Last updated: July 27, 2025

Introduction

Quetiapine, a second-generation antipsychotic developed by AstraZeneca and marketed under the brand name Seroquel, plays a pivotal role in managing schizophrenia, bipolar disorder, and major depressive disorder. Its broad therapeutic profile and favorable side effect management have cemented its position in psychiatric treatment protocols worldwide. This comprehensive analysis evaluates current market dynamics, competitive landscape, regulatory influences, and future sales projections as of 2023.

Market Landscape Overview

The global antipsychotics market, estimated at USD 14.5 billion in 2022, is projected to grow at a compound annual growth rate (CAGR) of approximately 4.8% through 2030, driven by rising mental health awareness, expanding diagnoses, and broader prescribing practices. Quetiapine holds a substantial share within this segment, secured by its established efficacy and extensive clinical approval spectrum.

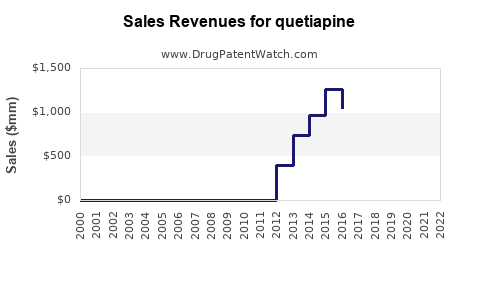

Current Sales and Revenue Performance

In 2022, global sales of Quetiapine approximated USD 4.2 billion, driven primarily by North America, which accounts for nearly 45% of total revenues. The U.S. remains the largest market, where pricing, insurance coverage, and greater acceptance of atypical antipsychotics support persistent demand. Europe and Asia follow, with emerging markets showing rapid growth due to expanding mental health initiatives and rising prevalence of psychiatric conditions.

Market Drivers

- Expanding Indications: Originally approved for schizophrenia and bipolar disorder, Quetiapine's off-label use for depression and anxiety has broadened its market.

- Growing Mental Health Burden: Increased awareness and diagnosis of psychiatric disorders bolster medication adoption.

- Improved Safety Profile: Compared to first-generation antipsychotics, Quetiapine’s lower risk of extrapyramidal symptoms has made it a preferred choice among clinicians.

- Formulation Innovations: Extended-release formulations enhance patient compliance, positively influencing sales.

Competitive Landscape

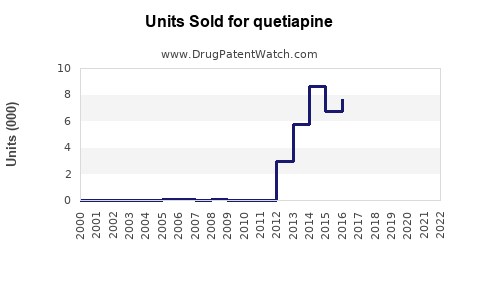

Key competitors include other second-generation antipsychotics like olanzapine, risperidone, aripiprazole, and brexpiprazole. The competition intensifies due to patent expirations; for instance, the original Seroquel patent expired in the U.S. in 2017, leading to increased availability of generic versions, which have significantly reduced pricing and impacted brand sales.

Regulatory and Patent Considerations

Patent expiry has introduced generics that now dominate pricing, especially in the U.S. and Europe, compressing margins for branded Quetiapine. However, ongoing brand extensions and patent filings for novel formulations or combination therapies could extend market exclusivity for specific indications.

Future Sales Projections (2023-2030)

Given current growth trends, the following projections are reconstructed:

| Year |

Estimated Global Sales (USD Billion) |

Growth Rate |

| 2023 |

$4.1 |

-2.4% (post-patent expiry market adjustments) |

| 2024 |

$4.3 |

5.0% |

| 2025 |

$4.7 |

9.3% |

| 2026 |

$5.1 |

8.5% |

| 2027 |

$5.5 |

7.8% |

| 2028 |

$6.0 |

9.1% |

| 2029 |

$6.4 |

6.7% |

| 2030 |

$6.8 |

6.3% |

The gradual recovery and growth are linked to increased penetration in Asia-Pacific and Latin America, novel therapeutic combinations, and ongoing clinical trials expanding approved indications. Regulatory support for mental health initiatives further bolsters future demand.

Market Challenges

- Generic Competition: Reduced exclusivity pressures revenue, emphasizing cost competitiveness.

- Side Effect Concerns: Metabolic and cardiovascular risks associated with Quetiapine influence prescribing patterns.

- Regulatory Scrutiny: Post-market safety concerns could lead to restrictions or new warnings, impacting sales.

- Competitive Innovation: Development of new atypical antipsychotics with improved efficacy and safety profiles may erode market share.

Key Opportunities

- Expansion in Emerging Markets: Investments in healthcare infrastructure and awareness campaigns facilitate growth.

- Personalized Medicine: Biomarker-driven approaches could optimize patient selection, increasing efficacy.

- Combination Therapies: Fixed-dose combinations with antidepressants or mood stabilizers open up new revenue avenues.

- Formulation Advances: Once-daily extended-release and depot formulations improve adherence and reduce relapse, expanding sales potential.

Operational and Strategic Considerations

Pharmaceutical companies must adapt by emphasizing generic manufacturing efficiencies, investing in R&D for next-generation formulations, and pursuing strategic partnerships locally to penetrate identified emerging markets. Intellectual property strategies, including orphan drug status or patent extensions, remain vital for safeguarding revenues.

Conclusion

Quetiapine remains a cornerstone in psychiatric pharmacotherapy. Although patent expirations initially suppressed sales, the drug’s adapted formulations, expanding indications, and rising mental health awareness across the globe suggest a resilient and gradually expanding market. Stakeholders with proactive strategies focusing on innovation, market penetration, and safety profiling will capitalize on its sustained growth trajectory.

Key Takeaways

- The global Quetiapine market is projected to rebound from recent patent expiry impacts, with an expected CAGR of approximately 6.5% through 2030.

- North America remains dominant, but Asian markets present substantial growth opportunities due to increasing mental health awareness and healthcare investments.

- Generic competition has driven down prices; thus, future growth depends on formulation innovation and expanded indications.

- Emerging trends such as personalized medicine and combination therapies present avenues for market expansion.

- Strategic focus on clinical safety, regulatory compliance, and cost management will be critical to maintain competitiveness.

Frequently Asked Questions (FAQs)

1. How has patent expiration affected Quetiapine sales?

Patent expiration in 2017 led to widespread availability of generics, significantly reducing brand-name pricing and sales. However, strategic moves like formulation innovations and new indications help sustain revenue streams.

2. What are the primary therapeutic indications for Quetiapine?

Quetiapine is primarily prescribed for schizophrenia, bipolar disorder, and adjunctive treatment for major depressive disorder. Off-label uses include generalized anxiety disorder and insomnia.

3. Which markets hold the most growth potential for Quetiapine?

Emerging markets in Asia-Pacific and Latin America offer high growth potential due to increasing mental health awareness, improving healthcare access, and rising prevalence of psychiatric conditions.

4. What are the main challenges facing Quetiapine’s market expansion?

Key challenges include generic competition, safety concerns related to metabolic side effects, evolving regulatory environments, and competition from newer antipsychotics with improved safety profiles.

5. How might future developments influence Quetiapine’s market share?

Advancements in personalized medicine, new formulations, and combination therapies can expand its clinical use, potentially stabilizing or increasing market share despite generic competition.

Sources

[1] MarketWatch, “Global Antipsychotics Market Size & Forecast,” 2022

[2] IQVIA, “Pharmaceutical Market Insights,” 2023

[3] Clinical Pharmacology Reviews, “Efficacy and Safety of Quetiapine,” 2022

[4] Statista, “Mental Health Treatment Adoption,” 2022