Last updated: July 28, 2025

Introduction

ACULAR, a widely used ophthalmic non-steroidal anti-inflammatory drug (NSAID), primarily contains ketorolac tromethamine. Approved by the FDA in 1989, ACULAR is widely prescribed postoperatively and for conditions like allergic conjunctivitis. With its established efficacy, safety profile, and broad clinical utility, ACULAR continues to occupy a significant position within the ophthalmic therapeutics market. This analysis explores current market dynamics, competitive landscape, regulatory factors, and innovative developments influencing ACULAR’s future sales trajectory.

Market Overview

Global Ophthalmic Drug Market Dynamics

The global ophthalmic drug market has experienced consistent growth, estimated at a Compound Annual Growth Rate (CAGR) of approximately 4-5% over the past five years. Driven by increasing prevalence of ocular diseases such as glaucoma, allergic conjunctivitis, dry eye syndrome, and age-related macular degeneration, the sector's expansion underscores the vital role of anti-inflammatory agents like ACULAR.[1]

Emerging markets exhibit accelerated growth fueled by rising healthcare expenditure, improved diagnostic capabilities, and heightened awareness of ophthalmic conditions. Additionally, advancements introducing formulations with enhanced bioavailability and reduced side effects bolster market offerings.

Indications and Usage Patterns of ACULAR

ACULAR's primary indications encompass:

- Postoperative inflammation management, particularly following cataract surgery.

- Treatment of allergic conjunctivitis and ocular surface inflammation.

- Management of pain associated with ocular procedures.

The drug's widespread utilization in ophthalmic surgeries and allergy treatment consolidates its position as a first-line NSAID therapy.

Key Market Drivers

- Aging Population: The global demographic shift towards an older population amplifies age-related ocular disease cases, increasing demand for anti-inflammatory medications.

- Technological Advancements: Improved drug formulations enhance patient compliance and treatment efficacy.

- Expanding Surgical Interventions: Rising numbers of cataract surgeries globally lead to increased ACULAR prescriptions.

- Regulatory Approvals & Label Expansions: Ongoing clinical trials and approvals broaden ACULAR’s indicated uses, fostering growth.

Market Challenges

- Availability of Alternatives: The emergence of generic NSAIDs and corticosteroids presents competitive pressure.

- Safety Concerns: NSAID-associated risks, such as corneal adverse effects, necessitate cautious prescription practices.

- Pricing Pressures: Payer restrictions and cost-containment strategies impact profitability.

Competitive Landscape

Key Players

- Allergan (AbbVie): Historically dominant, offering ACULAR in varied formulations.

- Santen Pharmaceutical Co., Ltd.: Provides an alternative ophthalmic NSAID, bromfenac.

- Bausch + Lomb: Offers ophthalmic anti-inflammatory and allergy treatments, applicable as substitutes.

- Generics manufacturers: Increasing market penetration with cost-effective options.

Product Differentiation

ACULAR’s advantages include proven safety, established efficacy, and familiarity among ophthalmic surgeons. Innovations such as the preservative-free formulation (e.g., ACULAR LS) have enhanced tolerability, expanding its user base.

Patent and Regulatory Status

While the original patents for ketorolac have expired, formulations like ACULAR LS benefit from product-specific patents and exclusivities, delaying generic entry. Regulatory approvals further reinforce market positioning.

Regulatory and Patent Considerations

Patent Expiry and Patent Expiration Impact

The expiration of original patents opens up opportunities for generic competitors, potentially reducing ACULAR’s market share and pricing but also encouraging pipeline development of improved formulations.

Regulatory Developments

Recent approvals targeting new indications or formulations could catalyze sales, provided they are supported by robust clinical evidence. Regulatory hurdles around safety, especially related to ocular side effects, remain critical.

Sales Outlook and Projections

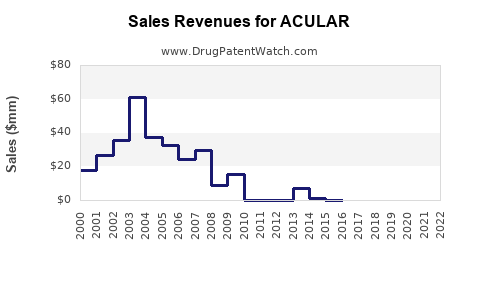

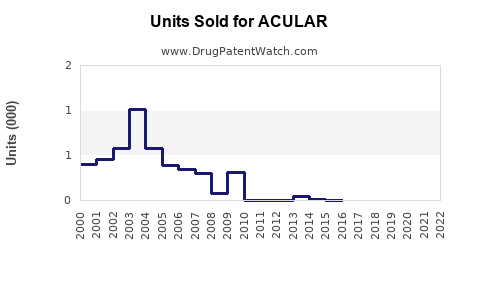

Current Sales Performance

While precise revenue figures vary by region, ACULAR’s global sales have historically ranged in the hundreds of millions annually. The drug’s performance remains resilient owing to its clinical utility, despite generic competition.

Future Sales Forecast (2023–2028)

Assuming steady market growth (~4-5% CAGR), patent protections for innovative formulations, and expanding indications, ACULAR’s sales are projected to grow modestly:

- Baseline Scenario: USD 250–300 million/year globally.

- Optimistic Scenario: Introduction of new formulations, expanded indications, and entry into emerging markets could elevate revenues up to USD 350 million annually by 2028.

- Risks: Market saturation, generic competition, safety concerns, and reimbursement policies could temper growth.

Key factors influencing projections:

- Increasing cataract surgeries worldwide.

- Approval of new uses, such as in ocular pain management.

- Launch of preservative-free formulations.

- Market penetration in developing regions.

Emerging Trends and Innovation Opportunities

- Formulation improvements: Preservative-free, sustained-release gels, or ocular inserts could enhance adherence and safety.

- Expanded indications: Investigating ACULAR's efficacy in newer inflammatory or ocular pain pathways may unlock additional markets.

- Digital health integration: Teleophthalmology and remote monitoring support personalized treatment and adherence.

Strategic Recommendations

- Invest in formulation innovation to differentiate from generics.

- Engage in clinical research to expand approved indications.

- Focus on emerging markets where ophthalmic procedures are increasing.

- Strengthen relationships with ophthalmic surgeons via educational initiatives and clinical support.

- Monitor regulatory developments to adapt swiftly to patent modifications and approvals.

Key Takeaways

- ACULAR remains a cornerstone NSAID in ophthalmology, with strong clinical efficacy and broad usage.

- Market growth is driven by demographic trends, surgical volume increases, and formulation innovations.

- Patent expiries pose challenges but also create opportunities for line extensions and new formulations.

- Competitive pressures from generics necessitate strategic differentiation, especially through product improvements.

- Expanding into emerging markets and securing new indications will be pivotal for sustained sales growth.

Conclusion

ACULAR's enduring market presence reflects its clinical utility and established safety profile. While patent expirations and generic competition temper near-term growth, strategic investments in formulation innovation, expanding indications, and market penetration can sustain and potentially boost sales over the coming years. Stakeholders must navigate evolving regulatory landscapes and emerging competitors carefully to maximize ACULAR’s market potential.

FAQs

1. What are the primary factors influencing ACULAR’s sales growth in the coming years?

The primary drivers include increasing volume of ophthalmic surgeries (notably cataract procedures), development of new formulations like preservative-free options, expansion into emerging markets, and approval of additional indications such as ocular pain management.

2. How does patent expiration affect ACULAR's market share?

Patent expiration facilitates generic entry, increasing competition and likely reducing prices. To sustain market share, manufacturers must innovate through new formulations, improved safety, and broader indications.

3. Are there any safety concerns associated with ACULAR that impact its marketability?

Yes, NSAIDs like ketorolac carry risks such as corneal adverse effects and delayed epithelial healing. These safety considerations necessitate cautious prescribing and ongoing clinical monitoring but have not significantly diminished overall utilization due to their manageable risk profile.

4. What strategic opportunities exist to enhance ACULAR’s market position?

Key opportunities include developing preservative-free and sustained-release formulations, pursuing approvals for additional indications, and expanding sales efforts in emerging markets with increasing ophthalmic procedural volumes.

5. How significant is the impact of generic competition on ACULAR’s revenues?

The impact is substantial, as generics typically offer lower prices and higher market penetration. However, proprietary formulations and new indications can mitigate this effect, preserving revenue streams.

Sources:

[1] MarketResearch.com. Global Ophthalmic Drugs Market Insights. 2022.