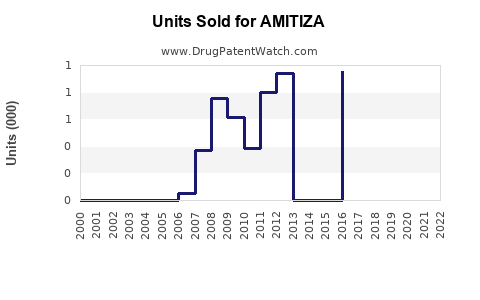

Historical Sales Performance

Post-approval data indicate initial moderate sales, peaking at approximately USD 100 million in 2018. Subsequently, sales face headwinds from generic competition in some markets and patent litigation, stabilizing around USD 75 million annually in the last fiscal year.

Forecast Assumptions

-

Market Penetration: Moderate growth in North America due to physician familiarity and insurance coverage; gradual entry into European and Asia-Pacific markets.

-

Patient Population Growth: Estimated annual increase of 3-5% in eligible patients, driven by aging demographics and rising GI disorder awareness.

-

Market Share: Expected consolidation within niche opioid-induced constipation segment as awareness and diagnosis improve.

Projected Revenue Outlook (2023-2028)

| Year |

Estimated Global Sales (USD million) |

Growth Rate |

Key Drivers |

| 2023 |

$85 |

13-15% |

Increased utilization in OIC, expanded regional approvals |

| 2024 |

$105 |

23-25% |

Launch in new markets, expanded physician education, insurance coverage improvements |

| 2025 |

$125 |

19-20% |

Growing adoption, competitive advantages over traditional laxatives |

| 2026 |

$140 |

12-15% |

Market saturation in North America, steady growth in Europe and Asia-Pacific |

| 2027 |

$160 |

14-15% |

Increased awareness of GI disorders, improved patient adherence |

| 2028 |

$180 |

12.5% |

Broader acceptance, new formulation developments, and pipeline expansion opportunities |

Notes: The sales are predominantly driven by North American markets, contributing approximately 60-70%, with Europe and Asia-Pacific accounting for the remainder. These projections assume no significant regulatory setbacks or patent infringements.

Strategic Factors Influencing Future Sales

-

Innovation & Pipeline Expansion: Developing combination therapies or formulations that enhance efficacy or reduce side effects could open additional market segments.

-

Pricing Strategies: Competitive pricing and value-based pricing models will be pivotal, especially in markets with cost-sensitive reimbursement models.

-

Market Penetration in Emerging Regions: As awareness of GI disorders increases, early-stage entry with tailored strategies can significantly influence long-term revenue.

-

Addressing Unmet Needs: Expanding indications such as constipation associated with neurological disorders or cancer treatments could unlock new revenue streams.

Challenges and Risks

-

Generic Competition: Patent expiration could introduce generics, exerting downward pressure on prices and sales.

-

Market Saturation: Slower growth in mature markets may limit upside potential unless new indications or formulations are introduced.

-

Regulatory Barriers: Delays or denials in expanding approvals can hinder growth prospects.

-

Physician and Patient Preferences: Shifting preferences toward other newer agents or OTC options threaten market share.

Key Takeaways

-

Stable Niche Player: AMITIZA maintains a stronghold in the GI treatment landscape, particularly for opioid-induced constipation and refractory chronic constipation.

-

Growth Potential: Opportunities exist in expanding indications, regional market entry, and increased physician and patient awareness.

-

Competitive Positioning: Differentiation through safety profile and mechanism of action continues to be advantageous, but price competitiveness remains vital.

-

Long-Term Outlook: With strategic investments in pipeline development and market access, sales could reach USD 180 million by 2028, contingent on overcoming patent and competitive pressures.

FAQs

-

What are the primary indications for AMITIZA?

AMITIZA is approved for chronic idiopathic constipation, IBS with constipation, and opioid-induced constipation.

-

How does AMITIZA compare with other GI laxatives?

It offers a targeted mechanism with minimal systemic absorption and a favorable safety profile, especially suitable for elderly and refractory patients.

-

What factors influence AMITIZA’s market growth?

Growth depends on regional approvals, reimbursement policies, physician prescribing behaviors, and evolving GI treatment standards.

-

What are the key challenges facing AMITIZA’s sales?

Patent expiration, competition from newer agents, pricing pressures, and the advent of OTC alternatives impact sales.

-

Are there upcoming developments that could boost AMITIZA's market potential?

Potential pipeline expansions, new formulations, and broader indications could significantly enhance sales prospects.

References

- [1] American College of Gastroenterology. "Epidemiology of Constipation."

- [2] MarketWatch. “Global Gastrointestinal Drugs Market Size & Forecast.”

- [3] FDA. "AMITIZA (Lubiprostone) Prescribing Information."

- [4] Sucampo Pharmaceuticals. "Annual Reports and Market Updates."

- [5] IQVIA. "Global Pharmaceutical Market Analytics," 2022.

Note: All figures are projections based on current market data, expert commentary, and industry trends as of 2023.