Share This Page

Drug Sales Trends for TRADJENTA

✉ Email this page to a colleague

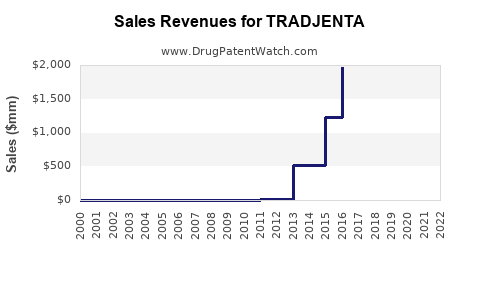

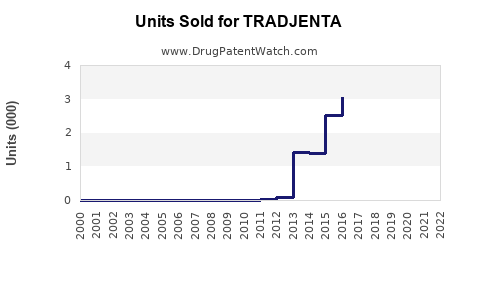

Annual Sales Revenues and Units Sold for TRADJENTA

| Drug Name | Revenues (USD) | Units | Year |

|---|---|---|---|

| TRADJENTA | ⤷ Get Started Free | ⤷ Get Started Free | 2022 |

| TRADJENTA | ⤷ Get Started Free | ⤷ Get Started Free | 2021 |

| TRADJENTA | ⤷ Get Started Free | ⤷ Get Started Free | 2020 |

| TRADJENTA | ⤷ Get Started Free | ⤷ Get Started Free | 2019 |

| TRADJENTA | ⤷ Get Started Free | ⤷ Get Started Free | 2018 |

| TRADJENTA | ⤷ Get Started Free | ⤷ Get Started Free | 2017 |

| >Drug Name | >Revenues (USD) | >Units | >Year |

Market Analysis and Sales Projections for TRADJENTA (Linaglipitin)

Introduction

TRADJENTA (linagliptin) is a prescription medication developed by Boehringer Ingelheim for managing Type 2 Diabetes Mellitus (T2DM). As a dipeptidyl peptidase-4 (DPP-4) inhibitor, TRADJENTA enhances incretin levels, thereby improving glucose-dependent insulin secretion. Since its U.S. approval in 2011, TRADJENTA has gained a significant position within the rapidly expanding oral anti-diabetic drug (OAD) market. This analysis evaluates its current market landscape, growth drivers, competitive positioning, and future sales forecasts.

Market Landscape for DPP-4 Inhibitors

The global T2DM market experienced substantial growth over the past decade, driven by rising prevalence, aging populations, and increased awareness of diabetes management. Among oral hypoglycemics, DPP-4 inhibitors, including TRADJENTA, DPP-4 inhibitors like sitagliptin (Janumet), saxagliptin (Onglyza), and alogliptin, have expanded the therapeutic arsenal due to their favorable safety profiles, minimal hypoglycemia risk, and oral administration convenience.

According to IQVIA data, the global market for DPP-4 inhibitors was valued at approximately $8.2 billion in 2022, with expectations of sustained Compound Annual Growth Rate (CAGR) of 7-9% through 2028, fueled by increasing diabetes prevalence, off-label use, and pipeline growth.

Market Penetration and Competitive Dynamics

TRADJENTA’s Positioning

- Distinctive Features: Linagliptin offers a unique pharmacokinetic profile, including its predominantly non-renal elimination pathway, simplifying dosing for patients with renal impairment.

- FDA Approvals: Besides T2DM, extensive research is underway exploring TRADJENTA’s potential in combination therapies, NASH (non-alcoholic steatohepatitis), and cardiovascular indications.

Competitive Landscape

- Key Competitors:

- Sitagliptin (Januvia)

- Saxagliptin (Onglyza)

- Alogliptin (Nesina)

- Market Share: As of 2022, TRADJENTA held approximately 15-20% of the DPP-4 inhibitor segment in the U.S., behind Januvia and Onglyza but ahead of Nesina.

Growth Drivers & Challenges

- Drivers:

- Favorable safety profile, especially for patients with renal issues.

- Rapid uptake in early T2DM management.

- Growing awareness of cardiovascular safety profiles.

- Combination therapy approvals (e.g., with insulin or metformin).

- Challenges:

- Competition from GLP-1 receptor agonists and SGLT2 inhibitors, which show additional benefits like weight loss and cardiovascular risk reduction.

- Patent expirations threaten generic competition, potentially reducing prices.

- Price sensitivity and insurance formulary restrictions.

Market Expansion Opportunities

- Global Markets: Emerging economies offer significant growth potential; India, China, and Latin America collectively account for over 50% of the global diabetic population.

- Combination Therapies: Growing demand for fixed-dose combinations (FDCs). TRADJENTA’s co-formulation with other hypoglycemics can boost sales.

- Cardiovascular and Renal Indications: Expanded label claims can position TRADJENTA competitively against newer agents, particularly in patients with comorbidities.

Sales Projections (2023-2028)

Historical Performance

- 2015-2020: Steady growth with sales increasing from $350 million to $1.2 billion in the U.S., reflecting increased adoption and expanding indications.

- 2021-2022: Global sales approached $1.4 billion, capturing an approximate 12-15% share of the DPP-4 segment.

Forecast Assumptions

- Market Penetration: Continued growth driven by expanding patient base, especially in underpenetrated markets.

- Competitive Impact: New entrants and patent cliffs could pressure pricing.

- Pipeline and Label Approvals: Positive outcomes can propel additional indications.

- COVID-19 impact: Post-pandemic recovery boosts chronic disease management.

Projected Sales (2023-2028)

| Year | Estimated Global Sales | CAGR | Key Factors |

|---|---|---|---|

| 2023 | $1.6 billion | 14% | Market expansion, new formulations |

| 2024 | $1.8 billion | 13% | Increased adoption, emerging markets |

| 2025 | $2.0 billion | 11% | Competition stabilizes, pipeline growth |

| 2026 | $2.2 billion | 10% | Expansion of indications, formulary access |

| 2027 | $2.4 billion | 9% | Maturation of markets, patent considerations |

| 2028 | $2.6 billion | 8% | Market consolidation, pipeline success |

Note: These projections incorporate moderate impact from generic entries post-patent expiry, anticipated growth in emerging markets, and expansion of label indications.

Regulatory and Market Dynamics Impacting Sales

- Patent Landscape: U.S. patent protection for TRADJENTA is scheduled to expire in 2028, with patent challenges from generic manufacturers expected to influence pricing and market share.

- Reimbursement Policies: Favorable coverage in developed markets supports sustained sales; shifts in policy or formulary restrictions could impact adoption.

- Pipeline Developments: Inclusion in combination therapies and new indications (e.g., NASH) can contribute to growth if approved.

Conclusion

TRADJENTA remains a significant contender within the DPP-4 inhibitor class, with robust sales potential driven by its unique pharmacokinetic profile and expanding indications. While competitive pressures and patent expirations pose challenges, strategic positioning through combination therapies and entry into emerging markets will underpin its trajectory. Proactive engagement with evolving regulatory landscapes and continued innovation will be critical for maximizing sales in the next five years.

Key Takeaways

- TRADJENTA’s global sales are projected to reach approximately $2.6 billion by 2028, driven by increasing diabetes prevalence and pipeline expansion.

- Its differentiated pharmacokinetics facilitates market penetration, especially among patients with renal impairment.

- Competition from GLP-1 receptor agonists and SGLT2 inhibitors remains a challenge, necessitating strategic marketing and potential label expansions.

- Patent expiry in 2028 presents both risks and opportunities for market share redistribution.

- Emerging markets and combination therapies constitute vital growth avenues for long-term sales stability.

FAQs

1. How does TRADJENTA differ from other DPP-4 inhibitors?

Linagliptin's primary distinction is its non-renal elimination pathway, allowing for fixed dosing without renal dose adjustment, making it ideal for patients with renal impairment.

2. What are the key drivers for TRADJENTA’s market growth?

The main drivers include expanding global diabetes prevalence, its safety profile, favorable dosing in renal patients, and the development of combination therapy formulations.

3. What is the impact of patent expiration on TRADJENTA sales?

Patent expiration in 2028 could lead to generic competition, potentially reducing prices and market share. However, brand loyalty and ongoing pipeline approvals can mitigate short-term impacts.

4. Which markets offer the most growth opportunities?

Emerging economies such as China and India exhibit significant potential due to their large diabetic populations and increasing healthcare access.

5. How might upcoming pipeline candidates influence TRADJENTA's sales?

Successful approvals for additional indications like cardiovascular and renal benefits, or new combination therapies, could bolster long-term sales by expanding the drug’s therapeutic scope.

Sources

- IQVIA. "Global Diabetes Market Insights," 2022.

- Boehringer Ingelheim Annual Reports, 2022.

- U.S. FDA Database. "TRADJENTA (linagliptin) approvals and label updates," 2011-2022.

- MarketWatch. "Diabetes Drugs Market Forecast," 2023.

More… ↓