Last updated: July 27, 2025

Introduction

Potassium, an essential mineral critical for maintaining cellular function, electrolyte balance, and nerve transmission, is widely utilized in both medical and nutritional contexts. The pharmaceutical market for potassium-based drugs—including potassium chloride, potassium citrate, and other formulations—is experiencing consistent demand driven by growing awareness of electrolyte imbalances and chronic health conditions such as cardiovascular diseases, renal disorders, and dehydration. This report offers a comprehensive analysis of the current market landscape and forecasts future sales trajectories, providing actionable insights for stakeholders including pharmaceutical companies, investors, and healthcare providers.

Market Overview

Current Market Landscape

The global potassium drug market is characterized by steady growth, supported by widespread clinical use, evolving treatment protocols, and increasing prevalence of electrolyte disturbances. The demand for potassium compounds is driven primarily by therapeutic applications such as treatment of hypokalemia, as an adjunct therapy in cardiac rhythm management, and in nutritional supplementation for at-risk populations.

Key Players and Competitive Dynamics

Major pharmaceutical firms involved in potassium drug manufacturing include B. Braun Melsungen AG, Pfizer Inc., Novartis AG, and specialty companies like Baxter International and Ferring Pharmaceuticals. These players focus on innovation, formulation improvements, and expanding indications to strengthen their market positions. Patent protections for specific formulations, particularly sustained-release formulations, remain a pivotal aspect influencing competitive dynamics.

Regulatory Environment

Regulatory agencies such as the U.S. Food and Drug Administration (FDA) and the European Medicines Agency (EMA) oversee approval processes, emphasizing safety, efficacy, and manufacturing standards. Recent revisions in guidelines for electrolyte supplement formulations have prompted pharmaceutical companies to adapt their product portfolios accordingly.

Market Drivers

Increasing Prevalence of Electrolyte Imbalances

Electrolyte disturbances are common among patients with chronic illnesses, dehydration, or undergoing certain treatments like chemotherapy. A 2021 report indicates that hypokalemia affects approximately 20% of hospitalized patients worldwide, underscoring the demand for effective potassium replacement therapies [1].

Rise in Cardiac and Renal Disorders

The global burden of cardiovascular diseases (CVDs) and kidney diseases is significant. According to WHO, CVDs account for 17.9 million deaths annually, with electrolyte management integral to treatment regimens. The increasing incidence correlates with higher potassium drug utilization.

Nutritional Supplementation Trends

Growing awareness about maintaining electrolyte balance in healthy populations, including athletes and elderly individuals, bolsters over-the-counter (OTC) market segments for potassium supplements.

Technological Advancements

Innovations in drug delivery, such as sustained-release formulations and combination therapies, enhance patient compliance and safety, encouraging broader adoption.

Market Challenges

Safety Concerns and Adverse Effects

Hyperkalemia—excess potassium—poses severe health risks, including cardiac arrest. Strict dosing guidelines and monitoring are necessary, which can restrict widespread use, especially OTC, requiring careful patient education.

Competition from Generic Drugs

Patent expirations have led to increased availability of generic potassium formulations, intensifying price competition and squeezing profit margins for branded products.

Supply Chain Disruptions

Factors like geopolitical conflicts, pandemics, and raw material shortages have periodically affected manufacturing and distribution, impacting market stability.

Regional Market Insights

North America

Led by the U.S., driven by high healthcare expenditure, a large patient population with chronic lipid and renal conditions, and robust R&D activity, North America holds a substantial market share.

Europe

Regulatory alignment and aging populations contribute to steady growth, with key markets in Germany, France, and the UK.

Asia-Pacific

The fastest-growing segment, fueled by rising healthcare access, increasing chronic disease prevalence, and expanding medical infrastructure in countries like China, India, and Japan.

Latin America and the Middle East

Emerging markets with increasing healthcare investments are gradually expanding their share in the global potassium drug landscape.

Sales Projections (2023–2030)

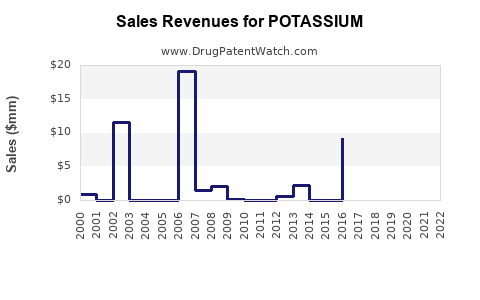

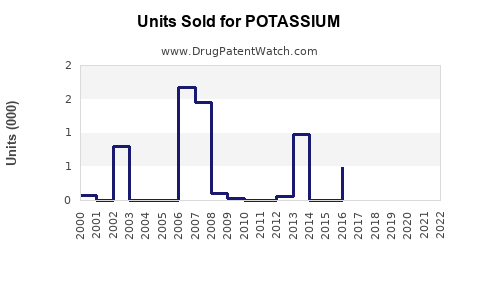

Methodology

Forecasting utilizes a combination of historical sales data, epidemiological trends, population growth rates, technological adoption levels, and regulatory developments. Compound annual growth rate (CAGR) calculations are adjusted for regional disparities.

Global Market Forecast

The potassium drug market is projected to grow from an estimated USD 1.2 billion in 2023 to approximately USD 2.1 billion by 2030, reflecting a CAGR of around 7.6%. This growth is primarily driven by rising chronic disease prevalence and increasing use in both prescription and OTC sectors.

Regional Projections

- North America: CAGR ~6.2%, reaching USD 800 million by 2030 due to mature healthcare systems and high disease burden.

- Europe: CAGR ~6.5%, with market value nearing USD 600 million.

- Asia-Pacific: CAGR ~10%, surpassing USD 500 million by 2030 amid rapid healthcare expansion.

- Latin America and Middle East: CAGR ~8%, entering a growth phase driven by urbanization and healthcare access.

Opportunities and Strategic Outlook

Innovation and R&D

Developing safer formulations with predictable pharmacokinetics and minimized risk of hyperkalemia offers competitive advantages. Personalized medicine approaches, including patient-specific dosing algorithms, could reduce adverse events.

Regulatory Strategy

Navigating fast-track approvals and leveraging orphan drug designations, where applicable, can accelerate market entry.

Market Penetration

Expanding OTC sales channels, especially in emerging markets, enhances accessibility and broadens customer base.

Digital and Managed Care Integration

Implementing digital health solutions like remote monitoring devices and adherence management tools can improve clinical outcomes and foster loyalty.

Risks and Mitigation Strategies

- Safety issues: Continuous pharmacovigilance and patient education can mitigate hyperkalemia risks.

- Pricing pressures: Cost-effective manufacturing, diversification of product lines, and differentiated formulations serve as buffers.

- Regulatory hurdles: Active engagement with regulatory agencies and compliance specialization streamline approval processes.

Key Takeaways

- The global potassium drug market is poised for healthy growth, driven by increasing disease burden, demographic shifts, and technological advances.

- North America and Europe currently dominate, but Asia-Pacific presents significant emerging opportunities.

- Innovation in drug formulations, safety, and delivery mechanisms will be critical for market leaders.

- Strategic collaborations with healthcare systems and digital health integration will optimize market reach.

- Vigilance around safety, regulatory compliance, and competitive pricing remains essential for sustainable growth.

FAQs

1. What are the primary therapeutic uses of potassium drugs?

Potassium drugs are primarily used to treat hypokalemia (low potassium levels), electrolyte imbalances, and assist in management of cardiac arrhythmias and certain renal conditions.

2. How does the rise in chronic diseases influence potassium drug demand?

Chronic illnesses such as heart failure, hypertension, and kidney disease increase the prevalence of electrolyte disturbances, thereby elevating the dependence on potassium supplementation and replacement therapies.

3. What are the safety concerns associated with potassium medications?

The main concern is hyperkalemia, which can cause life-threatening cardiac arrhythmias. Proper dosing, monitoring, and patient education are critical to minimize risks.

4. How is technological innovation impacting this market?

Innovations like sustained-release formulations and combination therapies improve safety profiles, adherence, and patient outcomes, fostering increased market adoption.

5. What regional factors are shaping the market trajectory?

Developed regions benefit from advanced healthcare infrastructure and regulatory processes, while emerging markets are experiencing rapid growth due to expanding healthcare access and rising chronic disease prevalence.

References

[1] World Health Organization. "Electrolyte Imbalances and Your Health," 2021.