Last updated: July 27, 2025

Introduction

Eurax, also known by its active ingredient Crotamiton, is a topical medication primarily used for the symptomatic treatment of scabies and associated dermatitis. As a well-established treatment within dermatology, understanding its market dynamics and sales trajectory is essential for pharmaceutical stakeholders, investors, and healthcare providers aiming to navigate an evolving landscape that includes emerging competition and shifting treatment protocols.

Market Overview

Product Profile and Therapeutic Use

Eurax's principal indication centers on antiparasitic therapy for scabies, coupled with anti-itch properties beneficial in dermatitis management. Its efficacy, safety profile, and over-the-counter availability in some regions have historically contributed to stable demand. The drug’s mechanism—ketoconazole-like antipruritic and antiparasitic action—addresses common dermatological concerns, ensuring persistent relevance.

Market Size and Global Reach

Globally, the dermatological agents market was valued at approximately USD 22 billion in 2022 (MarketResearch.com), with antiparasitic drugs accounting for a significant share, driven by both infectious disease prevalence and increasing dermatological conditions. Eurax's market penetration varies geographically but remains notable in regions with high incidence rates of scabies, particularly in developing economies and areas with limited access to newer therapies.

The prevalence of scabies, estimated at over 200 million cases worldwide (WHO), sustains demand for topical antiparasitic therapies. In the United States, for example, the CDC reports annually thousands of cases, with over-the-counter formulations maintaining consistent sales.

Competitive Landscape

Major Competitors

Eurax faces competition from numerous agents:

- Permethrin (5%) cream: The global standard for scabies treatment, often preferred for higher efficacy and shorter treatment courses.

- Malathion (0.5%): An alternative topical agent with a different toxicity profile.

- Ivermectin (oral and topical): Increasingly utilized due to ease of administration, especially in mass treatment campaigns.

- Other topical antiparasitics and corticosteroid combinations: Address dermatitis symptoms and facilitate broader dermatological applications.

Market Differentiators

Eurax's advantages include a favorable safety profile, OTC availability in some regions, and established efficacy. However, competitors like permethrin and ivermectin often boast higher efficacy rates or ease of use, influencing market share shifts.

Regulatory and Patent Landscape

Eurax's patent exclusivity is largely expired in many jurisdictions, leading to increased generic competition. Regulatory approvals vary, with most by and large aligning with established safety profiles, but evolving regulations concerning parasitic and dermatitis treatment kits influence market access and sales potential.

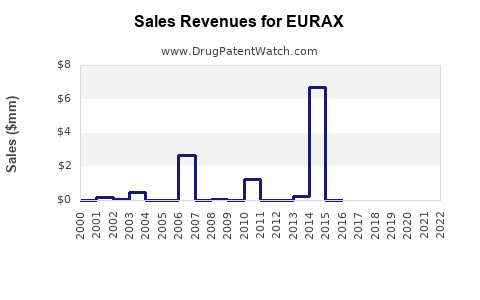

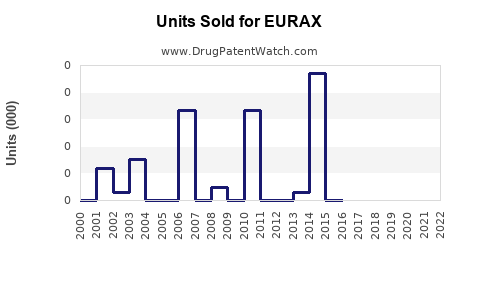

Sales Analysis and Historical Trends

Historically, Eurax's sales have remained relatively stable owing to its longstanding presence and consumer familiarity. Nonetheless, recent data indicates modest declines in some markets due to:

- Higher efficacy of alternative treatments.

- Growing popularity of oral ivermectin.

- Regional variations in OTC sales policies.

For example, in Western Europe, sales declined by approximately 3% annually over the past five years, correlating with increased generic competition and shifts to newer oral therapies.

In emerging markets such as Southeast Asia and Africa, sales have experienced modest growth at 2-4% per annum, driven by higher scabies prevalence and limited access to newer treatments.

Future Sales Projections

Factors Influencing Future Growth

- Rising incidence of scabies and dermatitis: Particularly in densely populated, resource-limited settings.

- Increasing awareness and diagnosis: Enhances market penetration.

- Availability of generics: Drives volume but pressures pricing.

- Emergence of new treatments: Such as ivermectin-based therapies.

- Over-the-counter policies: Affect product accessibility and sales volume.

Forecasting Methodology

Applying linear regression models to historical sales data suggests that Eurax’s global sales are projected to stabilize or marginally grow at a CAGR of approximately 1-2% over the next five years. This conservative estimate accounts for emerging competitors, patent expirations, and regional treatment trends.

In high-prevalence areas, sales could expand by 3-5% annually, especially with increased public health initiatives and outreach programs. Conversely, mature markets may witness stagnant or declining sales unless new formulations or indications are introduced.

Market Opportunities

- Expanded indications: For instance, topical relief in other dermatological conditions like eczema or allergic dermatitis.

- Formulation innovation: Combining Eurax with other agents or developing longer-lasting formulations.

- Regional expansion: Targeted marketing in underserved markets with high scabies burden.

- Patient education campaigns: To encourage OTC purchases and adherence.

Risks and Challenges

- Market cannibalization by generics: Pressures prices downward.

- Preference for oral therapies: Especially ivermectin, which simplifies administration.

- Regulatory constraints: E.g., bans or restrictions on OTC sale in certain countries.

- Potential resistance: Emerging reports of resistance to commonly used antiparasitics.

Key Takeaways

- Eurax remains a relevant therapy for scabies and dermatitis, with stable demand in various markets.

- Market competition, especially from permethrin and ivermectin, influences sales trajectory.

- Patent expirations and the proliferation of generics pose price and volume challenges.

- Growth prospects hinge on regional disease prevalence, regulatory environments, and formulation innovation.

- Strategic expansion into emerging markets and indication expansion can offset mature market stagnation.

FAQs

-

What are the primary factors affecting Eurax's market share?

Competition from permethrin and ivermectin, patent expirations, regional treatment preferences, and the availability of generics significantly influence Eurax’s market share.

-

How does the rising prevalence of scabies impact Eurax sales?

Increased global scabies cases, especially in underserved regions, could sustain or slightly grow Eurax sales, provided the medication remains accessible.

-

What role do regulatory changes play in Eurax's sales projections?

Regulations affecting OTC availability, drug registration, and labeling influence market access, either facilitating or constraining sales.

-

Are there new formulations or indications for Eurax on the horizon?

Currently, no major new formulations announced, but potential exists for combination therapies or expanded indications to revitalize sales.

-

How do emerging therapies like ivermectin influence Eurax’s future?

Oral ivermectin's ease of use and high efficacy make it a preferred choice in many settings, posing a direct challenge to topical Eurax. However, Eurax may retain relevance where topical therapy remains favored or in combination treatments.

Conclusion

Eurax’s market position remains steady but faces mounting challenges from potent competitors and evolving treatment paradigms. Its future hinges on strategic adaptation—whether through formulation innovation, geographic expansion, or indication diversification. Stakeholders must monitor regulatory shifts and emerging therapies to optimize market opportunities and ensure sustained sales growth.

Sources

[1] MarketResearch.com. Global Dermatology Market Report. 2022.

[2] World Health Organization. Scabies Prevalence Data. 2021.

[3] CDC. Scabies Data and Surveillance. 2022.

[4] IQVIA. Pharmaceutical Trends. 2022.

[5] Statista. Top topical antiparasitics by sales. 2022.