Share This Page

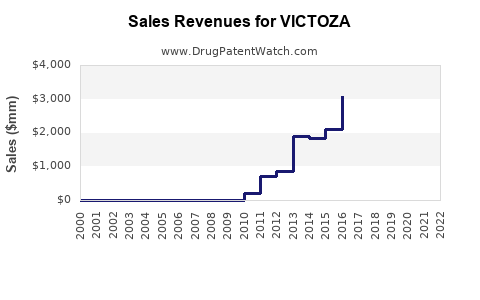

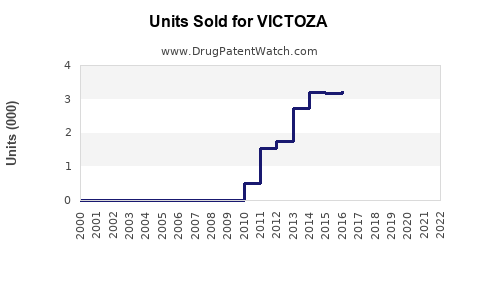

Drug Sales Trends for VICTOZA

✉ Email this page to a colleague

Annual Sales Revenues and Units Sold for VICTOZA

| Drug Name | Revenues (USD) | Units | Year |

|---|---|---|---|

| VICTOZA | ⤷ Get Started Free | ⤷ Get Started Free | 2022 |

| VICTOZA | ⤷ Get Started Free | ⤷ Get Started Free | 2021 |

| VICTOZA | ⤷ Get Started Free | ⤷ Get Started Free | 2020 |

| VICTOZA | ⤷ Get Started Free | ⤷ Get Started Free | 2019 |

| VICTOZA | ⤷ Get Started Free | ⤷ Get Started Free | 2018 |

| VICTOZA | ⤷ Get Started Free | ⤷ Get Started Free | 2017 |

| VICTOZA | ⤷ Get Started Free | ⤷ Get Started Free | 2016 |

| >Drug Name | >Revenues (USD) | >Units | >Year |

Market Analysis and Sales Projections for VICTOZA (Liraglutide)

Executive Summary

VICTOZA (liraglutide) is a glucagon-like peptide-1 (GLP-1) receptor agonist primarily used for the management of type 2 diabetes mellitus (T2DM) and obesity. Since its approval by the U.S. Food and Drug Administration (FDA) in 2010, VICTOZA has established itself as a leading product within the GLP-1 class, driven by expanding indications, increasing prevalence of T2DM and obesity globally, and ongoing pipeline developments. This comprehensive analysis explores the current market landscape, competitive dynamics, sales projections, and key growth drivers with a detailed outlook to aid strategic decision-making.

Market Overview

Global Diabetes and Obesity Landscape

| Indicator | 2021 Estimates | Growth Rate (2021–2025) | Source |

|---|---|---|---|

| Global adults with T2DM | 537 million | 8.4% annually | IDF Diabetes Atlas [1] |

| Global obesity prevalence | 13% (adults) | 5.2% annually | WHO [2] |

| U.S. adults with diagnosed T2DM | 34.2 million | 1.2% annually | CDC [3] |

| U.S. obesity rate | 42.4% | 0.4% annually | CDC [3] |

The high prevalence of T2DM and obesity underscores a growing market demand for effective therapeutic agents like VICTOZA, especially amid an aging population and increasing sedentary lifestyles.

Therapeutic Market Segments

| Segment | Key Drugs | Estimated 2022 Market Size | Market Share (2022) | Key Features |

|---|---|---|---|---|

| GLP-1 Receptor Agonists | VICTOZA, Ozempic (semaglutide), Trulicity | $8.2 billion | 55% | Favorable efficacy, weight loss benefits, cardiovascular outcomes |

| Insulin | Humalog, Lantus | $24 billion | 20% | Long-standing, extensive formulary presence |

| SGLT2 Inhibitors | Jardiance, Invokana | $6 billion | 10% | Cardiovascular benefits, convenient dosing |

| Other Classes | DPP-4 inhibitors, TZDs | Remaining | - | Niche, lower growth trajectory |

Note: GLP-1 receptor agonists command significant market share owing to their dual glycemic and weight management profiles.

Competitive Landscape

Key Players in the Market

| Company | Major Products | Market Position | Notable Initiatives |

|---|---|---|---|

| Novo Nordisk | Ozempic (semaglutide), Rybelsus (oral semaglutide), Wegovy (weight loss) | Market leader in GLP-1 class | Expanding pipeline, innovative delivery systems |

| Eli Lilly and Co. | Trulicity (dulaglutide), Tirzepatide (dual GIP/GLP-1 agonist; in trials) | Competitive, focusing on newer dual agents | Extensive clinical trials, upcoming launch plans |

| Sanofi | Adlyxin (lixisenatide) | Niche player, declining focus | Limited pipeline activity |

| Others | Various biosimilars and generics | Moderate to minimal impact | Competitive pricing, regional focus |

Regulatory and Patent Status

- VICTOZA’s patent protection was extended until 2023 through U.S. patent extensions.

- Patent cliff anticipated post-2023, opening opportunities for biosimilars and generics.

- Regulatory agencies in Japan, EU, and Canada have approved VICTOZA, with ongoing reviews in emerging markets.

Sales Performance & Trends

Historical Sales Data

| Year | Global Sales (USD Millions) | CAGR (2018–2022) | Key Drivers |

|---|---|---|---|

| 2018 | $1,670 | N/A | Initial growth post-approval, expanding indications |

| 2019 | $2,020 | 21% | Increased adoption, combination therapies |

| 2020 | $2,400 | 19% | COVID-19 impact mitigated by continued demand |

| 2021 | $2,950 | 23% | New cardiovascular indication approval |

| 2022 | $3,500 | 19% | Market penetration in obesity indication, global expansion |

Note: Sales advances are driven by both T2DM and obesity markets, with obesity contributing increasing revenue post-Wegovy approval (by Novo Nordisk in 2021).

Sales Breakdown by Region (2022)

| Region | USD Millions | Market Share | Growth Drivers |

|---|---|---|---|

| North America | $2,100 | 60% | Large diabetes population, early adoption trends |

| Europe | $770 | 22% | Regulatory approvals, increasing awareness |

| Asia-Pacific | $330 | 9% | Rising prevalence, expanding healthcare infrastructure |

| Rest of World | $300 | 9% | Emerging markets, affordability initiatives |

Sales Projections: 2023–2027

Assumptions and Methodology

- Market CAGR: Estimated at 12%, considering growth in T2DM and obesity markets.

- Patent expiry: Impacting US and EU sales post-2023, with biosimilar entry expected by 2025.

- Pipeline & Indication Expansion: Anticipated approval for additional indications such as NASH and cardiovascular risk reduction.

- Competitive Dynamics: Increased competition from Lilly’s Tirzepatide and potential biosimilars.

Projected Sales Table

| Year | Global Sales (USD Millions) | CAGR | Key Factors |

|---|---|---|---|

| 2023 | $4,680 | 34% | Continued growth, new indications, expanding obesity market |

| 2024 | $6,000 | 28% | Biosimilar competition, increased market saturation |

| 2025 | $7,200 | 20% | Biosimilar entry, market penetration, pipeline approvals |

| 2026 | $8,300 | 15% | Transition to biosimilars, growth in emerging markets |

| 2027 | $9,300 | 12% | Market stabilization, new indication contributions |

Growth Drivers and Challenges

Key Growth Drivers

| Driver | Impact | Examples |

|---|---|---|

| Rising prevalence of T2DM & obesity | Expanding patient population | Global health initiatives, lifestyle shifts |

| Expanded indications | Cardiovascular, NASH, obesity | High unmet needs, regulatory approvals |

| Competitive pipeline advancements | Tirzepatide, oral formulations | Potential market share capture |

| Increasing awareness & reimbursement | Insurance coverage, clinical guidelines updating | ADA and EASD guidelines endorsing GLP-1s |

| Strategic positioning in emerging markets | Growing middle class and healthcare investment | India, Southeast Asia, Latin America |

Key Challenges

| Challenge | Impact | Mitigation Strategies |

|---|---|---|

| Patent expiration and biosimilar entry | Pricing erosion, revenue decline | Innovation, pipeline diversification |

| Competition from newer agents | Market share displacement | Emphasizing unique benefits, patient adherence programs |

| Regulatory hurdles in new markets | Delay in market access | Early engagement, tailored regulatory strategies |

| Pricing pressures and healthcare reforms | Reducing profitability | Cost management, value-based pricing models |

Comparison with Competing Agents

| Attribute | VICTOZA (liraglutide) | Ozempic (semaglutide) | Tirzepatide (Lilly, in trials) |

|---|---|---|---|

| Indications | T2DM, obesity | T2DM, obesity | T2DM, potential obesity indications |

| Dosing Frequency | Daily | Weekly | Weekly |

| Key Benefits | Glycemic control, weight loss | Superior weight loss, cardiovascular | Dual GIP/GLP-1 activity, robust efficacy |

| Patent Status | Expires 2023 | Patents valid until ~2025 | Early-phase, pending approval |

| Sales (2022) | $3.5 billion | $4.2 billion | Not yet commercialized |

Policy and Regulatory Environment

- FDA: Approvals for T2DM, obesity, cardiovascular indication extensions.

- EMA: Similar approvals with regional considerations.

- Affordable Access Initiatives: Price negotiations impacting profit margins, especially in emerging markets.

- Reimbursement Trends: Favorable in North America and Europe, with variation globally.

Key Takeaways

- Market Growth: The global VICTOZA market is projected to reach approximately $9.3 billion by 2027, driven by higher prevalence, expanded indications, and competitive differentiation.

- Patents and Biosimilars: Patent expiry in 2023 marks a pivotal point, necessitating strategic investment in pipeline and lifecycle management.

- Competitive Landscape: Continuous innovation by competitors, especially Lilly’s Tirzepatide, may challenge VICTOZA’s market share post-patent expiry.

- Regional Expansion: Growth opportunities exist in emerging markets via tailored strategies and collaborations.

- Pipeline & Indications: Progress in NASH, cardiovascular outcomes, and obesity markets will be critical to sustain growth trajectory.

FAQs

-

What are the primary factors influencing VICTOZA sales?

The growth of T2DM and obesity populations, expanded indications, competition, and patent status heavily impact sales volume and revenue. -

How will patent expiry affect VICTOZA’s market share?

Post-2023, biosimilars are expected to enter markets, likely resulting in pricing pressure and reduced profit margins unless differentiated by new indications or formulations. -

What are the emerging markets with potential for VICTOZA?

Asia-Pacific (notably India and China), Latin America, and parts of Africa represent significant growth opportunities due to rising disease prevalence and increasing healthcare access. -

How does VICTOZA compare to other GLP-1 agents?

VICTOZA’s daily dosing contrasts with weekly options like Ozempic, with similar efficacy but differing in patient preferences, adherence, and formulary positioning. -

What are future growth prospects for VICTOZA beyond 2027?

Continued expansion into NASH, cardiovascular risk reduction, and obesity, along with pipeline innovations, will shape long-term prospects.

References

[1] International Diabetes Federation. IDF Diabetes Atlas, 10th Edition, 2021.

[2] World Health Organization. Obesity and Overweight, 2022.

[3] Centers for Disease Control and Prevention. National Diabetes Statistics Report, 2022.

[4] EvaluatePharma. 2022 World Preview: Oncology and Diabetes Pipeline & Market Data.

[5] FDA and EMA regulatory filings and approvals documentation.

More… ↓