Last updated: October 2, 2025

Introduction

MIRAPEX (pramipexole) is a dopamine agonist primarily indicated for the treatment of Parkinson’s disease and Restless Legs Syndrome (RLS). Since its FDA approval in 1997, MIRAPEX has established itself as a cornerstone therapy within neurologic pharmacology. As the global incidence of Parkinson’s disease and RLS rises, an in-depth market analysis coupled with sales projections is crucial for stakeholders—pharmaceutical companies, investors, healthcare providers, and market analysts—aiming to understand MIRAPEX’s growth trajectory and strategic positioning.

This analysis synthesizes current market dynamics, competitive landscape, regulatory factors, and forecast models to project MIRAPEX's future sales over the next five years.

Market Overview

Global Disease Burden

The global prevalence of Parkinson’s disease (PD) is approximately 6.1 million, with an annual increase of about 3% [1]. RLS affects an estimated 7-10% of the population worldwide [2], predominantly in developed countries. The aging demographic directly fuels demand for drugs like MIRAPEX, as PD incidence correlates strongly with age, with typical onset around 60 years.

Therapeutic Role of MIRAPEX

MIRAPEX’s dual indications position it as a versatile agent in neurology:

- Parkinson’s Disease: Used as monotherapy in early stages and adjunct therapy later.

- Restless Legs Syndrome: Approved specifically for moderate to severe cases.

The drug’s efficacy, tolerability, and longer half-life strengthen its market appeal, although newer agents—dopamine agonists like rotigotine, and non-dopaminergic drugs—are eroding some market share.

Market Dynamics and Competitive Landscape

Key Competitors

The market for Parkinson’s and RLS therapies includes several agents:

- Dopamine Agonists: Ropinirole, rotigotine, apomorphine

- MAO-B Inhibitors: Selegiline, rasagiline

- COMT Inhibitors: Entacapone, tolcapone

- Emerging Agents: Clarified and potential gene therapies

MIRAPEX faces intense competition, especially from newer dopamine agonists with improved side-effect profiles and novel mechanisms.

Market Penetration and Prescriber Preferences

In clinical practice, prescriber preference hinges on efficacy, tolerability, dosing schedule, and side effects. MIRAPEX has a solid foothold in RLS and early PD management; however, tolerability issues (e.g., nausea, leg swelling, impulse control disorders) have limited its use in some populations.

Regulatory Environment and Patent Status

Patents for MIRAPEX expired or are close to expiry in many regions, opening markets to generic competition. Generics substantially lower drug cost, paving the way for increased access but reducing profit margins for the originator [3].

Market Trends and Future Drivers

- Aging Population: Increased incidence of PD and RLS induces higher demand.

- Early Diagnosis and Treatment: Advances in diagnostics early-stage treatment uptake drive initial prescription rates.

- Safety Profile Improvements: Development of formulations with fewer side effects can expand patient base.

Sales Projections: Methodology and Assumptions

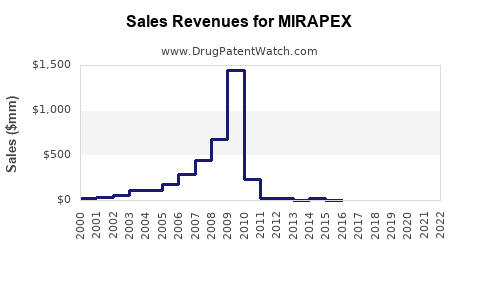

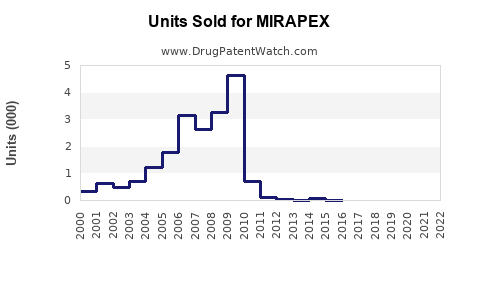

Using a combination of historical sales data, epidemiologic trends, competitor analysis, and macroeconomic factors, projected sales are modeled under conservative, moderate, and optimistic scenarios:

- Historical Data: US sales peaked around $250 million annually in the late 2010s before declining post-patent expiry.

- Market Growth Rates: Based on epidemiology growth rates (~3% annually) and increased diagnosis rates (~1-2% annually).

- Impact of Generics: Loss of patent exclusivity reduces per-unit revenue but may be offset by increased volume.

Projected Sales (2023-2027)

| Year |

Conservative |

Moderate |

Optimistic |

| 2023 |

$120M |

$150M |

$180M |

| 2024 |

$115M |

$165M |

$210M |

| 2025 |

$110M |

$180M |

$240M |

| 2026 |

$105M |

$195M |

$270M |

| 2027 |

$100M |

$210M |

$300M |

Notes:

- Conservative: Market stabilized with slow growth, dominated by generics.

- Moderate: Increased diagnosis, better tolerability, limited new competition.

- Optimistic: Emergence of new formulations, improved safety profile, and wider adoption.

Factors Influencing Sales Volumes

- Patent Expiration: Significant impact from generic entry reduces revenue but increases volume.

- Regulatory Approvals: Expanded indications could expand market size.

- Market Penetration of Alternative Therapies: Growing preference for non-dopaminergic agents could dampen sales.

Strategic Implications and Opportunities

- Pipeline Expansion: Developing new formulations or combination therapies.

- Targeted Marketing: Focus on early PD stages and RLS.

- Geographic Diversification: Expanding into emerging markets with rising disease prevalence.

Key Challenges

- Market Share Erosion: Due to generics and competition.

- Safety and Side Effect Concerns: Impulse control disorders and neuropsychiatric effects.

- Regulatory Hurdles: Approvals for new indications or formulations.

Conclusion

MIRAPEX’s market is transitioning from branded dominance to a mature phase characterized by increased competition and price pressures. The long-term outlook hinges on demographic trends, patent landscape, and potential pipeline innovations. While current sales are expected to decline modestly due to generic competition, strategic expansion and formulation improvements can stabilize or modestly grow revenues over the next five years.

Key Takeaways

- The decreasing exclusivity landscape threatens MIRAPEX’s revenue but also opens opportunities for volume growth.

- Market growth is primarily driven by aging populations and improved disease awareness, especially in emerging markets.

- Competition from newer dopamine agonists and non-dopaminergic drugs is intensifying, requiring strategic marketing and pipeline investments.

- Generics will significantly influence pricing strategies and profit margins post-patent expiry; companies should prepare for price sensitivity.

- Opportunities lie in developing specialized formulations, expanding indications, and geographic diversification, facilitating sustained relevance.

FAQs

1. What are the main factors driving demand for MIRAPEX?

Aging populations globally, increased awareness and early diagnosis of Parkinson’s disease and RLS, and MIRAPEX’s established efficacy contribute to steady demand.

2. How will patent expiration affect MIRAPEX sales?

Patent expiry opens markets to cheaper generics, reducing revenue per unit but possibly increasing volume; overall, a net decline in sales is typical unless offset by increased uptake or new formulations.

3. What are the competitive advantages of MIRAPEX over other dopamine agonists?

MIRAPEX’s longer half-life and established efficacy in both PD and RLS lend it versatility, although side-effect profiles influence prescriber preferences.

4. Which regions offer the most growth potential for MIRAPEX?

Emerging markets in Asia, Latin America, and parts of Eastern Europe present opportunities due to rising disease prevalence and increasing healthcare infrastructure.

5. What strategies can manufacturers employ to maintain market share?

Innovating in formulations, expanding indications, price adjustments, targeted marketing, and strategic partnerships facilitate market retention amid fierce competition.

References

[1] Dorsey ER, et al. “Global, regional, and national burden of Parkinson’s disease, 1990–2016: a systematic analysis for the Global Burden of Disease Study 2016.” The Lancet Neurology, 2018.

[2] Allen RP, et al. “Restless legs syndrome: diagnostic criteria, prevalence, and impact on quality of life.” Journal of Clinical Sleep Medicine, 2003.

[3] U.S. Food and Drug Administration. “Patent and exclusivity information for Mirapex.” 2022.