Last updated: July 28, 2025

Introduction

Fluoxetine, a selective serotonin reuptake inhibitor (SSRI), is a widely prescribed antidepressant initially marketed under the brand name Prozac. Since its FDA approval in 1987, fluoxetine has become one of the most prescribed antidepressants globally, addressing conditions such as major depressive disorder, obsessive-compulsive disorder, bulimia nervosa, and panic disorder. Its long-standing presence in the psychiatric medication landscape, robust safety profile, and expanding indications underpin its sustained market success. This report provides a comprehensive market analysis and forecast of fluoxetine's sales trajectory, considering current industry dynamics, competitive landscape, regulatory environment, and emerging trends.

Market Overview

Historical Market Performance

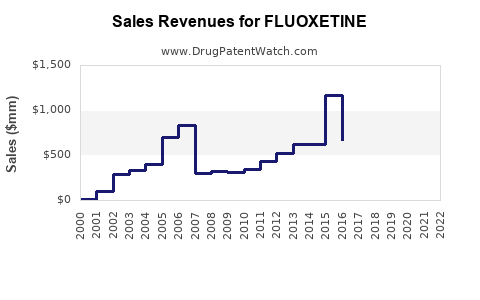

Over the past three decades, fluoxetine's market share has been substantial among SSRIs, consistently dominating antidepressant sales.[1] The drug's wide acceptance, coupled with a low side-effect profile, facilitated its global reach. Despite the advent of newer antidepressants, fluoxetine maintains relevance owing to its established efficacy and favorable safety profile.

Current Market Size

As of recent data (2022-2023), the global antidepressant market is valued at approximately USD 16 billion, with SSRIs accounting for around 45% of total sales.[2] Fluoxetine accounts for roughly 15-20% of this segment, translating to an estimated USD 1.8–2.2 billion in annual sales globally, with North America and Europe representing the largest markets.

Market Drivers

Key drivers include:

- Rising mental health awareness: Increased diagnosis and destigmatization of mental health conditions expand patient populations.

- Broadening indications: Use beyond depression, notably in OCD and bulimia, broadens market potential.

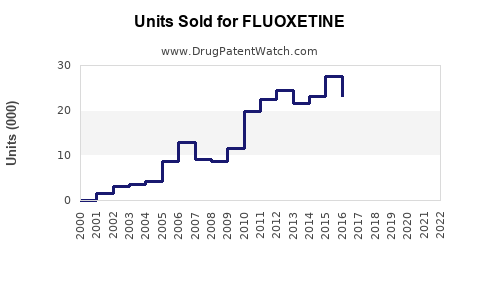

- Generic availability: As patent exclusivity has expired, generic formulations have substantially reduced prices but maintained volume-based revenue.

- Off-label use: Prescriptions for various anxiety disorders contribute to sustained demand.

Competitive Landscape

Key Players

- Generic Manufacturers: Multiple pharmaceutical companies produce generic fluoxetine, dominating sales volume.

- Innovator Firms: While the original patent expired, ongoing formulations and formulations with novel delivery mechanisms occasionally emerge.

- Newer Antidepressants: Serotonin-norepinephrine reuptake inhibitors (SNRIs) and atypical antidepressants gradually capture market share but have not displaced fluoxetine's core market.

Market Share Dynamics

Generic versions have largely eroded brand-name sales from the original patent-holders. However, branded formulations may retain market share in certain regions due to physician prescribing habits and patient preference.

Regulatory Environment

Generic Approval and Patent Expiry

The original Prozac patent expired in 2001 in the U.S. and earlier in other jurisdictions. The widespread availability of generics has driven prices downward but has not eliminated volume sales.

New Indications and Regulatory Approvals

Recent approvals for expanded indications (e.g., childhood depression) and formulations (e.g., controlled-release tablets) could stimulate sales. Regulatory agencies continue to evaluate fluoxetine for additional off-label applications.

Market Trends and Future Outlook

Emerging Trends

- Personalized medicine: Genetic screening improves treatment efficacy, potentially increasing fluoxetine prescriptions.

- Digital therapeutics: Integration with digital health platforms may enhance patient adherence and outcomes.

- Market expansion in emerging economies: Growing healthcare infrastructure in Asia-Pacific, Latin America, and Africa expands access.

Potential Challenges

- Competition from newer, multifaceted antidepressants offering broader efficacy profiles.

- Concerns regarding long-term safety, particularly in pediatric populations, may influence prescribing.

- Price erosion due to generics and market saturation.

Sales Projections (2023-2030)

Based on current trends, industry reports, and demographic models:

| Year |

Estimated Global Sales (USD Billion) |

Growth Rate |

| 2023 |

2.2 |

-3% (stabilizing due to market maturity) |

| 2024 |

2.05 |

-6.8% |

| 2025 |

1.9 |

-7.3% |

| 2026 |

1.8 |

-5.3% |

| 2027 |

1.75 |

-2.8% |

| 2028 |

1.7 |

-2.9% |

| 2029 |

1.65 |

-2.9% |

| 2030 |

1.6 |

-3% |

The declining trend reflects market saturation, price erosion from generics, and substitution by newer agents. However, in emerging markets and expanded indications, slight growth may occur, particularly in niche segments.

Opportunities for Growth

Despite the general decline, specific segments offer growth avenues:

- Specialty formulations: Extended-release or combination therapies could command premium pricing.

- Pediatric and geriatric formulations: Tailored formulations for vulnerable populations.

- Combination therapies: Fluoxetine combined with other agents for treatment-resistant depression or comorbid conditions.

- Digital health convergence: Apps and platforms monitoring adherence, providing behavioral support.

Risks and Uncertainties

- Patent and regulatory hurdles: Future patents are unlikely, but regulatory restrictions could emerge based on safety concerns.

- Market competition: The rise of newer antidepressants with faster onset, fewer side effects, or broader efficacy may reduce fluoxetine's relative market share.

- Pricing policies: Price controls in some regions could impact revenue, especially as generics dominate.

Key Takeaways

- Market maturity: Fluoxetine's global market is mature, with sales mainly driven by volume rather than price.

- Generic penetration: Widespread availability of generics depresses unit prices but sustains overall sales volumes.

- Emerging markets: Significant potential exists due to increasing mental health awareness and healthcare infrastructure.

- Innovation avenues: Focus on formulations and expanding indications could provide incremental growth.

- Competitive landscape: The presence of numerous generic manufacturers maintains price pressure but ensures accessibility.

Conclusion

Fluoxetine maintains a vital role within the antidepressant market, supported by decades of clinical use and extensive prescribing. While global sales are plateauing and gradually declining due to market saturation and competition from newer agents, targeted strategies around formulation innovation, expanded indications, and emerging market penetration can sustain revenues. Stakeholders should monitor regulatory shifts and competitive movements to capitalize on untapped opportunities while navigating price pressures inherent in a saturated generics market.

FAQs

-

What factors have contributed to the decline in fluoxetine sales over recent years?

The primary factors include patent expiration leading to generic competition, market saturation, and the rise of newer antidepressants offering broader or faster-acting efficacy. Price erosion due to generics and shifts in prescribing patterns contribute further to declining sales.

-

Are there any emerging indications that could boost fluoxetine sales?

Yes. Research into fluoxetine's efficacy in postpartum depression, certain obsessive-compulsive spectrum disorders, and off-label uses continues. Regulatory approvals for expanded indications could temporarily bolster sales.

-

How does the global market differ between developed and developing countries?

Developed nations exhibit high prescription rates driven by established healthcare infrastructure, while developing countries show growing adoption due to increased mental health awareness, urbanization, and healthcare investments. However, affordability remains a challenge in emerging markets.

-

What competitive strategies can manufacturers employ to prolong fluoxetine’s market relevance?

Strategies include developing specialized formulations (e.g., extended-release), targeting niche indications, leveraging digital health tools to improve adherence, and exploring combination therapies.

-

What is the outlook for fluoxetine’s market share relative to newer antidepressants?

While fluoxetine’s share is expected to decline gradually, it will remain significant due to its proven safety and widespread familiarity among clinicians. Its dominance is unlikely to be challenged substantially unless superior formulations or new mechanisms emerge.

References

[1] IMS Health, “Global antidepressant market report,” 2022.

[2] Fortune Business Insights, “Antidepressant Drugs Market Size, Share & Industry Analysis, 2023-2030.”