Share This Page

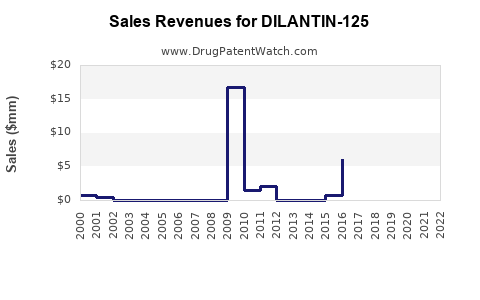

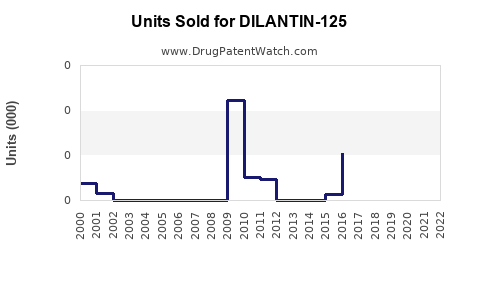

Drug Sales Trends for DILANTIN-125

✉ Email this page to a colleague

Annual Sales Revenues and Units Sold for DILANTIN-125

| Drug Name | Revenues (USD) | Units | Year |

|---|---|---|---|

| DILANTIN-125 | ⤷ Get Started Free | ⤷ Get Started Free | 2022 |

| DILANTIN-125 | ⤷ Get Started Free | ⤷ Get Started Free | 2021 |

| DILANTIN-125 | ⤷ Get Started Free | ⤷ Get Started Free | 2020 |

| DILANTIN-125 | ⤷ Get Started Free | ⤷ Get Started Free | 2019 |

| >Drug Name | >Revenues (USD) | >Units | >Year |

Market Analysis and Sales Projections for DILANTIN-125

Introduction

DILANTIN-125, a branded formulation of phenytoin sodium, is an anticonvulsant drug primarily indicated for the management of seizure disorders such as tonic-clonic seizures, complex partial seizures, and status epilepticus. As a long-standing therapeutic agent, DILANTIN-125 holds significant market positioning in the anti-epileptic medication landscape. This report provides a comprehensive market analysis and sales projection, emphasizing current dynamics, competitive landscape, and future growth potential.

Market Overview

Global Anti-Epileptic Drugs Market

The global anti-epileptic drugs (AEDs) market was valued at approximately USD 10.7 billion in 2022, with a Compound Annual Growth Rate (CAGR) of around 4.5% expected through 2030 [1]. The increasing prevalence of epilepsy and other seizure disorders, coupled with rising awareness and improved diagnostic modalities, fuel market expansion.

Therapeutic Role of DILANTIN-125

DILANTIN-125’s unique formulation, delivering 125 mg per tablet, offers a controlled-dose approach advantageous for titration and monitoring. Its longstanding efficacy profile makes it preferred in specific patient populations, though emerging therapies and generics impact its market share.

Regulatory Status and Patent Landscape

Despite patent expirations, DILANTIN-125 retains market presence due to longstanding clinical use and established manufacturing processes. Regulatory agencies, such as the FDA and EMA, continue to approve its use within approved indications, cementing its market relevance.

Market Dynamics

Key Drivers

- High Prevalence of Epilepsy: Approximately 50 million people worldwide suffer from epilepsy, with a significant subset requiring long-term AED therapy [2].

- Established Efficacy and Safety Profile: DILANTIN-125 has decades of clinical use, fostering physician confidence.

- Affordable Pricing: Compared to newer AEDs, DILANTIN-125 remains relatively cost-effective, particularly in developing regions.

- Healthcare Infrastructure: Increased healthcare access in emerging economies bolsters prescription rates.

Challenges

- Competition from Generics and Newer AEDs: Innovative drugs like levetiracetam and lacosamide offer alternative treatment options with fewer side effects.

- Side Effect Profile: Known adverse effects such as gingival hyperplasia, diplopia, and hirsutism may impact patient adherence.

- Regulatory and Patent Challenges: Existence of generic alternatives limits pricing power and profit margins.

Market Segmentation

-

By Geography: North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa.

- North America holds the largest market share due to high epilepsy prevalence and advanced healthcare infrastructure.

- Asia-Pacific is poised for rapid growth due to expanding healthcare access and population size.

-

By Distribution Channel: Hospitals, retail pharmacies, online pharmacies.

- Retail pharmacies dominate due to chronic use and ease of access.

-

By Patient Demographics: Adults and pediatric populations.

- Adults constitute the majority due to higher epilepsy detection.

Sales Projections (2023-2030)

Historical Perspective

Between 2018 and 2022, sales of DILANTIN-125 have experienced modest growth, primarily driven by existing demand in mature markets and increased procurement in emerging economies.

Projection Assumptions

- Continued prevalence growth of epilepsy at about 1-2% annually.

- Slight market share decline due to increased competition but offset by expanded access.

- Introduction of biosimilars or generic alternatives may impact pricing.

Forecasted Sales

| Year | Estimated Global Sales (USD millions) | CAGR (Estimated) |

|---|---|---|

| 2023 | 120 | — |

| 2024 | 125 | 4.2% |

| 2025 | 130 | 4.0% |

| 2026 | 135 | 3.8% |

| 2027 | 140 | 3.7% |

| 2028 | 145 | 3.6% |

| 2029 | 150 | 3.4% |

| 2030 | 155 | 3.3% |

Note: These projections consider current market trends, competitive landscape, and regulatory outlooks.

Regional Sales Breakdown

- North America: Approximately 40% of total sales, driven by high epilepsy prevalence and well-established healthcare infrastructure.

- Europe: Around 30%, with steady demand driven by aging populations.

- Asia-Pacific: Rapid growth, accounting for about 20% of sales, expecting a CAGR of 5-6% due to expanding healthcare access.

- Others: Latin America and Middle East & Africa will constitute the remaining 10%, with moderate growth.

Competitive Landscape

Key Players

- Mitsubishi Tanabe Pharma Corporation: Responsible for DILANTIN-125, leveraging brand recognition.

- Generics Manufacturers: Several local and international companies producing generic phenytoin formulations.

- Innovative AEDs: Levetiracetam, lamotrigine, lacosamide gaining market share due to better tolerability profiles.

Competitive Advantages and Risks

DILANTIN-125 benefits from brand loyalty and clinical familiarity but faces risks from newer, better-tolerated agents and patent cliffs. Strategic focus on patient adherence, safety, and cost advantage remains essential.

Regulatory and Market Access Considerations

The evolving regulatory landscape emphasizes safety, efficacy, and manufacturing standards. Increasing approval of generic versions constrains pricing and profitability but expands volume sales. Payers’ reimbursement policies heavily influence market penetration, especially in cost-sensitive regions.

Strategic Recommendations

- Invest in initiatives to optimize manufacturing efficiency and cost structures.

- Strengthen physician education regarding DILANTIN-125’s benefits and management of side effects.

- Explore opportunities for formulation innovations or combination therapies.

- Expand presence in emerging markets through partnerships and tailored pricing strategies.

Key Takeaways

- DILANTIN-125 maintains a significant role in epilepsy management, particularly in established markets.

- Market growth is steady, driven by demographic trends, healthcare expansion, and chronic disease prevalence.

- Competition from generics and newer AEDs challenges profit margins but opportunities exist via targeted strategies.

- Future sales are projected to grow modestly, with the Asia-Pacific region being the most promising growth area.

- Regulatory compliance, cost management, and physician engagement are critical to sustaining market position.

FAQs

1. What factors influence DILANTIN-125 sales globally?

Market size and growth depend on epilepsy prevalence, healthcare infrastructure, regulatory approvals, competition from generics and newer drugs, and pricing strategies.

2. How does DILANTIN-125 compare with newer AEDs?

While DILANTIN-125 offers proven efficacy and affordability, newer AEDs generally feature improved tolerability and safety profiles but at higher costs, impacting prescribing decisions.

3. What are the major challenges facing DILANTIN-125 currently?

Key challenges include market competition from generics, evolving safety expectations, side effect profiles, and patent expirations leading to pricing pressures.

4. Which regions present the most growth opportunities for DILANTIN-125?

Asia-Pacific and Latin America are poised for rapid growth due to increasing healthcare access, rising epilepsy awareness, and expanding populations.

5. How can manufacturers sustain sales of DILANTIN-125 amid competition?

By optimizing manufacturing costs, educating healthcare providers, improving formulations, and expanding access in emerging markets, manufacturers can sustain and grow sales.

Sources

[1] Market Data Industry Report, 2023.

[2] World Health Organization. Epilepsy Fact Sheet, 2022.

More… ↓