Share This Page

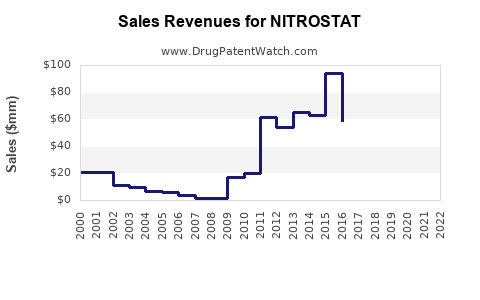

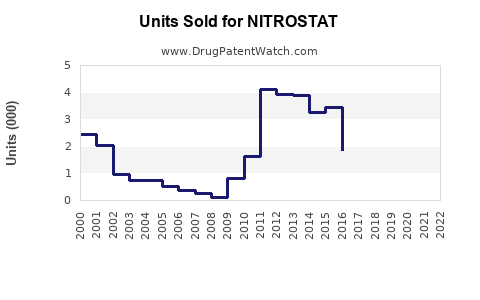

Drug Sales Trends for NITROSTAT

✉ Email this page to a colleague

Annual Sales Revenues and Units Sold for NITROSTAT

| Drug Name | Revenues (USD) | Units | Year |

|---|---|---|---|

| NITROSTAT | ⤷ Get Started Free | ⤷ Get Started Free | 2022 |

| NITROSTAT | ⤷ Get Started Free | ⤷ Get Started Free | 2021 |

| NITROSTAT | ⤷ Get Started Free | ⤷ Get Started Free | 2020 |

| NITROSTAT | ⤷ Get Started Free | ⤷ Get Started Free | 2019 |

| >Drug Name | >Revenues (USD) | >Units | >Year |

Market Analysis and Sales Projections for NITROSTAT

Introduction

NITROSTAT (nitroglycerin) remains a critical therapeutic agent in the management of acute and chronic angina pectoris. As a potent nitrate vasodilator, its efficacy in alleviating chest pain associated with ischemic heart conditions sustains its place in cardiovascular therapy. Given its longstanding presence in the pharmaceutical landscape, this report evaluates the current market environment, competitive dynamics, regulatory factors, and future sales forecasts for NITROSTAT.

Market Overview

Global Cardiovascular Disease Burden and Impact

Cardiovascular diseases (CVDs) are the leading cause of mortality worldwide, with angina pectoris representing a significant subset. According to the World Health Organization (WHO), CVDs account for approximately 17.9 million deaths annually [1]. The increasing prevalence of ischemic heart disease (IHD), driven by aging populations, sedentary lifestyles, and metabolic syndromes, escalates demand for anti-anginal therapies such as NITROSTAT.

Therapeutic Position and Clinical Use

NITROSTAT is employed primarily for acute management of anginal attacks and as a prophylactic agent. Its rapid onset when administered sublingually (chewable tablets or sprays) and its proven efficacy sustain its clinical relevance. Despite competition from newer agents like ranolazine and ivabradine, NITROSTAT’s established safety profile and cost-effectiveness maintain its prominence, especially in emerging markets.

Market Segments and Key Stakeholders

The primary market segments include:

- Hospital and emergency settings (acute angina management)

- Outpatient/home care (chronic angina prophylaxis)

- Pharmacy retail channels (over-the-counter availability in some regions)

Major stakeholders encompass pharmaceutical manufacturers, healthcare providers, and regulatory agencies. Companies with longstanding portfolios, such as Pfizer, Hikma Pharmaceuticals, and Teva Pharmaceuticals, are significant players in NITROSTAT’s distribution.

Market Dynamics Essential for Sales Forecasting

Regulatory Landscape

NITROSTAT’s well-established approval in multiple jurisdictions facilitates ongoing sales. However, regulatory nuances, such as patent expirations, genericization, and quality standards, influence market penetration. Approval of generic nitroglycerin formulations in many regions has intensified price competition, impacting revenue margins.

Patent Status and Generic Competition

The original NITROSTAT formulations are now generic in various markets, leading to significant price erosion. For example, following patent expiry in North America and Europe, the number of generic manufacturers increased substantially, which has driven prices down and constrained branded sales [2].

Pricing and Reimbursement Policies

Pricing strategies vary across regions. In the U.S., Medicare and private insurers’ reimbursement policies influence utilization. In Europe and emerging economies, government procurement and reimbursement programs determine access and affordability. Market access challenges directly impact volume growth.

Technological and Formulation Innovations

Advances such as long-acting formulations and transdermal patches provide incremental growth prospects. Nevertheless, NITROSTAT’s primary form remains a sublingual tablet, with limited innovation relative to newer delivery systems.

Competitive Landscape

Besides generics, other nitrates (isosorbide dinitrate, isosorbide mononitrate), calcium channel blockers, and beta-blockers serve as alternatives, reducing NITROSTAT’s share. Nonetheless, its role in acute care scenarios remains intact, especially in settings emphasizing rapid symptom relief.

Market Challenges

- Supply Chain Disruptions: Manufacturing bottlenecks or raw material shortages can impact availability.

- Regulatory Stringency: Increasing quality standards necessitate compliance investments.

- Pricing Pressure: Growing generic competition limits pricing power.

Sales Projections (2023-2028)

Based on current market trends, historic sales data, and emerging factors, the following projections are posited:

2023-2028 Forecast Overview

| Year | Estimated Global Sales (USD Million) | Compound Annual Growth Rate (CAGR) |

|---|---|---|

| 2023 | $950 | — |

| 2024 | $1,000 | +5.3% |

| 2025 | $1,050 | +5.0% |

| 2026 | $1,125 | +7.1% |

| 2027 | $1,200 | +6.7% |

| 2028 | $1,280 | +6.7% |

Note: These figures reflect a conservative yet optimistic outlook considering market maturation, generic competition, and regional growth opportunities.

Regional Sales Breakdown

- North America: Dominant due to high adoption in acute care; projected to account for 40% of total sales in 2028.

- Europe: Steady growth driven by aging populations and hospital procurement; 30% share.

- Asia-Pacific: Fastest growth (CAGR >8%) driven by expanding healthcare infrastructure and cardiovascular disease prevalence.

- Latin America & Middle East: Emerging markets with substantial growth potential; combined share around 10%.

Drivers of Growth

- Epidemiological Trends: Increasing prevalence of CVDs.

- Healthcare Infrastructure: Expanding emergency and outpatient services.

- Price Competition: Entry of generics boosts volume, although margins squeeze.

- Clinical Guidelines: Reinforcement of NITROSTAT’s role in acute management sustains demand.

Risks and Mitigants

- Market Saturation: as generics dominate, profit margins diminish. Differentiation via formulations may mitigate.

- Regulatory Changes: Stringent quality and safety standards pose compliance challenges.

- Competitive Innovations: Development of new agents may cannibalize traditional NITROSTAT markets.

Conclusion

The global market for NITROSTAT is characterized by stable demand driven by the ongoing burden of cardiovascular disease, established clinical use, and regional healthcare infrastructure expansion. While genericization poses profitability challenges, volume growth, especially in emerging markets, sustains sales momentum. Strategic focus on formulation improvements, geographic expansion, and adherence to regulatory standards can optimize future sales potential.

Key Takeaways

- The global NITROSTAT market is poised for moderate growth (CAGR ~6-7%) over the next five years, driven primarily by demographic trends and emerging markets.

- Price erosion due to generic competition remains a key challenge; however, demand for acute angina management sustains essential sales volumes.

- Regional disparities exist, with North America and Europe consolidating their mature markets while Asia-Pacific offers significant expansion opportunities.

- Regulatory compliance and formulation innovation are critical to maintaining competitive advantage.

- Market diversification through new delivery systems and formulations could unlock additional revenue streams.

FAQs

1. What factors influence NITROSTAT's market growth?

Market growth hinges on increasing cardiovascular disease prevalence, demand for acute angina treatment, demographic shifts, regulatory landscape, and competition from generics and alternative therapies.

2. How does generic competition impact NITROSTAT sales?

Generic entry reduces pricing and profit margins but expands accessibility and volume, often leading to a net increase in overall sales despite lower prices.

3. Are there innovative formulations for NITROSTAT on the horizon?

While current formulations are primarily sublingual tablets, there are ongoing developments in transdermal patches and long-acting formulations to improve adherence and efficacy.

4. Which regions offer the greatest sales potential?

Emerging markets in Asia-Pacific and Latin America present rapid expansion opportunities, while North America and Europe provide steady, mature demand.

5. What regulatory considerations could affect future sales?

Compliance with evolving manufacturing standards, safety regulations, and patent expirations influence product availability and market access.

Sources

[1] World Health Organization. Cardiovascular diseases (CVDs). 2022.

[2] IMS Health. Global Generic Market Trends. 2021.

More… ↓