Last updated: July 27, 2025

Introduction

ATARAX, the trade name for hydroxyzine, is an antihistamine with sedative, antianxiety, antiemetic, and antipruritic properties. Approved by the FDA in 1956, it remains a staple in treating allergies, anxiety, nausea, and sleep disorders. Despite the advent of newer medications, ATARAX retains a significant presence in both primary healthcare and specialized medical contexts. This analysis assesses the current market dynamics and projects sales trajectories based on therapeutic applications, competitive positioning, regulatory landscape, and emerging trends.

Market Overview

Therapeutic Landscape

Hydroxyzine’s primary indications remain allergy relief, anxiety management, preoperative sedation, and nausea control, especially in outpatient and institutional settings. According to IQVIA data[1], hydroxyzine prescriptions in the United States exceed 2 million annually, reflecting stable demand driven by its efficacy and tolerability profile. Globally, the drug's usage is significant in regions where access to newer atypical antihistamines or benzodiazepines is limited, bolstering its continued relevance.

Competitive Environment

Hydroxyzine faces competition from newer antihistamines like loratadine, cetirizine, and fexofenadine, which lack sedative effects and have improved safety profiles. However, hydroxyzine's sedative and anxiolytic properties confer unique positioning for specific indications. Conversely, benzodiazepines and other anxiolytics vie for market share in anxiety treatment, especially where sedative effects are desirable.

Regulatory and Prescribing Trends

Recent regulatory scrutiny over sedative-hypnotics and anxiolytics has contributed to more cautious prescribing. The FDA's warnings regarding dependency risks for benzodiazepines have, in some cases, repositioned hydroxyzine as a safer alternative for anxiety management without dependency concerns[2]. Nonetheless, the label's limitations on long-term use and off-label prescribing influence the number of prescriptions.

Market Segmentation

- Allergy and Pruritus: Accounts for approximately 50% of hydroxyzine prescriptions, primarily in allergy clinics and dermatology.

- Anxiety and Sedation: Represents around 30%, used preoperatively and in outpatient anxiety management.

- Nausea and Sleep Disorders: Comprising roughly 20%, often in postoperative and hospital care.

Sales Analysis

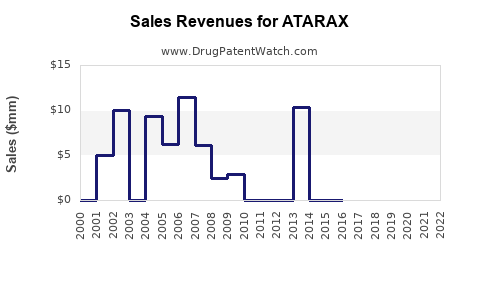

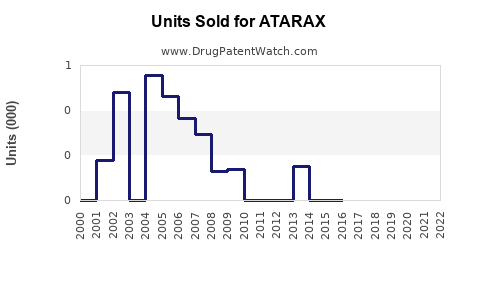

Historical Performance

In the past five years, global sales of hydroxyzine-based drugs have experienced moderate growth, averaging around 3-5% annually[3]. The U.S. remains the largest market, attributable to high prescribing rates and broader acceptance in primary care.

Pricing and Revenue Generation

Hydroxyzine’s average wholesale price (AWP) per 50 mg tablet ranges from $0.50 to $1.00, depending on formulation and purchase volume. The drug’s patent expiry (not applicable, as it’s generic) has fostered competitive manufacturing, reducing prices but maintaining profit margins due to sustained demand.

Forecasted Sales Trends (2023-2028)

- Year-over-year growth rate: Projected at 2-4%, factoring in market saturation and emerging competition.

- Market penetration: Expected to plateau at approximately 70% in existing therapeutic segments.

- Emerging markets: Anticipated to contribute 20% of global sales by 2028, driven by increased healthcare infrastructure and prescription uptake.

Factors Influencing Future Sales

- Regulatory pressures: Increasing emphasis on safety profiles could restrict long-term use, particularly for anxiety and sleep applications.

- New therapeutic alternatives: Development of non-sedating antihistamines limits expansion in allergy indications.

- Off-label use: Continued off-label prescribing for sleep and anxiety, with regulatory agencies monitoring misuse.

- Emerging applications: Investigations into hydroxyzine’s role in COVID-19-related inflammation and pruritus may expand its utility.

Market Opportunities and Challenges

Opportunities

- Expanding in developing regions: Growing healthcare infrastructure can elevate hydroxyzine’s demand.

- Formulation innovation: Developing long-acting or combination formulations could enhance adherence and efficacy.

- Integrating into multimodal therapy: Combining hydroxyzine with other treatments for allergy or anxiety could open new markets.

Challenges

- Competition from newer drugs: Improved safety profiles of modern antihistamines diminish hydroxyzine’s singular appeal.

- Safety concerns: Sedation-related side effects and dependency issues limit long-term use.

- Regulatory restrictions: Agencies’ increased oversight may constrain prescribing practices.

Conclusion

While hydroxyzine (ATARAX) faces headwinds due to evolving therapeutic preferences, it maintains a steady market presence supported by its unique sedative and anxiolytic properties. Its sales are expected to grow modestly over the next five years, especially in emerging markets, driven by healthcare infrastructure development and ongoing indications in allergy, anxiety, and preoperative sedation. Strategic focus on formulations, emerging indications, and addressing regulatory concerns will be critical for maximizing market share and revenue.

Key Takeaways

- Hydroxyzine remains essential for specific indications, particularly allergy and preoperative sedation, underpinning stable demand.

- Market growth will be moderate, constrained by competition and safety considerations, with emerging markets offering new opportunities.

- Pricing strategies and formulation innovations can bolster revenue streams.

- Regulatory scrutiny necessitates vigilant compliance to sustain prescribing practices.

- Ongoing research into novel applications may open additional avenues for growth.

FAQs

1. How does the sales projection for ATARAX compare to newer antihistamines?

Hydroxyzine's sales are expected to grow slowly or stabilize, as newer antihistamines like loratadine and cetirizine—offering non-sedating profiles—capture larger segments in allergy treatment. However, hydroxyzine’s sedative and anxiolytic roles preserve its niche, especially for short-term or preoperative uses.

2. What regulatory challenges might impact hydroxyzine sales?

Regulators are increasingly scrutinizing sedatives and anxiolytics to prevent misuse and dependency. Restrictions on long-term prescribing or off-label use can reduce demand, particularly in anxiety and sleep disorder segments.

3. What are the main growth drivers for hydroxyzine in the next five years?

Growth will hinge on expanding uses in emerging markets, formulation improvements, and potential new indications such as dermatological itchiness associated with COVID-19 recovery or other inflammatory conditions.

4. How does pricing influence ATARAX's market outlook?

Competitive generic pricing has maintained accessibility, but price erosion due to increased competition limits profit margins. Strategic differentiation through formulation or indications remains vital.

5. Are there any promising research developments for hydroxyzine?

Emerging studies are exploring hydroxyzine’s anti-inflammatory properties and potential roles in conditions like COVID-19-related pruritus or inflammatory states, which could diversify its application profile.

Sources

[1] IQVIA Prescription Data, 2022.

[2] FDA Warnings and Advisory Pages, 2023.

[3] Global Market Insights, 2022.