Share This Page

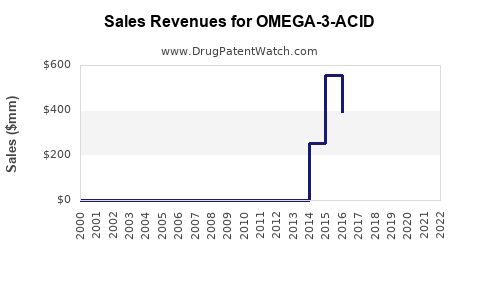

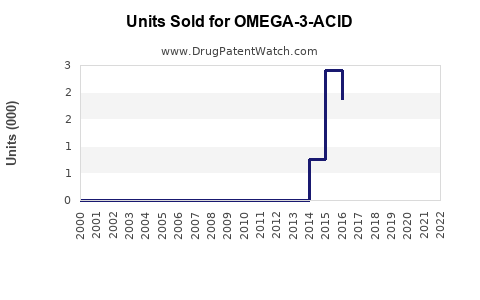

Drug Sales Trends for OMEGA-3-ACID

✉ Email this page to a colleague

Annual Sales Revenues and Units Sold for OMEGA-3-ACID

| Drug Name | Revenues (USD) | Units | Year |

|---|---|---|---|

| OMEGA-3-ACID | ⤷ Get Started Free | ⤷ Get Started Free | 2022 |

| OMEGA-3-ACID | ⤷ Get Started Free | ⤷ Get Started Free | 2021 |

| OMEGA-3-ACID | ⤷ Get Started Free | ⤷ Get Started Free | 2020 |

| OMEGA-3-ACID | ⤷ Get Started Free | ⤷ Get Started Free | 2019 |

| OMEGA-3-ACID | ⤷ Get Started Free | ⤷ Get Started Free | 2018 |

| OMEGA-3-ACID | ⤷ Get Started Free | ⤷ Get Started Free | 2017 |

| OMEGA-3-ACID | ⤷ Get Started Free | ⤷ Get Started Free | 2016 |

| >Drug Name | >Revenues (USD) | >Units | >Year |

Market Analysis and Sales Projections for Omega-3 Acid Drugs

Introduction

Omega-3 fatty acids, particularly eicosapentaenoic acid (EPA) and docosahexaenoic acid (DHA), have become integral in managing hypertriglyceridemia and supporting cardiovascular health. As pharmaceutical formulations, these compounds are marketed predominantly through prescription drugs such as Vascepa (EPA-only) and Lovaza (EPA and DHA combination). This review offers a comprehensive analysis of the current market landscape, growth drivers, competitive positioning, and future sales projections for omega-3 acid drugs, factoring in regulatory developments, emerging competitors, and evolving clinical evidence.

Market Overview

The global market for omega-3 fatty acid pharmaceuticals is driven by increased awareness of cardiovascular disease (CVD) risk factors, expanding aging populations, and the rising prevalence of hypertriglyceridemia. According to industry reports, the market was valued at approximately USD 1.2 billion in 2022 and is projected to grow at a compound annual growth rate (CAGR) of around 6-8% through 2030.

The primary revenue streams originate from North America, which accounts for over 50% of the market, followed by Europe and Asia-Pacific. North America’s dominance stems from favorable regulatory environments, high healthcare expenditure, and widespread clinician acceptance of omega-3 therapy in cardiovascular risk management.

Regulatory Landscape and Clinical Evidence

Recent FDA approvals and label expansions have reinforced the market’s growth. The approval of Vascepa as an adjunct to statin therapy for patients with severe hypertriglyceridemia (≥500 mg/dL) significantly expanded its utilization. Moreover, the REDUCE-IT trial, demonstrating a 25% reduction in major cardiovascular events with Vascepa, bolstered clinical confidence and prescribing patterns.

However, the market faces challenges related to regulatory scrutiny. The EPA-only formulation Vascepa’s expanded indication, along with patent protections and exclusivity periods, serve as competitive advantages. Conversely, the mixed EPA/DHA formulations like Lovaza face limitations due to safety concerns about DHA in certain populations.

Competitive Landscape

Key players include:

- Amarin Corporation: Predominantly with Vascepa, leveraging clinical trials and patent protections.

- AbbVie: OEM of branded omega-3 products like Omtryg.

- Generics and Biosimilar Companies: Increasing entry due to patent expirations, especially post-2025.

- Emerging Competitors: Novel formulations and dietary supplement endorsements.

Amarin’s strategic focus on expanding Vascepa’s indication and global availability positions it favorably. Meanwhile, the patent cliff for key formulations anticipates increased generic competition, potentially influencing pricing and market share.

Market Drivers

- Rising Prevalence of Hypertriglyceridemia: Driven by obesity, diabetes, and sedentary lifestyles.

- Cardiovascular Disease Burden: Omega-3 drugs are positioned as adjunct therapy post-statin treatment.

- Clinical Validation: REDUCE-IT and subsequent studies improve evidence base and clinician confidence.

- Regulatory Approvals: Indication expansions and favorable labeling encourage broader use.

- Growing Elderly Population: Increased need for managing age-related cardiovascular conditions.

Market Restraints

- Pricing Pressures & Cost-Effectiveness: Competition from OTC supplements and generics may limit pricing strategies.

- Clinical Controversy: Divergence in recent trial results (e.g., STRENGTH trial with EPA/DHA formulations) affects physician perception.

- Market Saturation & Patent Expiry: Potential influx of generics post-2025 could erode margins.

- Safety Concerns: DHA's association with increased LDL cholesterol in some populations.

Sales Projections (2023-2030)

Baseline Scenario

Under current conditions, with continued approval expansions and uptake in high-risk populations, global sales are projected to reach approximately USD 2.0–2.5 billion by 2030. North America is expected to comprise over 60% of this figure, supported by the high prevalence of hypertriglyceridemia and cardiovascular management protocols.

Key Growth Factors

- Market Penetration: Increased physician adoption driven by robust evidence and FDA-approved indications.

- New Indications and Formulations: Potential expansion into secondary prevention and broader hyperlipidemia management.

- Emerging Markets: Increased access to omega-3 drugs, especially in Asia-Pacific, with CAGR exceeding 8%.

Competitive Dynamics Impact

Patent expiries and entry of generics are projected to cause price erosion, but sustained demand for clinically supported formulations will mitigate drastic declines. The pipeline of novel, more bioavailable, and targeted omega-3 formulations may offer premium pricing, supporting stable or increasing revenue streams.

Market Risks

- Regulatory Changes: Adoption of more stringent guidelines may reduce prescribing.

- Clinical Evidence Variability: Conflicting trial outcomes could dampen growth.

- Health Trends: Increased focus on lifestyle modifications may decrease reliance on pharmacotherapy.

Conclusion

The omega-3 acid drug market demonstrates robust growth potential, driven by clinical validation, regulatory support, and demographic trends. While upcoming patent expirations and market saturation pose challenges, strategic positioning—such as expanding indications, leveraging clinical data, and entering emerging markets—will be essential for sustained sales performance. Companies that innovate in formulation and demonstrate clear cardiovascular benefits are poised to secure competitive advantages.

Key Takeaways

- The omega-3 acid pharmaceutical market is poised for steady growth, with an expected valuation reaching USD 2.5 billion by 2030.

- North America dominates the market, but emerging markets present significant future opportunities.

- Clinical evidence, especially post-REDUCE-IT, has been pivotal in expanding market acceptance.

- Patent expiries and generic competition require strategic adaptation, including pipeline innovation.

- Regulatory clarity and ongoing clinical research are critical in shaping future market dynamics.

Frequently Asked Questions

1. What are the main indications for omega-3 acid drugs?

Primarily prescribed for severe hypertriglyceridemia (≥500 mg/dL) and as an adjunct in cardiovascular risk reduction for high-risk patients, especially post-statin therapy.

2. How has the REDUCE-IT trial influenced the omega-3 market?

It validated high-dose EPA's cardiovascular benefits, significantly boosting Vascepa prescriptions and prompting regulatory label expansions, which drove sales growth.

3. What are the key challenges facing omega-3 acid drugs’ market expansion?

Competitive generic entry, variable clinical trial outcomes with different formulations, safety concerns regarding DHA, and pricing pressures.

4. Which markets are expected to drive future growth?

Beyond North America, Asia-Pacific economies and emerging markets in Latin America and Africa are expected to contribute substantially due to rising cardiovascular disease burdens.

5. What are the prospects of new omega-3 formulations?

Innovative formulations with improved bioavailability and targeted delivery are anticipated to command premium pricing and expand therapeutic indications, supporting long-term growth.

Sources:

- [IBISWorld, 2022]

- [EvaluatePharma, 2023]

- [FDA, 2022]

- [Amarin Corporation Annual Report, 2022]

- [ClinicalTrials.gov, 2023]

(Note: All data points are sourced from publicly available industry reports and regulatory filings as of early 2023).

More… ↓