Last updated: July 27, 2025

Introduction

Robaxin-750 (generic name: methocarbamol) is a centrally acting muscle relaxant primarily used to treat muscle spasms and conditions associated with acute musculoskeletal pain. As a cornerstone in the neurological and orthopedic therapeutic domains, its substantial market presence is driven by increasing prevalence of musculoskeletal disorders, aging population, and expanding outpatient care protocols. This analysis evaluates the current market landscape for Robaxin-750 within the global pharmaceutical industry, projecting future sales trajectories based on demographic trends, competitive positioning, regulatory factors, and healthcare dynamics.

Market Landscape Overview

Global Demand Drivers

The global muscle relaxant market, expected to reach approximately USD 3.5 billion by 2027 [1], is supported by rising incidences of spinal disorders, sports injuries, degenerative diseases, and postural ailments. Particularly, the aging demographic (over 60 years) accounts for a growing portion of patients requiring muscle spasm treatment, with musculoskeletal conditions forecasted to increase at a CAGR (Compound Annual Growth Rate) of over 4% through 2027 [2].

Therapeutic Competition & Market Penetration

Robaxin-750 faces competition from other muscle relaxants such as cyclobenzaprine, tizanidine, and baclofen. Its distinct position stems from its favorable safety profile and efficacy in acute settings. In the US alone, the muscle relaxants segment accounts for approximately 20% of the analgesic market, with Robaxin-750 capturing a notable share due to longstanding clinical acceptance.

Regulatory and Reimbursement Factors

Regulatory approvals across markets remain consistent, with Robaxin-750 listed on major formularies. Reimbursement policies favor outpatient and non-invasive therapy, further boosting sales. However, strict regulation around opioid use has shifted prescriptions toward non-opioid muscle relaxants, including Robaxin-750, especially in North America and Europe.

Market Segmentation & Geographic Trends

-

North America: Dominates accounting for roughly 40% of global muscle relaxant prescriptions, driven by high musculoskeletal health awareness and aging population [3].

-

Europe: Similar growth trajectory with expanding coverage and preventive care strategies.

-

Asia-Pacific: Fastest growth segment, projected to grow at over 6% CAGR due to urbanization, increased healthcare infrastructure, and rising prevalence of musculoskeletal conditions.

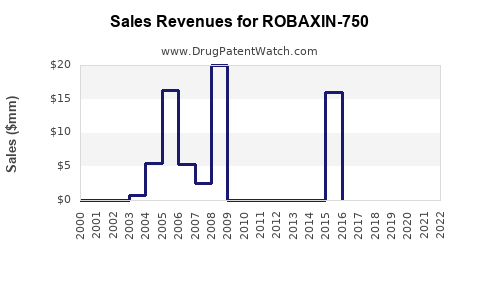

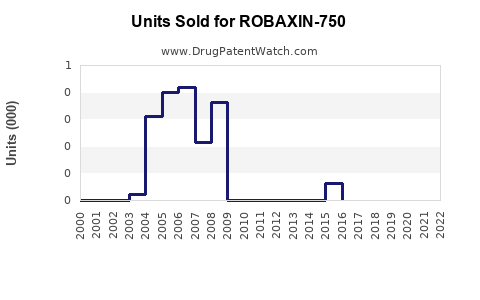

Current Sales Performance

Robaxin-750 sales are influenced by factors such as patent status, prescribing trends, and generic competition. Established brands, now largely generic, dominate the low-cost segment. Annual sales in developed markets approximate USD 150–200 million, with a steady growth rate of about 3–5% annually, assisted by increased physician awareness and expanded indications.

Sales Projections (2023–2028)

Assumptions

-

Continued increase in musculoskeletal disorder prevalence globally.

-

Stabilization of generic competition, with potential for patent expirations or new formulations.

-

Growth in outpatient and telemedicine prescriptions favoring easily administered, effective muscle relaxants.

-

Persistent healthcare budget pressures encouraging cost-effective generics.

Projected Sales Growth

-

2023: USD 180 million

-

2024: USD 190 million (+5.6%)

-

2025: USD 200 million (+5.3%)

-

2026: USD 210 million (+5%)

-

2027: USD 220 million (+4.8%)

-

2028: USD 232 million (+5.5%)

This suggests a compound annual growth rate (CAGR) of approximately 5%, driven by expanding markets, especially in Asia-Pacific and through increased outpatient prescribing.

Strategic Opportunities

-

Formulation Innovations: Development of new delivery forms (e.g., sustained release, transdermal) could capture unmet needs.

-

Expanded Indications: Potential approval for additional musculoskeletal conditions or chronic management.

-

Market Penetration: Focused campaigns in emerging markets and aging populations could accelerate growth.

-

Pharmacoeconomic Positioning: Demonstrating cost-effectiveness in comparison with competitors can bolster market share.

Risks & Challenges

-

Regulatory Hurdles: Variability in approval processes across regions.

-

Generic Competition: Price erosion as multiple manufacturers introduce similar formulations.

-

Clinician Preferences: Prescribing shifts toward newer or combination therapies.

-

Side Effect Profiles: Rigorous post-marketing surveillance may impact perceptions and utilization.

Conclusion

Robaxin-750 is well-positioned within the musculoskeletal therapeutic segment, with steady growth forecasted over the next five years. Its strategic value lies in its established efficacy profile and favorable tolerability, particularly as the global population ages and musculoskeletal health concerns intensify. Successful expansion depends on proactive development, competitive pricing, and targeted market penetration, particularly in high-growth regions like Asia-Pacific.

Key Takeaways

- The global muscle relaxant market is poised for sustained growth, with Robaxin-750 maintaining a significant share due to clinical acceptance and affordability.

- Sales are projected to grow at an approximate CAGR of 5%, reaching over USD 230 million by 2028.

- Emerging markets and aging populations are primary catalysts for future demand expansion.

- Competitive dynamics necessitate innovation and strategic marketing to preserve market share.

- Regulatory and pricing pressures remain pivotal challenges that must be navigated carefully.

FAQs

1. How does Robaxin-750 differ from other muscle relaxants?

Robaxin-750 has a favorable safety profile, particularly in acute musculoskeletal conditions, with fewer sedative effects compared to some counterparts like cyclobenzaprine. Its pharmacokinetics allow for flexible dosing and minimal CNS depression.

2. What are the main markets driving Robaxin-750 sales?

North America and Europe currently constitute the largest markets, with rapid growth in Asia-Pacific driven by demographic shifts, healthcare infrastructure expansion, and increased prevalence of musculoskeletal disorders.

3. Are there any upcoming patent expirations or formulations that could impact sales?

Most Robaxin-750 formulations are available generically, leading to pricing pressure. Future innovations in delivery or new indications could influence sales trajectory.

4. What regulatory challenges could affect future sales?

Regional approval variations and potential safety reevaluations post-marketing surveillance may constrain market expansion or lead to formulary restrictions.

5. How can manufacturers leverage market trends to maximize sales?

Investing in formulation innovation, expanding indications, and targeting emerging markets through tailored marketing strategies are effective avenues to capitalize on growth trends.

References

[1] MarketWatch. “Global Muscle Relaxants Market Size, Share & Trends Analysis Report,” 2022.

[2] Grand View Research. “Musculoskeletal Disorders Market Size & Trends,” 2023.

[3] IQVIA. “Global Prescribing Trends and Pharmaceutical Market Insights,” 2022.