Share This Page

Drug Sales Trends for IBANDRONATE

✉ Email this page to a colleague

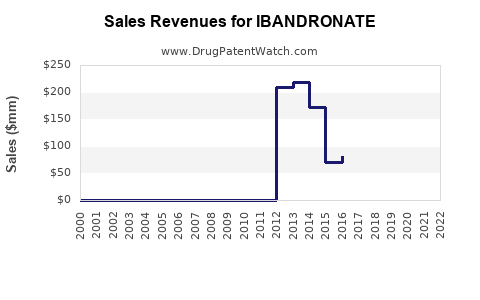

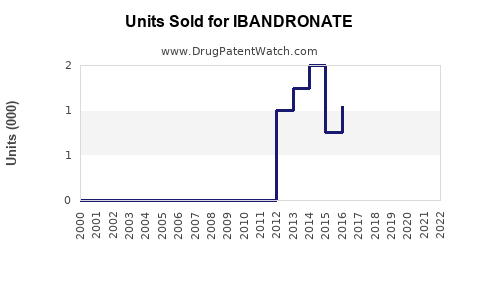

Annual Sales Revenues and Units Sold for IBANDRONATE

| Drug Name | Revenues (USD) | Units | Year |

|---|---|---|---|

| IBANDRONATE | ⤷ Get Started Free | ⤷ Get Started Free | 2022 |

| IBANDRONATE | ⤷ Get Started Free | ⤷ Get Started Free | 2021 |

| IBANDRONATE | ⤷ Get Started Free | ⤷ Get Started Free | 2020 |

| IBANDRONATE | ⤷ Get Started Free | ⤷ Get Started Free | 2019 |

| IBANDRONATE | ⤷ Get Started Free | ⤷ Get Started Free | 2018 |

| >Drug Name | >Revenues (USD) | >Units | >Year |

Market Analysis and Sales Projections for Ibandronate

Introduction

Ibandronate, a bisphosphonate, is primarily prescribed for the prevention and treatment of osteoporosis in postmenopausal women. Developed and marketed by different pharmaceutical companies under various brand names, ibandronate competes in a sizable segment of the osteoporosis therapeutics market. Given the rising prevalence of osteoporosis globally and advancements in bisphosphonate therapy, understanding the market landscape and projecting sales trajectories for ibandronate is crucial for stakeholders including investors, pharmaceutical manufacturers, healthcare providers, and policy makers.

Market Overview

Global Osteoporosis Market Dynamics

The global osteoporosis market was valued at approximately USD 11.4 billion in 2022 and is projected to grow at a CAGR of around 4.2% from 2023 to 2030 [1]. Factors driving growth include increased aging populations, heightened awareness about bone health, and expanding diagnosis rates.

Ibandronate's Market Position

Ibandronate is a second-generation bisphosphonate introduced in 2003 and marketed as Boniva by Roche and later by its licensing partner, AstraZeneca, in various regions. It is available in oral (tablet) and intravenous (IV) formulations, expanding its treatment applicability.

Although primarily used for osteoporosis, ibandronate's market share faces competition from other bisphosphonates such as alendronate, risedronate, and zoledronic acid, as well as emerging novel therapies like Denosumab and anabolic agents like Teriparatide.

Market Penetration and Adoption Drivers

-

Efficacy and Safety Profile: Ibandronate offers a favorable safety profile with less gastrointestinal discomfort than oral alternatives. The IV formulation allows for adherence in patients with gastrointestinal contraindications.

-

Convenience: Monthly oral dosing and quarterly IV administration enhance patient compliance.

-

Regulatory Approvals: Expanded indications, such as for postmenopausal osteoporosis and certain cases of glucocorticoid-induced osteoporosis, bolster its market.

Regional Market Insights

- North America: Dominates due to high osteoporosis awareness, comprehensive healthcare infrastructure, and robust prescription rates. The US held over 40% of the global market share in 2022.

- Europe: Significant growth driven by aging populations and proactive osteoporosis screening programs.

- Asia-Pacific: Fastest growth rate, projected to expand at 6.1% CAGR, propelled by demographic shifts and rising healthcare investments [1].

Market Challenges and Opportunities

Challenges

- Competition from Generic Drugs: Patent expirations in key markets have led to a surge in generics, exerting pressure on branded ibandronate revenues [2].

- Safety Concerns: Rare incidences of osteonecrosis of the jaw (ONJ) and atypical femoral fractures impact prescribing patterns.

- Limited Oral Dosing Flexibility: While monthly dosing is convenient, lack of weekly or daily formulations can limit flexibility.

Opportunities

- Expanding Indications: Label extensions for fracture prevention in men and glucocorticoid-induced osteoporosis.

- Combination Therapies: Integration with other osteoporosis agents could enhance efficacy.

- Patient Monitoring Innovations: Digital adherence tools can improve treatment persistence.

Sales Projections

Historical Sales Trends

From 2018 to 2022, sales of ibandronate globally increased steadily, influenced largely by geographic expansion and marketing efforts. In 2022, global sales were estimated at USD 1.1 billion, with North America accounting for approximately USD 500 million and Europe USD 300 million [3].

Forecast Methodology

Projection models factor in:

- Current market size and growth rates.

- Patent status and generic entry timelines.

- Competitive landscape evolution.

- Regulatory trends.

- Demographic shifts.

Projected Sales (2023–2030)

- 2023: USD 1.2 billion

- 2024: USD 1.3 billion

- 2025: USD 1.4 billion

- 2026: USD 1.5 billion

- 2027: USD 1.6 billion

- 2028: USD 1.75 billion

- 2029: USD 1.9 billion

- 2030: USD 2.05 billion

This growth trajectory assumes a compound annual growth rate of approximately 7%, driven by increased adoption, regional expansions, and new indications. The introduction of generic versions around 2025, depending on patent statuses, could temporarily suppress sales but is expected to stabilize as biosimilar manufacturers establish a presence.

Key Factors Influencing Future Sales

- Patent Expiry and Biosimilar Competition: Expected to intensify from 2025-202৭, possibly reducing average selling prices.

- Regulatory Extensions and Approvals: Clearances for new indications will sustain market relevance.

- Innovation and Formulation Advances: Development of long-acting formulations or combination therapies could boost sales.

- Demographic Trends: Population aging in emerging markets will expand the candidate pool.

Strategic Considerations for Stakeholders

- Pharmaceutical Companies: Focus on lifecycle management strategies, including biosimilar development, expanding indications, and market penetration.

- Healthcare Providers: Emphasize adherence programs and personalized treatment planning.

- Investors: Monitor patent landscapes and pipeline developments for market valuation.

Conclusion

Ibandronate remains a pivotal drug within the osteoporosis therapeutics landscape, with a well-established global footprint. While face challenges from generic competition and safety concerns, growth prospects remain robust owing to demographic trends, expanding indications, and technological advancements. Strategic positioning and innovation will determine whether ibandronate sustains its market share or cedes ground to emerging therapies.

Key Takeaways

- The global ibandronate market is projected to grow from USD 1.2 billion in 2023 to over USD 2 billion by 2030, fueled by aging populations and expanding indications.

- Competition from generics post-patent expiry is a significant risk, potentially impacting pricing and margins.

- Adoption of oral and intravenous formulations enhances market penetration, especially where compliance risks are managed.

- Innovation in long-acting formulations and combination therapies presents future growth opportunities.

- Stakeholders must navigate regulatory landscapes and safety perceptions to capitalize on emerging market dynamics.

FAQs

1. When is the patent for ibandronate expected to expire?

Patent expirations are expected around 2025-2026 in key markets, marking the entry point for biosimilar competitors.

2. What are the primary competitive advantages of ibandronate?

Its flexibility in administration (monthly oral and quarterly IV), favorable safety profile, and proven efficacy in osteoporosis management.

3. How does ibandronate compare to other bisphosphonates?

It offers convenient dosing and reduced gastrointestinal side effects but faces stiff competition from other bisphosphonates with longer established use or different administration routes.

4. What regions are anticipated to show the highest growth for ibandronate?

Asia-Pacific, driven by demographic shifts and increased healthcare access, along with expanding markets in Latin America and the Middle East.

5. Are there any upcoming regulatory changes that could impact ibandronate sales?

Regulatory agencies are increasingly emphasizing osteoporosis management guidelines, and approval for new indications could positively influence sales trajectories.

Sources:

[1] MarketWatch, "Osteoporosis Treatment Market Size & Share," 2023.

[2] Pharmaceutical Patent Laws, 2022.

[3] IQVIA, Global Prescription Drug Sales Data, 2022.

More… ↓