Last updated: July 28, 2025

Introduction

VAGIFEM (estradiol vaginal gel) is a prescription hormone therapy designed to treat vulvar and vaginal atrophy—common menopausal symptoms characterized by vaginal dryness, irritation, and pain during intercourse. As an estrogen-based topical formulation, VAGIFEM addresses a significant segment in the hormone replacement therapy (HRT) market, especially among postmenopausal women. This analysis evaluates current market dynamics, competitive landscape, and future sales trajectories for VAGIFEM, providing crucial insights for stakeholders.

Market Overview

Segmentation and Demand Drivers

The primary consumers of VAGIFEM are postmenopausal women experiencing vaginal atrophy, which affects approximately 50% of women over 50 globally, according to the North American Menopause Society (NAMS) [1]. The increasing aging female population, heightened awareness of menopausal health issues, and rising acceptance of hormone therapies drive demand.

Additionally, shifting perceptions around menopause management, with a focus on localized treatments as safer alternatives to systemic hormone therapy, bolster the market for topical estrogen formulations like VAGIFEM.

Regulatory and Reimbursement Environment

VAGIFEM’s approval status varies across markets, influencing sales potential. In the United States, the drug has received FDA approval, facilitating market entry and reimbursement pathways, although insurance coverage remains somewhat variable [2]. European and Asian markets exhibit diverse regulatory landscapes, impacting accessibility and uptake.

Competitor Landscape

The competitive environment includes other local estrogen products such as Premarin Vaginal Cream (conjugated estrogen), Estrace Vaginal Cream, and newer formulations like Osphena (ospemifene). While these products differ slightly in formulation or approval status, VAGIFEM’s differentiating factor rests on its gel formulation and targeted delivery system, potentially offering improved patient compliance.

Market Dynamics

Current Market Size

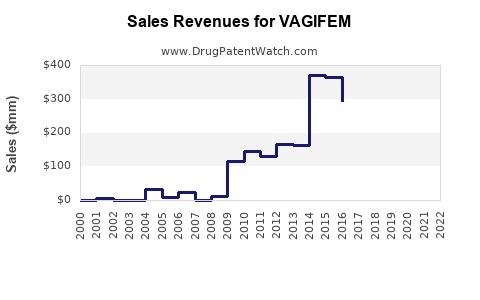

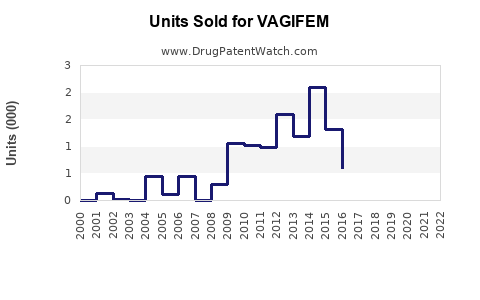

Globally, the market for local estrogen therapies was valued at approximately USD 1.2 billion in 2022, with growth driven primarily by North America and Europe. The vaginal estrogen segment accounts for an estimated 35-40% of this figure, translating roughly to USD 420-480 million [3].

Given VAGIFEM’s niche positioning, its current sales are estimated in the low hundreds of millions, predominantly in the U.S. and select European markets, where awareness and physician prescribing patterns are more established.

Growth Factors

-

Aging Female Population: The rising number of postmenopausal women is expected to sustain demand. By 2030, worldwide menopause incidence will increase by approximately 13%, further expanding the market [4].

-

Preference for Local Estrogen Therapies: Growing patient preference for localized treatments with fewer systemic side effects supports VAGIFEM’s growth.

-

Physician Acceptance: Increasing clinical guidelines endorsing vaginal estrogen therapy bolster physician prescribing behaviors.

-

Innovative Formulations: The convenience and ease of application of gel formulations like VAGIFEM could enhance adherence, especially among women wary of creams or tablets.

Market Challenges

-

Competition from Oral and Other Topical Therapies: Patients and clinicians may favor other formulations due to familiarity or access factors.

-

Regulatory Variability: Uneven approval statuses may limit market penetration in emerging markets.

-

Awareness and Education Gaps: Limited awareness among patients and healthcare providers could slow adoption rates.

Sales Projections

Short-Term Outlook (Next 1-3 Years)

In the immediate term, VAGIFEM’s sales are likely to grow modestly, driven by increased awareness campaigns, favorable prescribing trends, and expanded access in key markets.

-

Estimation: US annual sales could reach USD 150–200 million by 2025, assuming a conservative compound annual growth rate (CAGR) of 10-12% from current levels.

-

Key factors influencing short-term growth: Market penetration strategies, physician education programs, and reimbursement expansion.

Medium to Long-Term Outlook (3-10 Years)

Over the next decade, multiple factors could influence a significant expansion:

-

Market Penetration: Broader adoption in European and Asian markets with improving regulatory approval.

-

Product Differentiation: Launch of next-generation formulations or combination therapies could drive incremental sales.

-

Demographic Trends: The continuing aging population will expand the potential patient pool.

-

Projected Sales Volume: By 2030, global sales could surpass USD 500 million annually, assuming steady growth and increased brand recognition.

-

Market Share: Assuming successful marketing and physician acceptance, VAGIFEM could command 20-30% of the vaginal estrogen therapy market in mature regions.

Note: These projections are speculative and contingent upon regulatory approvals, market acceptance, and competitive dynamics.

Strategic Considerations for Growth

-

Enhancing Physician Education: Targeted education campaigns to inform healthcare providers about VAGIFEM’s benefits compared to existing therapies.

-

Patient Awareness: Digital marketing and patient advocacy partnerships can amplify awareness, improving adherence.

-

Market Expansion: Prioritize regulatory approval in emerging markets such as Asia-Pacific, Latin America, and the Middle East.

-

Formulation Innovation: Develop combination products or alternative delivery systems to differentiate the brand.

-

Healthcare Policy Engagement: Collaborate with payers to ensure reimbursement and coverage, vital for broad adoption.

Regulatory and Competitive Outlook

Anticipated regulatory advances could unlock new markets or expand indications. Moreover, emerging competitors innovating on delivery systems or combining hormonal and non-hormonal drugs will shape the competitive environment. Maintaining a focus on clinical outcomes and patient-centric formulations will be essential for sustained growth.

Key Takeaways

-

The global market for vaginal estrogen therapies is poised for steady growth, driven by demographic shifts and evolving treatment paradigms.

-

VAGIFEM’s niche as a gel-based topical estrogen positions it favorably amid existing competition, especially if supported by strategic marketing and clinical differentiation.

-

Short-term sales in the US could approach USD 200 million annually with cumulative long-term market potential exceeding USD 500 million.

-

Expansion into emerging markets, coupled with ongoing innovation and education, will be critical to maximizing sales potential.

-

Regulatory agility and proactive engagement with healthcare stakeholders will underpin successful market penetration.

FAQs

1. What differentiates VAGIFEM from other vaginal estrogen therapies?

VAGIFEM offers a gel-based formulation designed for targeted delivery and ease of application, potentially improving patient compliance over creams or tablets.

2. How significant is the market opportunity for VAGIFEM?

Given the high prevalence of menopausal vaginal atrophy and increasing acceptance of localized estrogen therapy, the market opportunity is substantial, with projections exceeding half a billion dollars in annual sales globally by 2030.

3. What are the main challenges facing VAGIFEM’s market growth?

Key challenges include intense competition from other local and systemic estrogen therapies, regulatory hurdles in emerging markets, and limited initial awareness among healthcare providers and patients.

4. How does demographic change influence the future sales of VAGIFEM?

An aging female population worldwide will expand the pool of potential users, ensuring sustained demand for vaginal estrogen therapies like VAGIFEM.

5. What strategies can enhance VAGIFEM's market adoption?

Effective physician education, patient awareness programs, strategic regulatory approvals, and product innovation are strategic pillars for expanding VAGIFEM’s market presence.

References

[1] North American Menopause Society (NAMS). "Menopause Practice: A Clinician’s Guide." 2022.

[2] U.S. Food and Drug Administration (FDA). VAGIFEM approval documents. 2021.

[3] MarketWatch. "Global Hormone Replacement Therapy Market Size," 2022.

[4] United Nations. "World Population Ageing 2022."

In conclusion, VAGIFEM stands positioned for growth within the expanding market for local estrogen therapies. Its success hinges on strategic regulatory navigation, innovative marketing, and the evolving needs of the aging female demographic. Stakeholders investing in this segment should monitor regulatory developments, competitive moves, and demographic trends to optimize positioning and capitalize on projected sales growth.