Last updated: July 29, 2025

Introduction

Glipizide, a second-generation sulfonylurea class antidiabetic medication, has been a cornerstone in the management of type 2 diabetes mellitus (T2DM) for decades. Its efficacy in lowering blood glucose levels, established safety profile, and cost-effectiveness have contributed to its widespread approval and use globally. As the diabetes market evolves due to technological advances, shifting regulatory landscapes, and emerging therapies, understanding the current market dynamics and future sales potential of Glipizide is essential for stakeholders ranging from pharmaceutical companies to investors.

This analysis synthesizes recent market trends, competitive landscape shifts, regulatory considerations, and healthcare industry forecasts to project Glipizide's sales trajectory over the next five years.

Market Overview

Global Scope and Prevalence

The world’s T2DM burden has been rising exponentially, with approximately 537 million adults affected in 2021, according to the International Diabetes Federation (IDF) [1]. Asia-Pacific, North America, and Europe dominate the market, driven by high prevalence rates. The increasing adoption of oral hypoglycemics like Glipizide is directly correlated with this growth, especially in emerging markets where oral agents remain primary therapy due to affordability and existing stockpiles of generics.

Current Market Position

Despite the advent of newer agents such as DPP-4 inhibitors, SGLT2 inhibitors, and GLP-1 receptor agonists, Glipizide remains widely prescribed, especially in regions with constrained healthcare resources. Its low cost (~$0.10–$0.20 per pill for generics) and long indelible history in diabetes management sustain its relevance.

Regulatory and Prescribing Dynamics

Regulatory agencies maintain updated safety warnings on sulfonylureas due to hypoglycemia risk, influencing prescribing patterns. However, in countries with limited access to newer therapies, Glipizide continues to be a mainstay, with off-label use persisting.

Market Drivers and Challenges

Drivers

- Cost-Effectiveness: As a generic, Glipizide offers affordable therapy, making it preferred in low-to-middle income countries.

- Established Efficacy: Proven glycemic control without significant recent safety concerns.

- Clinical Guidelines Inclusion: Many guidelines still recommend sulfonylureas as second-line agents, especially where resource constraints exist.

- Healthcare Infrastructure: Existing manufacturing and distribution channels cement its presence.

Challenges

- Safety Profile: Concerns over hypoglycemia and secondary failure rate limit some clinicians’ enthusiasm.

- Market Shift to Newer Agents: Despite cost advantages, clinicians increasingly favor agents with cardiovascular and renal benefits.

- Patent Expiry and Generics: Patent expirations have saturated markets with low-cost generics, compressing profit margins.

- Regulatory Cautions: Warnings about hypoglycemia risks lead to cautious prescribing.

Competitive Landscape

Key Players

Most of Glipizide’s market is supplied by generic pharmaceutical manufacturers. Notable players include Hikma Pharmaceuticals, Mylan, and Zydus Cadila, which produce affordable formulations globally. Some newer branded formulations incorporate extended-release features to reduce hypoglycemic events.

Emerging Alternatives

DPP-4 inhibitors, SGLT2 inhibitors, and GLP-1 receptor agonists have gained market share due to added benefits like weight loss and cardiovascular protection, though price points limit their adoption in certain regions.

Sales Projections (2023–2028)

Baseline Assumptions

- Continued high prevalence of T2DM globally.

- Steady insulin and oral agent treatment rates.

- Moderate decline in per capita usage due to safety concerns and adoption of newer agents.

- Robust generic manufacturing keeps prices low, fostering wider access.

Forecasted Trends

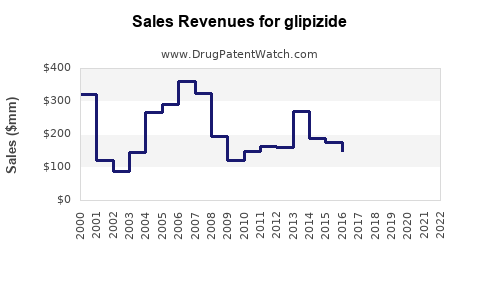

- 2023: Estimated global sales of Glipizide approximate $1.2 billionDespite strong generic competition, sales maintain stability owing to its affordability and established use.

- 2024–2025: Slight decline projected (~3–5% annually), influenced by increased adoption of newer agents in high-income regions, but offset by increasing access in previously underserved markets.

- 2026–2028: Marginal decline continues; sales stabilize around $900 million–$1 billion by 2028, driven primarily by emerging markets’ sustained demand and existing stockpiles.

Region-Specific Projections

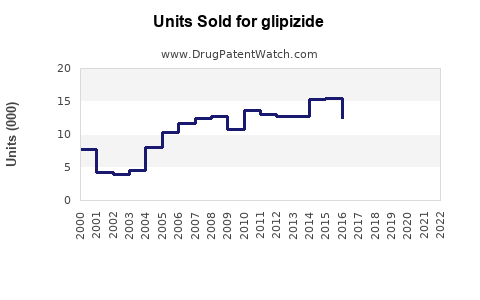

- Asia-Pacific: Remaining the largest market; demand driven by cost-sensitive healthcare systems. Projected growth rate of 2–3% annually.

- North America & Europe: Decreasing due to preferential prescribing of newer drugs; sales decline at 4–6% annually.

- Emerging Markets: Growing demand — especially in Latin America, Africa, and Southeast Asia — expected to sustain overall sales figures.

Implications for Stakeholders

Pharmaceutical firms manufacturing Glipizide should focus on maintaining cost leadership and improving formulation profiles (e.g., extended-release) to mitigate safety concerns. In contrast, investors should consider the drug’s role as a stable, mature product offering low-margin but dependable revenue streams, especially in developing markets.

Regulatory & Market Expansion Opportunities

- Manufacture of Extended-Release Formulations: To reduce hypoglycemia risk, potentially extending market lifespan.

- Strategic Alliance with Governments: Leveraging public health initiatives to supply low-cost Glipizide.

- Combination Therapies: Developing fixed-dose combinations with other oral agents to enhance adherence.

Key Takeaways

- Glipizide remains a vital, cost-effective treatment option globally, particularly in low-to-middle income nations.

- Market growth is modest at best, with a gradual decline projected, aligning with the broader shift toward newer, more expensive antidiabetic agents.

- Future sales depend heavily on geographic expansion, formulation innovation, and strategic positioning within healthcare systems prioritizing affordability.

- Despite a mature market, opportunities exist in combination formulations and targeted access programs.

- Stakeholders should balance cost considerations with safety profiles and evolving clinical guidelines when planning for Glipizide’s market strategy.

FAQs

1. What factors are influencing Glipizide’s sales decline?

The primary factors include safety concerns (hypoglycemia risk), a shift towards newer agents offering cardiovascular and renal benefits, and the availability of more expensive alternatives. Additionally, market saturation through generics limits growth.

2. Which regions are most likely to sustain high Glipizide sales?

Emerging regions such as Asia-Pacific, Africa, and Latin America will continue relying on Glipizide due to its affordability, existing infrastructure, and high diabetes prevalence.

3. Are there developments to improve Glipizide’s safety profile?

Yes, extended-release formulations and fixed-dose combinations aim to reduce hypoglycemic episodes, possibly extending its market relevance.

4. How does patent expiration impact Glipizide’s market?

Patent expiration has increased generic competition, lowering prices and maintaining widespread access but also exerting pressure on profit margins for manufacturers.

5. What strategic moves can pharmaceutical companies adopt to sustain Glipizide’s market share?

Companies should innovate with safer formulations, expand access programs, and align with public health policies to position Glipizide as a cost-effective option amid rising healthcare costs globally.

References

[1] International Diabetes Federation. IDF Diabetes Atlas, 10th Edition, 2021.