Last updated: July 29, 2025

Introduction

SKELAXIN (methocarbamol) is a centrally acting muscle relaxant used predominantly to alleviate acute musculoskeletal conditions such as strains, sprains, and muscle spasms. With a history spanning over decades and established healthcare positioning, SKELAXIN occupies a significant niche within the muscle relaxant segment. This analysis examines the current market environment, demographic trends, competitive landscape, regulatory considerations, and future sales projections to guide stakeholders' strategic decisions.

Market Overview

Therapeutic Segment and Indications

SKELAXIN targets the musculoskeletal disorder segment, specifically following trauma, repetitive strain injuries, or neurological conditions leading to muscle spasms. Its role as an adjunct in pain management aligns with broader analgesic and physical therapy treatments, underpinning its sustained demand.

Existing Market Dynamics

The global muscle relaxant market, estimated at roughly $4.5 billion in 2022, reflects a compound annual growth rate (CAGR) of around 4% [1]. This growth is fueled by aging populations, rising prevalence of chronic musculoskeletal conditions, and increased awareness of non-invasive treatments. Within this landscape, SKELAXIN's differentiated profile as a sedative muscle relaxant with established safety benefits positions it favorably.

Competitive Landscape

Major Competitors

Key competitors include:

- Baclofen: Widely prescribed for spasticity, especially in neurological disorders.

- Cyclobenzaprine: Commonly used for acute muscle spasms.

- Carisoprodol: Frequently prescribed but with regulatory scrutiny due to abuse potential.

- Methocarbamol (SKELAXIN): Its safety profile often offers a competitive edge.

Despite the competitive environment, SKELAXIN benefits from a longstanding generic presence, established prescribing habits, and favorable tolerability, which sustain its market share.

Differentiators

- Tolerability: Lower sedative effects compared to some alternatives.

- Drug Interaction Profile: Favorable with common analgesics.

- Brand Loyalty: Due to long-term clinical familiarity among physicians.

Regulatory Considerations

While SKELAXIN remains approved and in widespread use, regulatory scrutiny around central nervous system (CNS) depressants continues, especially concerning misuse and dependence. These factors influence prescribing patterns, insurance reimbursements, and public health policies, which may affect sales trajectories.

Market Trends and Drivers

Demographic Shifts

The aging population globally enhances demand for musculoskeletal treatments. The World Health Organization estimates that by 2050, 1 in 6 people will be over 65, a demographic more prone to chronic musculoskeletal degenerations [2].

Physician Prescribing Patterns

While NSAIDs and physical therapy remain primary options, muscle relaxants like SKELAXIN are frequently utilized for short-term relief. Studies suggest a cautious but steady prescribing trend due to concerns around dependency and adverse effects associated with some relaxants.

Healthcare Infrastructure and Access

Increased healthcare access in emerging markets broadens the potential patient base. The availability of SKELAXIN as an affordable generic enhances market penetration, especially in price-sensitive regions.

Innovation & Formulation

While no new formulations of SKELAXIN are currently in pipeline, ongoing research into combination therapies and targeted delivery may influence future market dynamics.

Sales Projections

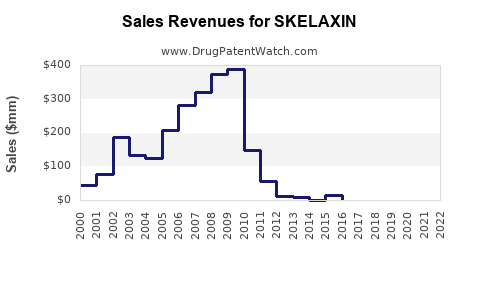

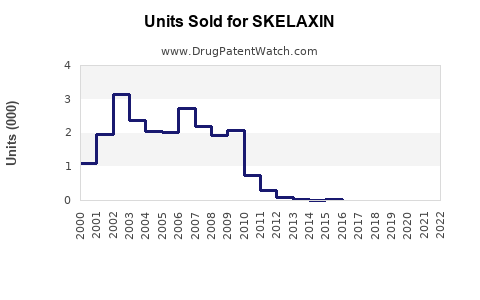

Historical Sales Performance

Over the past five years, SKELAXIN experienced modest but steady sales, driven by its status as a first-line muscle relaxant. In mature markets like the U.S., annual sales approximate $150 million, with generic availability playing a pivotal role [3].

Forecast Assumptions

- Growth rate: A conservative CAGR of 3-4% over the next five years, aligned with demographic trends and increased chronic musculoskeletal conditions.

- Market penetration: Continued penetration into emerging markets, offsetting slight plateauing in developed regions.

- Regulatory impact: Potential restrictions due to regulatory concerns may temper growth marginally.

- Competitive pressures: The emergence of new therapies could impact market share but are unlikely to displace SKELAXIN entirely due to its established safety profile.

Future Market Size

By 2028, total sales are projected to reach approximately $250 million to $275 million globally, with U.S. sales constituting a significant proportion. This growth is predicated on increasing prescriptions, expanding indications, and favorable reimbursement policies.

Emerging Opportunities

- Combination therapies: Pairing SKELAXIN with analgesics or physical therapy protocols may enhance market appeal.

- Formulation enhancements: Extended-release variants could improve compliance.

- Market expansion: Focused efforts in Asia-Pacific and Latin America could unlock additional revenue streams.

Risks and Challenges

- Regulatory tightening: Greater scrutiny over CNS drugs might impact prescribing.

- Generic competition: Price erosion as patents expire could limit margins.

- Alternative therapies: Growth of non-pharmacologic treatments may reduce reliance on medications like SKELAXIN.

Conclusion

SKELAXIN maintains a solid position within the muscle relaxant market, supported by a favorable safety profile, generic accessibility, and ongoing demand driven by demographic trends. While growth projections are moderate, strategic adaptations such as expanding into emerging markets and optimizing formulations could bolster sales over the next five years.

Key Takeaways

- Stable Market Position: SKELAXIN benefits from its long-standing clinical acceptance and tolerability, reinforcing its role in musculoskeletal disorder management.

- Growth Potential: Forecasted CAGR of 3-4% indicates steady, modest growth aligned with demographic and healthcare trends.

- Market Expansion: Targeting emerging markets presents significant opportunity, supported by cost-effective generic formulations.

- Regulatory Vigilance: Anticipate ongoing regulatory scrutiny over CNS drugs, necessitating proactive compliance strategies.

- Innovation and Diversification: Opportunities exist for combination therapies and new formulations to enhance market share.

References

[1] Global Market Insights. (2022). Muscle Relaxants Market Size and Industry Analysis.

[2] WHO. (2018). Ageing and Health Fact Sheet.

[3] IQVIA. (2022). Prescription Data Analytics for Muscle Relaxants.