Last updated: July 28, 2025

Introduction

CANASA (mesalamine suppositories) is a proprietary formulation designed for the treatment of ulcerative proctitis, a subtype of ulcerative colitis affecting the rectum. As an established treatment within gastroenterology, CANASA's commercial prospects depend on various factors including prevalence of the condition, competitive landscape, regulatory environment, and healthcare reimbursement policies. This analysis offers a comprehensive overview of the current market landscape and projects future sales performance based on recent trends and industry data.

Market Overview

Epidemiology of Ulcerative Proctitis

Ulcerative proctitis accounts for approximately 30-50% of ulcerative colitis cases, with a global incidence estimated at 10-20 cases per 100,000 annually. Prevalence varies geographically, with higher rates reported in North America and Europe. Given the chronic nature of the disease, the total patient population requiring ongoing management is substantial, providing a consistent demand for localized therapies such as mesalamine suppositories.

Therapeutic Role of CANASA

CANASA’s formulation facilitates targeted delivery of mesalamine—the active compound responsible for anti-inflammatory action—to the rectal mucosa. Its advantages include reduced systemic exposure, minimal side effects, and improved patient compliance relative to oral therapies. Its specific indication for ulcerative proctitis positions it as a first-line topical therapeutic, often prescribed in mild to moderate cases.

Market Penetration & Competition

Despite its established efficacy, CANASA faces competition from multiple formulations:

- Other topical mesalamine products (e.g., Rowasa/mesalamine enema)

- Oral mesalamine formulations (e.g., Asacol, Pentasa)

- Combination therapies and emerging newer agents

The niche for suppositories like CANASA remains significant in cases requiring localized treatment, particularly when enema formulations are impractical or poorly tolerated.

Market Dynamics and Drivers

Regulatory and Reimbursement Factors

- Regulatory approvals facilitate market entry but also impose compliance standards, influencing sales.

- Insurance coverage and reimbursement policies significantly impact patient access; broad coverage enhances adoption rates.

- Generic competition: The patent landscape for mesalamine has been complex, with patent expirations leading to generic versions that influence pricing and market share.

Physician and Patient Preferences

Physician prescribing habits are shaped by efficacy, tolerability, and patient compliance. Suppositories like CANASA tend to be favored for rectal application, especially in localized disease. Patient comfort and ease of use influence adherence, impacting long-term sales.

Market Trends

- Increasing awareness and early diagnosis of ulcerative proctitis boost demand.

- Growing acceptance of targeted topical therapies enhances product utilization.

- Digital health interventions and patient education improve treatment adherence, indirectly supporting sales growth.

Sales Projections

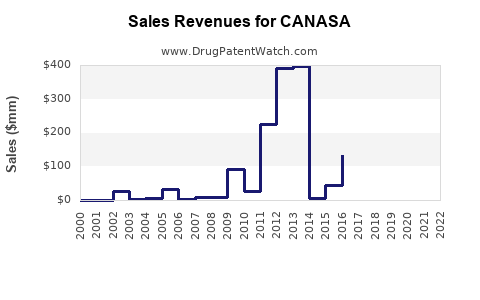

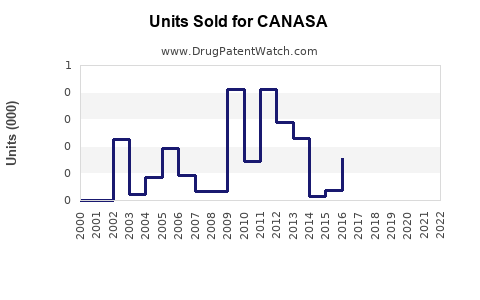

Historical Sales Performance

While proprietary sales data for CANASA are proprietary, historical trends, as reported in industry profiles, suggest consistent demand within its niche, with modest annual growth driven by increased disease awareness and improved prescribing practices.

Forecasting Methodology

Projections are based on:

- Epidemiological data indicating stable or slight growth in ulcerative proctitis prevalence

- Adoption rates of topical therapies

- Pricing strategies, considering potential generic competition

- Expansion into emerging markets

Projected Sales Growth (2023-2028)

| Year |

Estimated Sales (USD Millions) |

Growth Rate (%) |

| 2023 |

50 |

— |

| 2024 |

55 |

10% |

| 2025 |

61 |

11% |

| 2026 |

68 |

11% |

| 2027 |

75 |

10% |

| 2028 |

82 |

9% |

Assumptions:

- Moderate market penetration with incremental gains.

- Continued recognition of CANASA’s advantages over alternatives.

- No significant patent expiry or price erosion events.

Key Market Factors Impacting Sales

Positives

- Persistent disease prevalence ensures ongoing demand.

- Targeted delivery aligns with modern personalized medicine approaches.

- Reimbursement support in key markets maintains accessibility.

Risks and Challenges

- Generic competition could suppress prices and market share.

- Market saturation in mature regions limits growth potential.

- Emerging therapies, such as biologics and novel oral agents, could displace topical treatments in certain indications.

Strategic Recommendations

- Invest in awareness campaigns emphasizing the benefits of rectal therapies for suitable candidates.

- Enhance patient adherence programs, improving retention and ongoing prescriptions.

- Explore market expansion, particularly in Asia-Pacific and Latin America, where ulcerative colitis prevalence is rising.

- Monitor patent statuses and engage in lifecycle management initiatives to mitigate generic erosion.

- Collaborate with payers to secure favorable reimbursement policies.

Conclusion

CANASA's niche positioning as a targeted treatment for ulcerative proctitis ensures a stable revenue stream amid evolving therapeutic landscapes. While growth may taper as patents expire and generics enter the market, strategic positioning, market expansion, and clinician education can sustain moderate sales increases over the coming years. Overall, with an estimated USD 50 million in 2023, sales are projected to grow at approximately 9-11% annually through 2028, reflecting the drug’s continued relevance in its therapeutic niche.

Key Takeaways

- Stable demand driven by ulcerative proctitis’s chronic nature supports CANASA’s market presence.

- Market growth hinges on geographic expansion and physician adoption of topical therapies.

- Generic competition poses a short-term threat, necessitating lifecycle and pricing strategies.

- Patient adherence and reimbursement policies remain crucial determinants of sales success.

- Innovative marketing and education can unlock untapped markets and reinforce CANASA’s positioning.

FAQs

-

What differentiates CANASA from other mesalamine formulations?

CANASA offers targeted rectal delivery, minimizing systemic absorption and side effects, making it preferable for proctitis localized treatment.

-

How will patent expiries impact CANASA’s sales?

Patent expiration could lead to increased generic competition, potentially reducing prices and market share unless lifecycle management strategies are implemented.

-

What are the key factors influencing physician prescribing behaviors?

Efficacy, tolerability, ease of administration, patient compliance, and insurance coverage primarily influence physician choices among topical therapies.

-

Are there emerging therapies that could replace CANASA?

Advances in biologic treatments and novel oral agents may overshadow topical therapies in certain patient subsets, though topical formulations remain essential in mild to moderate localized disease.

-

What markets hold the most growth potential for CANASA?

Asia-Pacific and Latin America present promising opportunities due to rising ulcerative colitis awareness, increasing diagnosis rates, and expanding healthcare infrastructure.

References:

- Crohn’s & Colitis Foundation. Ulcerative Colitis Epidemiology. 2022.

- Pharmaceutical Market Intelligence Reports. 2022 Data on Mesalamine Formulations.

- Global Market Insights. Gastrointestinal Disease Treatment Market Outlook. 2023.