Last updated: July 28, 2025

Introduction

Felodipine, a dihydropyridine calcium channel blocker, is prescribed to treat hypertension and angina pectoris. Since its approval, it has gained prominence due to its efficacy and safety profile, fitting into the broader cardiovascular therapeutic landscape. This report evaluates the market dynamics, competitive positioning, and future sales prospects of felodipine, providing insights for stakeholders, including pharmaceutical firms, investors, and healthcare policymakers.

Pharmacological Profile and Clinical Utility

Felodipine functions by inhibiting calcium influx into vascular smooth muscle and cardiac cells, promoting vasodilation and reducing peripheral resistance. Its advantages include a selective action on vasculature, once-daily dosing, and a favorable side effect profile, often resulting in reduced risk of edema compared to other dihydropyridines (e.g., amlodipine). Its clinical utility is well-established in managing hypertension, which continues to be a high-prevalence condition globally.

Market Overview

Global Hypertension and Cardiovascular Disease Market

The global market for antihypertensive drugs exceeds USD 25 billion as of 2023, with calcium channel blockers (CCBs) comprising nearly 20-30% of prescriptions [1]. The rising prevalence of hypertension, driven by aging populations and lifestyle factors, sustains high demand for CCBs, including felodipine.

Current Market Position of Felodipine

Felodipine is marketed primarily in Europe, Asia, and select regions in Latin America, with limited presence in North America due to patent expirations and market competition. Major pharmaceutical companies such as AstraZeneca and Pfizer have historically produced felodipine formulations, though manufacturing licenses are held broadly.

Competitive Landscape

Key competitors include amlodipine, nifedipine, and other dihydropyridine CCBs, with amlodipine leading market share owing to its extensive global approval and cardiovascular benefits. The competitive edge of felodipine lies in its tolerability and once-daily dosing, but it faces challenges from more aggressively marketed agents with broader clinical labeling.

Regulatory and Patent Environment

Felodipine's patent protection has expired in many jurisdictions, leading to generic manufacturing, which reduces drug prices and affects sales volumes. Regulatory hurdles are minimal where generics dominate, but brand-name sales remain significant in certain markets where physicians prefer original formulations or where regulatory barriers limit generic entry.

Market Trends and Drivers

Growing Hypertension Prevalence

WHO reports that approximately 1.3 billion adults worldwide suffer from hypertension; this number is projected to grow, especially in low- and middle-income countries (LMICs), fueling demand for affordable antihypertensives [2].

Shift Towards Fixed-Dose Combinations (FDCs)

FDCs combining CCBs with other antihypertensives improve adherence and are increasingly adopted. Felodipine is incorporated into such combinations, expanding its usage.

Lifestyle and Demographic Factors

Increasing urbanization and aging populations amplify hypertension prevalence, supporting sustained demand for effective treatments like felodipine.

Impact of COVID-19

The pandemic shifted healthcare priorities but emphasized the importance of hypertension control as a factor in COVID-19 morbidity, indirectly supporting antihypertensive medication sales.

Sales Projections (2023–2030)

Methodology

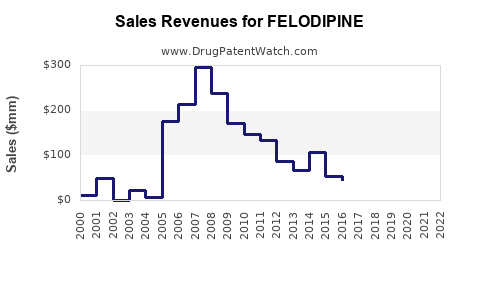

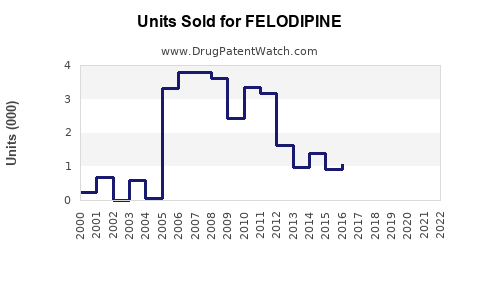

Sales forecasts are based on historical sales data, patent expiry timelines, regional hypertension burdens, competitive positioning, and anticipated regulatory changes. Market penetration rates of generics versus branded products are modeled accordingly.

Short-term Outlook (2023–2025)

Post-pandemic stabilization, market sales of felodipine are expected to grow modestly at a CAGR of approximately 2-3%, driven largely by generic penetration in Europe and Asia. The increasing adoption of fixed-dose combinations and expanded indications will compensate for competition from newer agents.

Mid to Long-term Outlook (2026–2030)

As emerging markets amplify their healthcare spending and hypertension awareness rises, sales are projected to expand at an overall CAGR of approximately 4-5%. The integration of felodipine into multiple combination therapies and ongoing cardiovascular clinical trials will further bolster sales. Despite patent expiries, stable demand persists due to the drug's proven efficacy and cost-effectiveness.

Quantitative Sales Estimates

- 2023: Approximately USD 500 million globally, predominantly from Europe and Asia.

- 2025: Projected to reach USD 600-650 million.

- 2030: Anticipated to surpass USD 900 million, with notable contributions from LMIC markets and combination formulations.

Market Opportunities and Challenges

Opportunities

- Expansion into emerging markets lacking advanced antihypertensive options.

- Development of branded fixed-dose combination products containing felodipine.

- Conducting post-marketing studies to demonstrate added benefits or new indications.

Challenges

- Competition from generics and newer agents like amlodipine with broader labeling.

- Regulatory delays or restrictions affecting market access.

- Price erosion following patent expiries requiring strategic pricing and marketing.

Conclusion

Felodipine remains a relevant entity within the global antihypertensive landscape, with steady growth driven by demographic trends, clinical utility, and evolving treatment paradigms. Strategic focus on formulations, regional expansion, and integration into combination therapies will be essential to capitalize on its market potential. Companies that effectively navigate competitive pressures, optimize pricing strategies, and leverage emerging market growth will realize sustainable sales trajectories in the coming years.

Key Takeaways

- Market stability stems from the persistent global prevalence of hypertension, underpinning demand for felodipine.

- Patent expiries have increased generic availability, reducing prices but expanding access, especially in emerging markets.

- Growth opportunities include fixed-dose combinations and expansion into LMICs, where hypertension remains underdiagnosed and undertreated.

- Competitive differentiation relies on clinical tolerability, cost-effectiveness, and strategic regional marketing.

- Long-term sales are projected to grow at a CAGR of approximately 4-5%, reaching near USD 900 million by 2030.

FAQs

1. How does felodipine compare to other CCBs like amlodipine?

Felodipine offers similar antihypertensive efficacy but is often preferred in patients prone to peripheral edema due to its favorable side effect profile. Its once-daily dosing and tolerability provide a competitive edge, but market share favors amlodipine because of broader global approval and aggressive marketing.

2. What are the main regulatory considerations for felodipine?

Generic versions face minimal regulatory hurdles where patents have expired, facilitating market access. However, branded formulations may face restrictions in certain regions due to regulatory restrictions or upcoming patent litigations.

3. In which regions is felodipine most commercially successful?

Felodipine's primary markets include Europe, parts of Asia, and Latin America, where regional healthcare policies support its use. North America has limited sales due to market preferences and established competition.

4. What are the prospects for felodipine in fixed-dose combination therapies?

FDCs are increasingly popular for hypertension management. Felodipine-based combinations are expected to grow, providing opportunities for expanding sales particularly in countries emphasizing medication adherence.

5. How do patent expirations impact felodipine sales?

Patent expiry generally leads to increased generic competition, reducing price but expanding accessibility. While this short-term revenue may decline, volume increases and market expansion in underserved regions can offset the loss.

References

[1] Global Data. "Hypertension Market Forecast." 2022.

[2] World Health Organization. "Hypertension Fact Sheet." 2021.