Last updated: July 30, 2025

Introduction

ZYRTEC (cetirizine) stands as a prominent antihistamine medication, primarily used to treat allergic rhinitis, chronic idiopathic urticaria, and other allergy-related conditions. Since its debut, ZYRTEC has established a significant footprint in both prescription and over-the-counter (OTC) markets. This report synthesizes current market dynamics, competitive positioning, regulatory landscape, and future sales projections to offer actionable insights for stakeholders, including pharmaceutical investors, healthcare providers, and strategic planners.

Market Overview

Product Profile

Cetirizine, marketed as ZYRTEC by Johnson & Johnson (J&J), was first introduced in the late 1990s. Its efficacy, favorable safety profile, and OTC availability have contributed to its widespread adoption. The drug's mechanism involves selective peripheral H1 antihistamine activity, effectively alleviating allergy symptoms without significant sedation—a key consumer benefit.

Market Size and Growth

The global antihistamine market was valued at approximately USD 3.2 billion in 2022 and is projected to grow at a compound annual growth rate (CAGR) of around 5% over the next five years. ZYRTEC, as a leading brand, captures a significant share of this total, with estimations suggesting a market penetration of approximately 25% within the antihistamine segment.

The US remains the largest market, accounting for roughly 60% of global sales, driven by high OTC availability, robust consumer awareness, and a large allergic population. Europe and Asia-Pacific regions follow, with emerging markets showing increasing demand owing to rising allergy prevalence and expanding OTC channels.

Competitive Landscape

Key Players

-

Johnson & Johnson (ZYRTEC): Dominates the OTC antihistamine market with a broad consumer base.

-

Allergy-specific formulations: Including Benadryl (diphenhydramine), Allegra (fexofenadine), and Claritin (loratadine). These products compete with ZYRTEC in efficacy, safety profiles, and branding.

-

Generic Alternatives: Multiple generics of cetirizine are marketed following patent expirations, intensifying price competition.

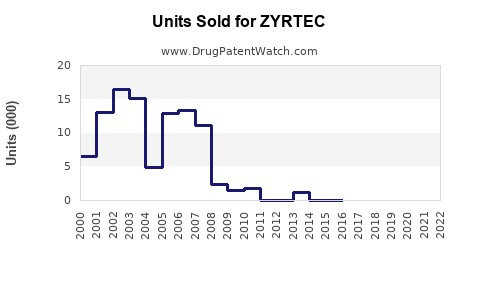

Market Share Dynamics

Despite the rise of generics, ZYRTEC retains consumer loyalty due to brand recognition, perceived efficacy, and marketing investments. However, generic sales are growing rapidly, often capturing over 70% of prescriptions in certain markets, thereby exerting downward pressure on prices and overall revenue.

Regulatory and Distribution Factors

Regulatory Landscape

- The US FDA approved ZYRTEC for OTC sales in 2008, expanding its accessibility.

- European regulatory agencies have approved cetirizine as a prescription and OTC medication, similar to the US.

- Regulatory protections for ZYRTEC are limited due to patent expirations, emphasizing the importance of brand loyalty and marketing.

Distribution Channels

- OTC Retail Pharmacies and Supermarkets: The primary sales channel, especially in North America.

- Online Pharmacies: Increasingly critical, particularly for OTC products in mature markets.

- Prescription Channel: Slightly declining for cetirizine as an OTC medication but still relevant in some regions.

Sales Projections

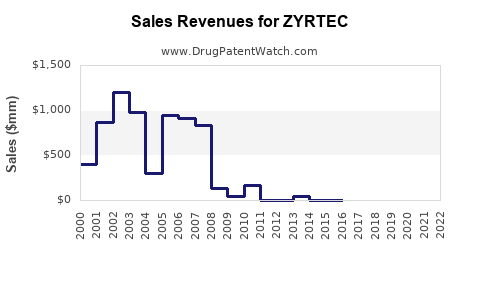

Historical Sales Trends

From 2018 to 2022, ZYRTEC's global sales have demonstrated steady growth, averaging approximately 4.5% annually. In 2022, Johnson & Johnson reported global ZYRTEC revenues of roughly USD 1.2 billion, with North America contributing over 70% due to market size and OTC adoption.

Forecasting Future Sales

Considering market expansion, demographic trends, and the impact of generics, the following projections are estimated:

| Year |

Projected Global Sales (USD Billion) |

Assumptions |

| 2023 |

1.25 |

Continued OTC growth, some erosion from generics |

| 2024 |

1.35 |

Market saturation approaches, increasing online sales |

| 2025 |

1.45 |

Emerging markets compound growth, new formulations rollout |

| 2026 |

1.55 |

Heightened consumer awareness, increased allergy prevalence |

| 2027 |

1.65 |

Intensified competition, but brand loyalty sustains sales |

Note: These forecasts assume a CAGR of approximately 5%, aligned with overall antihistamine market growth.

Factors Influencing Sales Trajectory

- Patent expirations and generic competition will likely exert downward pressure on unit prices but may be offset by expanded market access and increased allergy prevalence.

- Product line extensions (e.g., ZYRTEC-D or allergy relief combos) could stimulate incremental sales.

- Digital marketing and direct-to-consumer strategies will further drive OTC sales.

Strategic Implications

-

Brand Differentiation: Maintaining ZYRTEC’s market position requires ongoing investment in marketing and education to strengthen consumer loyalty.

-

Pipeline Innovation: Developing new formulations or delivery mechanisms (e.g., long-acting tablets or nasal sprays) could support sales extension.

-

Market Penetration in Emerging Economies: Tailored strategies are required to capitalize on rising allergy rates and OTC accessibility in Asia-Pacific and Latin American regions.

-

Addressing Competition: Price competition from generics necessitates value-based marketing and possibly bundling strategies to retain consumers.

Key Takeaways

- ZYRTEC remains a leading antihistamine with substantial global sales, but faces increased competition from generics.

- The overall antihistamine market is poised for moderate growth, driven by rising allergy prevalence and expanding OTC channels.

- Sales are projected to grow at a CAGR of approximately 5% through 2027, centered on the US and emerging markets.

- Long-term success depends on strategic innovation, regulatory navigation, and reinforcement of brand loyalty amidst declining patent protections.

FAQs

1. How does ZYRTEC’s market share compare to other antihistamines?

ZYRTEC holds approximately 25% of the global antihistamine market, trailing behind loratadine (Claritin) but ahead of other second-generation antihistamines due to its early OTC entry and strong brand recognition.

2. What factors threaten ZYRTEC’s sales growth?

The primary threats include the proliferation of generic cetirizine formulations, price competition, and shifting consumer preferences toward newer or alternative allergy treatments.

3. How significant are emerging markets for ZYRTEC’s future sales?

Emerging markets are vital, with increased allergy diagnoses and expanding OTC distribution infrastructure offering substantial growth opportunities, potentially doubling sales in some regions by 2030.

4. Will product innovation impact ZYRTEC's market position?

Yes. Launching new formulations, combination products, or delivery methods can reinforce differential value and market share among competitors.

5. How might regulatory changes influence ZYRTEC sales?

Regulatory approvals expanding OTC accessibility and ease of manufacturing or patent protections can sustain or enhance sales. Conversely, patent expirations without new formulations could accelerate generic substitution, impacting revenues.

Sources

[1] Statista. Global antihistamine market size and forecasts, 2022-2027.

[2] Johnson & Johnson Annual Reports, 2022.

[3] IMS Health. OTC antihistamine sales analysis, 2022.

[4] FDA. Approved OTC medications, 2008.

[5] MarketsandMarkets. Antihistamine market insights, 2022.

This comprehensive analysis enables stakeholders to strategically navigate ZYRTEC's evolving market landscape, balancing growth initiatives with competitive realities to optimize future sales trajectories.