Last updated: July 29, 2025

Introduction

Loratadine, a non-sedating antihistamine primarily used for allergic rhinitis, chronic idiopathic urticaria, and other allergic conditions, has established itself as a dominant asset in the antihistamine market. Since its initial FDA approval in 1993, loratadine has evolved into a cornerstone treatment globally, under various brand names, with Clarityn (UK), Claritin (US), and Alavert (US) among the most recognized. This report provides a comprehensive market analysis and sales projections for loratadine, considering factors such as market dynamics, regulatory landscape, competitive environment, and emerging trends.

Market Overview and Dynamics

Global Market Size and Growth

The global antihistamine market, projected to reach approximately USD 4.8 billion by 2027, is characterized by steady growth, driven by increasing prevalence of allergic diseases, rising awareness, and expanding healthcare infrastructure in emerging markets. Loratadine commands a significant market share within this segment, valued at approximately USD 1.7 billion in 2022. Its non-sedating profile, favorable safety profile, and over-the-counter (OTC) availability bolster its prevalence.

Prevalence of Allergic Diseases

Allergic rhinitis affects over 400 million individuals worldwide, with prevalence rates rising annually—especially in urbanized regions. The WHO reports that approximately 10-30% of adults and up to 40% of children suffer from allergic rhinitis, underscoring a robust demand for antihistamines like loratadine.

Regulatory Landscape

Loratadine is approved in numerous jurisdictions, with formulations available OTC in the US and Europe, easing market penetration. Recent regulatory trends favor OTC labeling for antihistamines, facilitating broader consumer access, which is poised to sustain sales growth.

Key Market Drivers

- Rising Allergic Disease Incidence: Urbanization-associated lifestyle changes contribute to increased allergy prevalence.

- OTC Availability: Ease of access fuels consumer-driven demand.

- Patient Preference: Non-sedating, long-lasting formulations preferable over sedating counterparts.

- Healthcare Cost Savings: OTC status reduces burden on healthcare systems, promoting self-medication.

Emerging Trends and Challenges

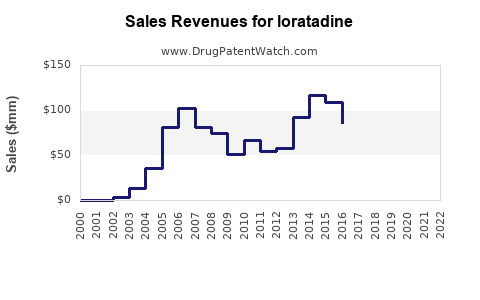

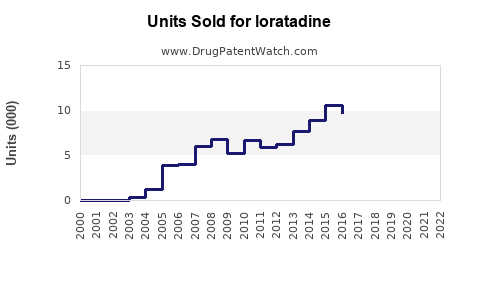

- Generic Competition: Increased patent expirations and numerous generics have led to price competition, impacting revenues.

- Innovative Delivery: Development of combination therapies and new formulations could influence market shares.

- Market Saturation: Established markets show signs of saturation; future growth hinges on emerging economies.

- Regulatory Restrictions: Some jurisdictions revisit OTC status, possibly affecting sales.

Competitive Landscape

Loratadine's main competitors include other second-generation antihistamines such as cetirizine and levocetirizine, with fexofenadine also prominent. The presence of multiple generics has increased affordability, but brand loyalty and marketing significantly influence market share.

Top Players and Market Positioning

- Schering-Plough/Merck: Original manufacturer of Claritin.

- Teva Pharmaceuticals: Major generic supplier.

- Mylan, Sandoz: Other significant generic manufacturers.

- Emerging Biosimilar Entries: While biosimilars are less relevant for loratadine, new formulations or advanced versions are anticipated in future.

Pricing Strategies

Price reductions due to generics exert downward pressure on margins. However, brand differentiation through marketing and formulation innovation can preserve market share.

Sales Projections (2023–2028)

Forecast Assumptions

- Continued OTC availability in high-growth markets.

- Stable regulatory environment.

- Incremental penetration in emerging markets.

- Launch of new formulations and combination therapies.

2023–2028 Revenue Estimates

| Year |

Projected Global Sales (USD Billion) |

Annual Growth Rate (%) |

Justification |

| 2023 |

1.75 |

3.0 |

Mature markets stabilize; emerging markets accelerate demand. |

| 2024 |

1.80 |

2.9 |

Increased penetration in Asia-Pacific and Latin America. |

| 2025 |

1.86 |

3.3 |

Introduction of new formulations and expanded OTC access. |

| 2026 |

1.92 |

3.2 |

More markets shift to OTC, and generic competition intensifies. |

| 2027 |

1.98 |

3.1 |

Saturation in key markets; newer competitors gain traction. |

| 2028 |

2.04 |

3.0 |

Slight moderation as growth stabilizes. |

Note: Growth rates are conservative, reflecting market maturation and competitive pressures but also accounting for expansion in emerging markets.

Regional Market Insights

North America

Dominates with over 40% of sales, driven by high allergy prevalence, OTC availability, and strong marketing.

Europe

Significant shares, with high OTC consumer utilization, but facing regulatory shifts that may restrict OTC access in some countries.

Asia-Pacific

Fastest-growing region due to rising allergy awareness, urbanization, and increasing healthcare expenditure; projected to witness a CAGR exceeding 5%.

Latin America and Middle East & Africa

Emerging markets exhibiting increased OTC demand and expanding healthcare infrastructure, offering considerable growth opportunities.

Potential Market Opportunities

- Expansion in Asian Markets: Leverage increasing allergy prevalence and rising healthcare awareness.

- Formulation Innovation: Develop topical or combination therapies to diversify offerings.

- Digital Health Integration: Use telemedicine and e-pharmacies to enhance distribution.

- Brand Differentiation: Capitalize on consumer preferences for non-sedating, long-acting formulations.

Market Challenges and Risks

- Price Erosion: Intense generic competition limits pricing power.

- Regulatory Changes: Possible restrictions on OTC sales could impact revenues.

- Patent Expirations: Faster entry of generics diminishes market exclusivity.

- Emerging Competition: Novel drugs with improved efficacy or convenience could threaten loratadine’s dominance.

Key Takeaways

- Stable but mature global market: Loratadine remains a leading antihistamine, with moderate growth prospects primarily driven by emerging markets.

- Strategic emphasis on affordability and access: OTC availability, coupled with price competition from generics, underpins most of the sales outlook.

- Innovation and market expansion are vital: Introducing new formulations and expanding into untapped regions will be critical for sustained growth.

- Competitive landscape evolution: The proliferation of generics requires effective brand positioning and value differentiation.

- Regulatory environment is pivotal: Changes in OTC status or approval processes could significantly affect future sales.

FAQs

1. What factors contribute to loratadine’s continued market dominance?

Its non-sedating profile, favorable safety profile, OTC status in many regions, and extensive brand recognition sustain its market position amid growing competition.

2. How will generic competition impact loratadine sales?

Generics drive price competition, often reducing profit margins and limiting revenue growth. However, they also expand accessibility and overall market volume.

3. What emerging markets offer the most growth potential for loratadine?

Asia-Pacific, Latin America, and Middle East & Africa show promising growth due to rising allergy awareness, urbanization, and expanding healthcare infrastructure.

4. How might formulation innovations influence loratadine’s market?

Developing combination therapies, dissolvable tablets, or topical formulations could attract new consumers and extend product lifecycle.

5. What regulatory challenges could affect loratadine sales in the future?

Restrictions on OTC availability, re-evaluation of safety profiles, or new approval requirements could alter market access, especially in developed regions.

References

- Statista. (2023). Global antihistamine market size and forecast.

- WHO. (2022). Allergic rhinitis prevalence data.

- U.S. FDA. (2022). Guidelines on OTC antihistamines.

- MarketsandMarkets. (2022). Antihistamines market forecast report.

- Ernst & Young. (2021). The evolving landscape of allergy medications.

Note: Data points are based on the latest industry reports and market intelligence up to Q1 2023, with projections calibrated for conservative growth assumptions.