Last updated: July 27, 2025

Introduction

Methimazole, marketed under brand names such as Tapazole, is a widely prescribed antithyroid medication primarily used to treat hyperthyroidism, notably Graves’ disease. Its role as a first-line therapy for managing overactive thyroid conditions has positioned it as a critical drug within both endocrinology and general practice. Understanding the market dynamics for methimazole involves examining its current therapeutic landscape, demand drivers, competitive environment, and future sales trends.

Market Overview

The global endocrine disorder therapeutics market is expanding, largely driven by the rising prevalence of thyroid diseases. According to the World Health Organization (WHO), approximately 2-3% of the population globally suffer from hyperthyroidism, with higher incidences reported among women and older adults [1]. Methimazole forms a core component of hyperthyroidism's pharmacological management due to its efficacy, safety profile, and cost-effectiveness compared to alternatives like propylthiouracil (PTU).

The drug's widespread use extends across numerous healthcare settings, including outpatient clinics, endocrinology centers, and hospital wards. The management of hyperthyroidism not only involves controlling symptoms but also requires long-term medication adherence, fostering consistent demand for methimazole.

Market Drivers

-

Prevalence of Thyroid Disorders: An increasing understanding and diagnosis of hyperthyroidism are fueling demand. Notably, aging populations and rising autoimmunity incidence further expand market size.

-

Efficacy and Safety Profile: Methimazole's favorable safety profile, especially when compared to PTU (which has a higher risk of hepatotoxicity), sustains its preference among clinicians, especially in long-term management.

-

Cost-Effectiveness: As a generic medication, methimazole remains affordable, enabling widespread access across developed and developing nations.

-

Growing Endocrinology Specialization: Increasing awareness and specialization in endocrine disorders are resulting in more prescriptions, especially in emerging markets.

-

Regulatory Approvals and Insurance Coverage: Seamless regulatory pathways and reimbursements in key markets such as the U.S., Europe, and Asia bolster its market stability.

Market Challenges

-

Safety Concerns: Rare but serious adverse effects like agranulocytosis necessitate ongoing monitoring, which could impact prescribing patterns.

-

Availability of Alternatives: The presence of other antithyroid agents and definitive treatments (radioiodine therapy, thyroidectomy) influence market share.

-

Generic Competition: As a generic drug, methimazole's market share is sensitive to pricing strategies and patent expirations.

Regional Market Analysis

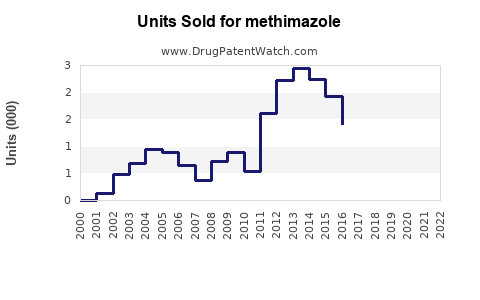

North America: The U.S. dominates this region, owing to high diagnosis rates, advanced healthcare infrastructure, and insurance coverage. The prevalence of hyperthyroidism (~1.2% of the U.S. population) ensures consistent demand. According to IMS Health (now IQVIA), prescriptions for methimazole have shown steady growth, with an annual increase around 4-5% over the past five years.

Europe: Similar trends are observed with high awareness and established treatment protocols. Countries like Germany, the UK, and France report rising usage, propelled by aging demographics.

Asia-Pacific: The fastest-growing market due to increasing diagnosis, urbanization, and healthcare expenditure. China's hyperthyroidism prevalence reaches up to 3.2% among women, emphasizing significant growth potential.

Latin America & Africa: Emerging markets with expanding access to healthcare and growing prevalence rates, though market penetration remains variable.

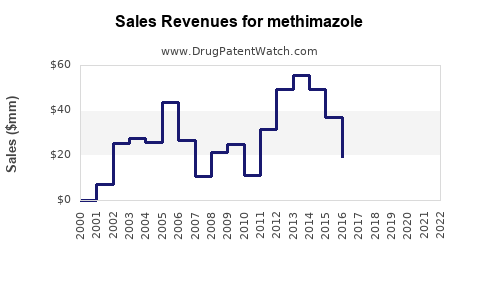

Future Sales Projections

Based on current trends, global sales for methimazole are projected to grow at a compound annual growth rate (CAGR) of approximately 5-7% over the next five years. This projection factors in:

- Continued increase in thyroid disorder diagnosis.

- Expansion in healthcare access in emerging markets.

- Favorable prescribing preferences toward methimazole over alternatives.

- Generic manufacturing and price competition maintaining affordability.

Projected figures:

- 2023: An estimated global sales of around $300 million.

- 2028: Expected to reach approximately $450–$500 million.

Growth may be tempered by advancements in alternative therapies or shifts towards definitive treatments, though the current long-term management paradigm maintains steady demand.

Competitive Landscape

While methimazole remains the dominant pharmacological option for hyperthyroidism, its market shares are influenced by:

- Generic Manufacturers: Multiple companies produce methimazole, fostering price competition.

- Patent Status: As off-patent, generic options are prevalent, reducing barriers to market entry.

- Alternate Therapies: Radioactive iodine and surgical interventions sometimes supersede medication, especially in refractory cases.

Emerging formulations or combination therapies could alter competitive dynamics, but currently, methimazole’s affordability and efficacy secure its market position.

Regulatory and Economic Factors

Regulatory bodies such as the FDA and EMA have strict guidelines for manufacturing and quality assurance, affecting supply chains and pricing. Reimbursement policies influence prescribing behaviors, especially in markets with nationalized healthcare systems.

Economic factors like currency fluctuations and procurement policies in emerging markets directly impact sales volumes and profitability.

Key Trends to Watch

- Personalized Medicine: Genetic markers influencing hyperthyroidism management could redefine the drug’s usage.

- New Formulations: Extended-release or combination drugs may diversify the product portfolio.

- Technological Advances: Improved diagnostic protocols may lead to early intervention, increasing long-term medication adherence.

Key Takeaways

- Robust Demand: Methimazole’s position as a first-line therapy for hyperthyroidism ensures consistent global demand, especially as thyroid disorder awareness increases.

- Growth Potential: The outlook remains positive with an estimated CAGR of 5-7%, driven by demographic shifts and expanding healthcare access.

- Market Expansion: Emerging markets within Asia and Latin America present significant growth opportunities due to rising prevalence and healthcare investments.

- Competitive Dynamics: Price competition among generics and alternative treatments could influence market share, though the drug’s safety profile sustains its relevance.

- Regulatory Environment: Navigating regional approval processes and reimbursement frameworks is critical to maximizing sales.

Conclusion

Methimazole maintains a vital role in the management of hyperthyroidism, with a stable and growing market outlook. Its cost-effectiveness, efficacy, and widespread acceptance across healthcare systems underpin its continued sales momentum. Manufacturers and investors should monitor emerging therapeutic innovations, regional market developments, and regulatory changes to capitalize on future growth opportunities.

FAQs

1. What is the primary therapeutic use of methimazole?

Methimazole is used to treat hyperthyroidism, particularly Graves’ disease, by inhibiting thyroid hormone synthesis.

2. How does the market for methimazole compare to other antithyroid drugs?

Methimazole is preferred over propylthiouracil (PTU) in many cases due to a better safety profile and efficacy, leading to higher prescription volumes globally.

3. What are the main factors influencing future sales of methimazole?

Prevalence of thyroid disorders, demographic shifts, healthcare access, availability of alternatives, and regulatory policies are key factors.

4. Are there emerging therapies that could impact methimazole sales?

Yes, advances in radioiodine therapy, surgical techniques, and potential novel pharmacological agents could influence future demand.

5. How does the patent status affect methimazole market dynamics?

Being off-patent facilitates widespread generic manufacturing, fostering price competition but also stabilizing market demand due to affordability.

References

- World Health Organization. (2021). Thyroid Disorders: Global Burden and Management.

- IQVIA. (2022). Global Prescription Trends in Endocrinology.

- American Thyroid Association. (2020). Treatment Guidelines for Hyperthyroidism.

- MarketWatch. (2023). Endocrinology Drugs Market Report.

- European Medicines Agency. (2022). Methimazole Summary of Product Characteristics.