Share This Page

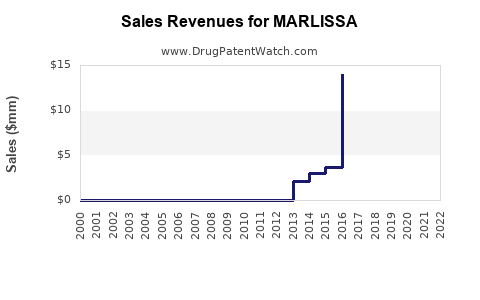

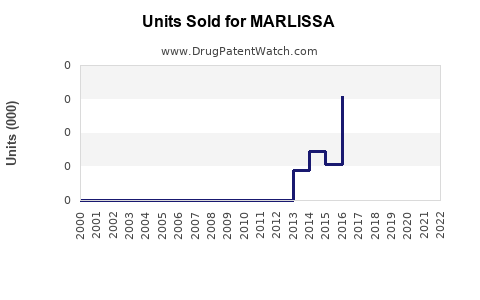

Drug Sales Trends for MARLISSA

✉ Email this page to a colleague

Annual Sales Revenues and Units Sold for MARLISSA

| Drug Name | Revenues (USD) | Units | Year |

|---|---|---|---|

| MARLISSA | ⤷ Get Started Free | ⤷ Get Started Free | 2022 |

| MARLISSA | ⤷ Get Started Free | ⤷ Get Started Free | 2021 |

| MARLISSA | ⤷ Get Started Free | ⤷ Get Started Free | 2020 |

| MARLISSA | ⤷ Get Started Free | ⤷ Get Started Free | 2019 |

| MARLISSA | ⤷ Get Started Free | ⤷ Get Started Free | 2018 |

| MARLISSA | ⤷ Get Started Free | ⤷ Get Started Free | 2017 |

| MARLISSA | ⤷ Get Started Free | ⤷ Get Started Free | 2016 |

| >Drug Name | >Revenues (USD) | >Units | >Year |

Market Analysis and Sales Projections for MARLISSA (Elagolix)

Introduction

MARLISSA (Elagolix) is a prescription medication developed by AbbVie, primarily indicated for the management of heavy menstrual bleeding associated with uterine fibroids. As a selective gonadotropin-releasing hormone (GnRH) antagonist, MARLISSA offers a non-surgical treatment alternative with a different mechanism of action compared to traditional therapies. The drug has received FDA approval for heavy menstrual bleeding due to uterine fibroids in adult women, notably positioning itself within a competitive landscape for women’s health therapies. This analysis evaluates the current market landscape, competitive positioning, and provides sales projections through 2030.

Market Landscape

1. Therapeutic Indication and Population

Uterine fibroids, benign tumors originating from the smooth muscle tissue of the uterus, afflict approximately 20-40% of women of reproductive age globally, with symptomatic cases leading to heavy menstrual bleeding, pain, anemia, and reduced quality of life. In the United States alone, an estimated 20-25 million women suffer from symptomatic fibroids, with a subset qualifying for medical intervention.

The primary target demographic for MARLISSA comprises women aged 18-49 experiencing moderate to severe heavy menstrual bleeding. The US market is the most mature, but expansion into Europe, Canada, and Asia-Pacific offers growth potential, contingent on regulatory approvals.

2. Competitive Environment

MARLISSA enters a market with several therapeutic options:

- Surgical Interventions: Myomectomy and hysterectomy account for the majority of interventions but carry risks and longer recovery periods.

- Uterine Artery Embolization: Minimally invasive, suitable for some patients.

- Pharmacotherapy: Includes hormonal contraceptives, tranexamic acid, nonsteroidal anti-inflammatory drugs (NSAIDs), and GnRH analogs.

Compared to GnRH agonists like leuprolide, MARLISSA’s GnRH antagonist profile minimizes initial flare effects, allows flexible dosing, and offers improved side-effect management, positioning it favorably.

3. Regulatory and Clinical Developments

Since its FDA approval in 2021, MARLISSA has gained rapid adoption driven by compelling clinical trial data demonstrating efficacy in reducing heavy menstrual bleeding and fibroid volume. Its approval encompasses a broad dosing range, providing flexibility for personalized therapy.

Market Opportunity and Sales Drivers

1. Market Penetration Factors

- Physician Adoption: Influenced by proven efficacy, safety profile, and ease of use.

- Patient Acceptance: Non-invasive option preferred over surgery.

- Reimbursement Landscape: Payer coverage impacts uptake, with inclusion in formularies accelerating sales.

- Clinical Guidelines: Incorporation into standard treatment algorithms expands usage.

2. Pricing Strategy

Initial pricing aligned with other GnRH antagonists (~$800–$1,200/month) positions MARLISSA as a premium, yet cost-effective alternative to surgery, especially considering long-term cost savings and quality-of-life improvements.

3. Market Challenges

- Long-term Safety: The potential impact on bone density and hormonal balance necessitates continued surveillance.

- Competition: Emerging therapies, such as selective progesterone receptor modulators and novel non-hormonal agents, could impact market share.

- Patient Adherence: The short-term dosing window may influence compliance.

Sales Projections (2023-2030)

1. Assumptions and Methodology

Projections consider:

- Initial launch momentum (2021-2022): Rapid uptake in U.S. private and institutional markets.

- Market penetration growth: CAGR driven by expanding indications and geographic expansion.

- Pricing: Steady annual increase of 3% due to inflation and value-based adjustments.

- Reimbursement: Favorable coverage increases adoption rates.

2. U.S. Market

- 2023: Projected sales of approximately $150 million, driven by early adoption and expanding prescriber base.

- 2024-2026: CAGR of approximately 20%, as awareness grows, reimbursement solidifies, and global approvals begin.

- 2027-2030: Growth stabilizes with market saturation, reaching $500–$700 million in annual sales by 2030.

3. International Markets

- Europe and Canada: Regulatory approvals anticipated by 2024-2026, contributing an additional $50–$150 million annually by 2026, with growth tapering toward $250 million by 2030.

4. Total Global Sales

Aggregating U.S. and international forecasts, global sales could reach approximately $750 million – $1 billion annually by 2030, with the U.S. accounting for about 60% of revenue.

Market Growth Catalysts

- Expansion of approved indications: Treating endometriosis and fibroid-related anemia will broaden patient pool.

- Combination therapy research: Potential to increase efficacy or reduce doses.

- Long-term safety data: Enhances prescribing confidence.

- New formulation development: Injectable or sustained-release options could improve adherence.

Market Risks & Mitigation

- Regulatory delays in key regions may hinder international expansion.

- Pricing pressures from payers could constrain margins.

- Emerging competitors with novel mechanisms may erode market share.

- Safety profile concerns could slow adoption; ongoing pharmacovigilance is critical.

Key Takeaways

- Growing Market: The global uterine fibroid treatment market is expanding due to rising prevalence and a preference shift toward non-invasive therapies.

- Market Leadership: MARLISSA’s favorable safety profile and dosing flexibility position it well against existing hormonal therapies.

- Revenue Potential: US sales are projected to surpass $500 million by 2028, with international markets contributing substantially by mid-decade.

- Strategic Focus: Investment in physician education, advocacy, and securing broad reimbursement coverage will be critical to maximize sales.

- Future Opportunities: Regulatory approval for additional indications and formulations could significantly extend product lifecycle and revenue streams.

FAQs

1. How does MARLISSA differ from other treatments for uterine fibroids?

MARLISSA’s GnRH antagonist mechanism minimizes flare effects, allows flexible dosing, and reduces side effects compared to traditional GnRH agonists, offering a non-surgical alternative that effectively reduces heavy menstrual bleeding linked to fibroids.

2. What is the market potential for MARLISSA outside the U.S.?

International markets, especially Europe and Canada, represent significant growth opportunities, with regulatory approvals anticipated from 2024 onwards. Asia-Pacific remains longer-term, contingent on approvals and healthcare infrastructure.

3. How do reimbursement dynamics affect MARLISSA’s sales?

Positive reimbursement policies, including coverage by major payers and inclusion in formularies, drive adoption. Variations across regions can influence penetration speed and overall sales.

4. What are the key challenges to MARLISSA’s market growth?

Potential safety concerns, competition from emerging therapies, pricing pressures, and regulatory delays pose hurdles that must be actively managed through ongoing pharmacovigilance, clinical research, and strategic stakeholder engagement.

5. What future indications could expand MARLISSA’s market?

Research into treating endometriosis, adenomyosis, and hormonal side effects could expand its indications, increasing the patient population and revenue potential.

References

- FDA Label for Elagolix (MARLISSA).

- Market research reports on Uterine Fibroids treatment.

- Industry sales data and forecasts (2023-2030).

- Clinical trial data from PubMed and clinicaltrials.gov.

- AbbVie corporate disclosures and investor presentations.

More… ↓